Market Review (August 2025)

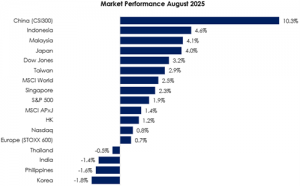

The MSCI Asia Pacific Ex-Japan Index (+1.4%) lagged the MSCI World Index (+2.5%) despite an exceptionally strong showing from regional corporates. China (+10.3%) staged a spectacular rally, fueled by increased buying activity from domestic investors as low interest rates and a lack of alternatives drove retail and institutional investors back into equities. Indonesia (+4.6%) continued its strong performance despite heated protests demanding government action on economic hardships. Malaysia (+4.1%) also surged strongly thanks to robust GDP growth and resilient corporate earnings. In contrast, Korea (-1.8%) underperformed as exports to the US declined double digits as tariff risks crystallized. The Philippines (-1.6%) continued its steady drop despite lower inflation and a policy rate cut. India (-1.4%) also caught the short end of the stick as the US’ targeted tariffs took effect in response to India’s trade relations with Russia (see Exhibit 1).

Exhibit 1: Market Performance Aug 2025

Source: Bloomberg, PCM, 31 Aug 2025

On the monetary policy front, the Bank of England cut interest rates by 25 basis points to 4.00%. In Asia, the People’s Bank of China (PBoC) maintained the one-year LPR at 3.0% and the five-year LPR at 3.5%. The Reserve Bank of India (RBI) kept its key repo rate unchanged at 5.50% during its August meeting. Within ASEAN, Bank Indonesia (BI) cut its benchmark interest rate by 25 basis points to 5.00%, while the Bangko Sentral ng Pilipinas lowered its Target Reverse Repurchase (RRP) Rate by 25 basis points to 5.00%. The Bank of Thailand (BOT) cut its benchmark interest rate by 25 basis points to 1.50%.

The FBMKLCI Index gained 4.1% month-on-month (m-o-m) in August, closing at 1,575.53 points. Meanwhile, the Small Cap Index inched up 0.1%, while the Mid 70 Index decreased by 0.8%.

Sector-wise in August, the top-performing sectors were Construction, Technology, and Finance, up 5.9%, 5.6%, and 5.6%, m-o-m, respectively. The worst-performing sectors were Healthcare, REITs, and Telecommunication, which saw declines of 5.3%, 2.4% and 2.4%, respectively. Foreign investors continued to be net sellers in August, recording RM3.4 billion in outflows. There were no new listings in August.

For the month of August, WTI crude oil plunged 7.6% m-o-m, closing at US$64.0 per barrel, while Brent oil fell 6.1%, finishing at US$68.1 per barrel. Crude palm oil closed at RM4,308/MT, registering a gain of 3.2%, while spot gold rose 5.9%, ending the month at US$3,487.2/oz. Currency-wise, the Malaysian ringgit appreciated 1.1% m-o-m against the greenback to RM4.2248/USD. Meanwhile, the Dollar Index declined 2.2% to 97.8 points.

Equity Market Outlook & Investment Strategy

Malaysia

2Q25 reporting was largely in line with expectations, except for EMS and O&G, which underperformed. Consensus now forecasts KLCI earnings to grow in the mid-single digits in 2025 and 2026. We believe Malaysia offers appealing valuations across PE, PB, and the earnings-MGS yield spread, helping sustain investor optimism. We also believe easing US policy uncertainties, including front-loaded Trump measures and greater clarity on tariffs, along with ample domestic liquidity, provide scope for markets to grind higher into 4Q25 and 2026.

Regional

Globally, the US market outlook remains cautiously optimistic into late 2025, supported by resilient consumer spending and easing labour tightness, though inflationary pressures linger. At Jackson Hole, Fed Chair Jerome Powell indicated rate cuts could begin in September, potentially lifting equities, but stretched valuations—highlighted by the Warren Buffett Indicator—warrant caution. In China, August delivered a solid rally as exports and high-tech sectors underpinned growth. Policy signals and supply-side reforms aim to address overcapacity and stabilise profitability, but weak domestic demand and execution risks remain key challenges. We recommend a barbell strategy through 2025, combining quality growth opportunities with defensive income assets to navigate potential volatility.

Fixed Income Outlook & Strategy

Malaysia

Domestic demand strengthened in 2Q25 (+7.0% vs. 1Q25: +6.0%), supported by resilient household consumption and both private and public investments, particularly in structures and machinery. Forward momentum, however, is likely to moderate given tariff uncertainties and regional supply chain disruptions. This caution is reflected in weaker loan demand for working capital and the manufacturing sector. Private consumption remains supported by healthy labour market conditions, steady wage growth, and net income measures, which help explain BNM’s relatively gradual easing cycle (–25bps since Jan 2024).

