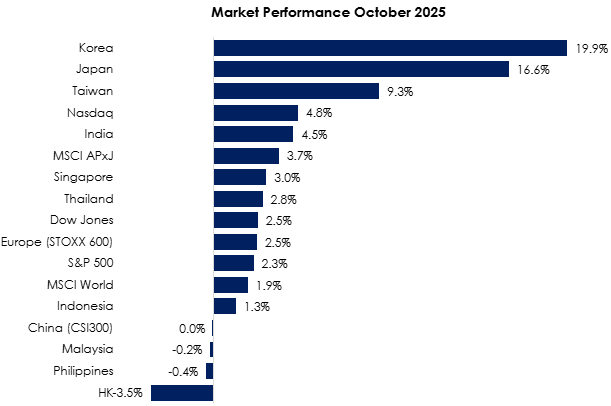

The MSCI Asia Pacific Ex-Japan Index (+3.7%) charted another month of outperformance against the MSCI World Index (+1.9%), largely in part due to semiconductor exceptionalism that benefited supply chain names in Asia Pacific. South Korea (+19.9%) placed first for the second month in a row, with 3Q GDP expanding at the fastest pace in 1.5 years along with positive developments on its trade deal with the US. The semiconductor buzz also rallied Taiwan (+9.3%) as its exports reached record highs in recent months together with a renewed bullish outlook for cutting-edge chips. India (+4.5%) climbed back to record-high levels as festive season demand and a pivot back to a net buyer position by foreign investors helped to boost sentiment. Hong Kong (-3.5%) pulled back after five consecutive months of strong gains, likely triggered by a less-than-expected compromise from the US on trade negotiations. The Philippines (-0.4%) and Malaysia (-0.2%) ended October largely flat to slightly negative as investors remained mixed on the outcomes of the recent ASEAN Conference (see Exhibit 1).

Exhibit 1: Market Performance October 2025

Source: Bloomberg, PCM, 31 October 2025

On the monetary policy front, the Federal Reserve cut interest rates by 25 basis points to 3.75–4.00%. The European Central Bank (ECB) kept its deposit facility rate at 2.00%. In Asia, the People’s Bank of China (PBoC) maintained the one-year LPR at 3.0% and the five-year LPR at 3.5%, while the Bank of Japan left its benchmark short-term rate unchanged at 0.5%.

The FBMKLCI Index lost 0.2% month-on-month (m-o-m) in October, closing at 1,609.15 points. Meanwhile, the Small Cap Index gained 0.1%, while the Mid 70 Index increased by 1.9%.

Sector-wise in October, the top-performing sectors were Technology, Consumer, and Healthcare, which rose 9.8%, 3.6%, and 2.9% m-o-m, respectively. The worst-performing sectors were Construction, Property, and Utilities, which lost 6.0%, 2.7%, and 1.7% m-o-m, respectively. Foreign investors turned net sellers in October, recording outflows of RM2.7 billion. Separately, in October, there were six listings on the ACE Market (Camaroe Bhd, Cheeding Holdings Bhd, Verdant Solar Holdings Bhd, THMY Holdings Bhd, Insights Analytics Bhd and Powertechnic Group Bhd), and one listing on the LEAP Market (LPC Group Bhd).

For the month of October, WTI crude oil plunged 2.2% m-o-m, closing at US$61.0 per barrel, while Brent oil fell 2.9% to US$65.1 per barrel. Crude palm oil closed at RM4,185/MT, down 2.8% from the previous month, while spot gold rose 4.1%, ending the month at US$3,996.5/oz. Currency-wise, the Malaysian ringgit appreciated 0.4% m-o-m against the greenback to RM4.1885/USD. Meanwhile, the Dollar Index gained 2.1% at 99.8 points.

Equity Market Outlook & Investment Strategy

Malaysia

We remain constructive on the Malaysia market, supported by multiple tailwinds. Expectations of a Fed easing cycle from 4Q25 into 2026 should improve global liquidity and risk appetite across Asia. Domestically, fiscal reforms are largely priced in, while resilient macro fundamentals, robust consumption, and an expanding investment pipeline support growth. Structural transformation is reinforced by key national blueprints (13MP, NIMP 2030, NSS, NETR), while Malaysia’s ASEAN Chairmanship enhances its strategic relevance. Strong local institutional flows, a firmer ringgit, undemanding CY26 P/E of 13.9x, and record-low foreign shareholding of 18.7% further strengthen the market’s risk-reward profile.

Regional

The recent Xi–Trump meeting at the APEC summit marked a “transactional truce” in US–China relations, easing trade tensions and halting the momentum toward economic decoupling. This development sets the stage for a more stable geopolitical environment heading into 2026. Meanwhile, the Federal Reserve cut rates by 25bps in October to 3.75–4.00%, with markets expecting one more cut to bring the federal funds rate to 3.50–3.75% by end-2025, though future moves remain data-dependent. US equities continue to draw support from robust technology earnings, but elevated valuations may limit upside potential. While concerns about a sustained US government shutdown persist, markets have largely discounted its impact given past precedents. In Asia Pacific, improved liquidity could offer some tailwinds, though global growth and policy uncertainties may weigh on sentiment. We maintain a barbell strategy through 2025, combining quality growth opportunities with defensive income assets to navigate potential volatility.

Fixed Income Outlook & Strategy

Malaysia

Looking ahead, the 10-year MGS yield is expected to remain broadly stable around 3.50%, supported by expectations that Bank Negara Malaysia will maintain the OPR at 2.75%. Anticipation of a U.S. rate cut and improving US–China relations are likely to sustain foreign interest in Malaysian bonds. Investors are expected to focus on short- to medium-duration securities to manage duration risk while taking a selective approach toward longer maturities amid persistent global uncertainties.

Regional

As widely anticipated, the Federal Reserve cut the federal funds rate by 25 bps to 3.75%–4.00%, though a split vote revealed growing division within the committee. The key policy shift was the decision to end the balance sheet runoff on December 1, with the Fed set to roll over all maturing Treasuries and reinvest MBS proceeds into Treasury bills to stabilize short-term funding markets. Chair Powell emphasized policy flexibility, pushing back against expectations of an automatic easing path amid limited data visibility and ongoing labour market concerns. Markets trimmed the odds of another December cut to around 70%, while UST yields rose above 4.00% as confidence in near-term rate cuts moderated.

Eurozone GDP expanded 0.4% QoQ in Q3, beating forecasts, driven by France’s robust 0.7% growth, while Germany and Italy stagnated at 0.0%. The ECB kept its deposit rate unchanged at 2% for a third straight meeting.

The People’s Bank of China (PBOC) maintained an accommodative stance, keeping the one-year Loan Prime Rate (LPR) at 3.00% and the five-year LPR at 3.50% amid ongoing policy support through liquidity measures and targeted credit easing. Despite stable rates, policymakers remained cautious given lingering deflationary pressures and weak private investment, signaling potential for further stimulus if growth continues to underperform.

Strategy for the month

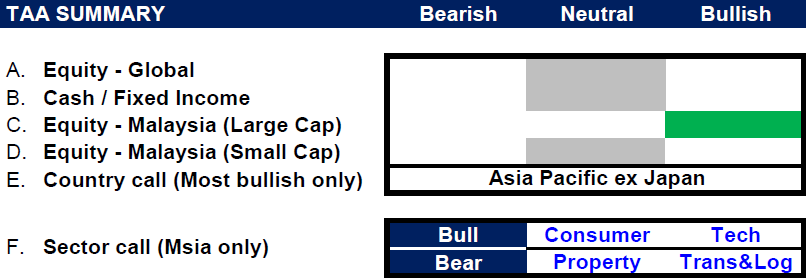

We remain neutral on global equities, mainly the US, as elevated valuations and heavy concentration in a few mega-cap technology names limit broad market upside despite still-robust earnings growth. However, we remain constructive on Asia Pacific ex-Japan equities, particularly in North Asia, supported by a weaker US dollar and a more dovish Federal Reserve. Further easing by the Fed would give Asian central banks greater flexibility to lower interest rates, which in turn could further support regional market sentiment.

In Malaysia, we are turning bullish on large-cap equities and remain neutral on small-cap equities. Other supportive factors further strengthen the KLCI’s risk–reward profile, including seasonal strength in Q4 with 10- and 20-year average returns of +2.0% and +2.4%, respectively, ringgit appreciation of more than 6% YTD, attractive CY2026 valuations at 13.9x P/E versus a 5-year mean of 17.2x alongside a 4.1% dividend yield, and record-low foreign shareholding of 18.7% as of September, signalling ample re-rating potential.

Sector-wise, we overweight Consumer and Technology sectors, supported by resilient domestic demand, strong earnings visibility, and structural growth trends, which position these sectors to benefit from both cyclical recovery and long-term market opportunities. Meanwhile, we remain underweight on the Property and Transport & Logistics sectors.

Exhibit 2: PCM’s monthly strategy snapshot

Source: PCM, 31 October 2025

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.