Inflationary pressures are muted, with the core CPI steady at 1.8% in July, while the CPI-PPI gap indicates that margins remain sufficient to limit cost pass-through. Fiscal measures, including RM2 billion cash aid, reduced fuel prices, and upcoming civil servant salary hikes (see 23 July 2025 report “Special Appreciation: Cash, Freeze and Cut”), alongside the pre-emptive 25 basis point OPR cut in July, provide BNM with room to navigate through softer 3Q25 data.

Malaysian government bond yields were largely rangebound in August, with the 10-year MGS holding at 3.38% and the 10-year GII inching higher to 3.42%. While external risk factors—most notably renewed tariff rhetoric from Trump and protracted Russia–Ukraine tensions—exerted intermittent upward pressure on yields, these were effectively counterbalanced by supportive domestic conditions. The IMF’s upgrade of Malaysia’s 2025 GDP growth forecast to 4.5% (from 4.1%) underscored confidence in the country’s medium-term trajectory, while July’s export growth of 6.8% YoY highlighted the resilience of external demand despite global headwinds. In parallel, the rollout of the 13th Malaysia Plan reinforced expectations of sustained investment activity and structural reforms, anchoring investor appetite for sovereign bonds and keeping yields broadly stable.

On the flow side, foreign investors reduced holdings for a second straight month (-MYR5.5bn) amid external uncertainties, though YTD net inflows remained positive at MYR15.9 bn. Corporate bond issuance accelerated to MYR11.5bn in July, lifting YTD issuance to MYR72.5 bn, with banks and transport sectors leading supply.

Domestically, yields are expected to remain range-bound in the near term as the market awaits the 4 September BNM MPC meeting, where the OPR is likely to be maintained at 2.75%. Firmer PMI readings or continued trade resilience could encourage additional buying interest, but persistent foreign portfolio outflows and elevated geopolitical risks remain key upside risks to yields.

Regional

U.S. Treasury yields were volatile in August as investors balanced softer economic indicators with evolving Fed guidance and rising political risks. The 10-year yield ended the month at 4.23% (-14 bps MoM), while the 2-year declined more sharply to 3.59% (-35 bps). Weaker payrolls, subdued ISM Services, and a modest July CPI print (+0.2% MoM) reinforced expectations of imminent Fed easing, a view further supported by Chair Powell’s Jackson Hole remarks and Governor Waller’s dovish signals. Mid-month, however, firmer PPI and resilient retail sales briefly pushed yields higher, underscoring the fragile balance between slowing growth and sticky inflation.

In China, August’s manufacturing PMI edged up slightly to 49.4 (+0.1pt mom), while non-manufacturing PMI improved modestly to 50.3 (+0.2pt mom). However, construction PMI fell to 49.1 (-1.5pt mom), below the expansion threshold for the first time since January. With a moderating decline in new orders and new export orders, PMI for large-sized enterprise (50.8, +0.5pt mom) and small-sized enterprise (46.6, +0.2pt mom) both improved.

IMF upgrades China’s growth forecast to 4.8% yoy from 4.0% yoy previously, marking the biggest upward revision among major economies. The upgrade reflects stronger-than-expected 1H25 activity, particularly robust exports despite declining sales to the US, being offset by strong performance in the EU, Asia, and other regions. However, the IMF noted domestic demand remains relatively weak as a source of concern.

Strategy for the month

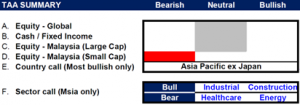

We remain neutral on global equities, mainly the US, as elevated valuations and heavy concentration in a few mega-cap technology names limit broad market upside despite still-robust earnings growth. However, we remain constructive on Asia Pacific ex-Japan equities, particularly in North Asia, supported by a weaker US dollar and a more dovish Federal Reserve. Potential easing by the Fed would give Asian central banks greater flexibility to lower interest rates, which in turn could further support regional market sentiment.

Malaysia-wise, we prefer large-cap equities over small caps, given their stronger fundamentals, better earnings visibility, and greater resilience against external volatility. Large caps also tend to benefit more from foreign investor flows and provide higher liquidity compared to smaller names.

Sector-wise for the next six months, we are bullish on the Industrial and Construction sectors, supported by strong policy tailwinds and rising investment momentum. Key initiatives such as the New Industrial Master Plan 2030, the National Semiconductor Strategy, and the Johor-Singapore Special Economic Zone are expected to spur infrastructure development and energy demand. In addition, the upcoming National Investment Incentives Framework and the next phase of multi-pronged reforms under the 13th Malaysia Plan will further reinforce investment flows. Especially for Construction, we see positive spillovers from rising capex in infrastructure, industrial parks, and data centre developments.

We are also underweighting the Healthcare sector, particularly gloves, given intense competition and a slower-than-expected pace of earnings recovery. Finally, we maintain an underweight view on the Energy sector due to its cyclical nature, which makes earnings more volatile. Nonetheless, energy companies with diversified business models are likely to be more resilient and less affected by these cyclical pressures.

Exhibit 2: PCM’s monthly strategy snapshot

Source: PCM, 31 August 2025

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.