Market Review (November 2025)

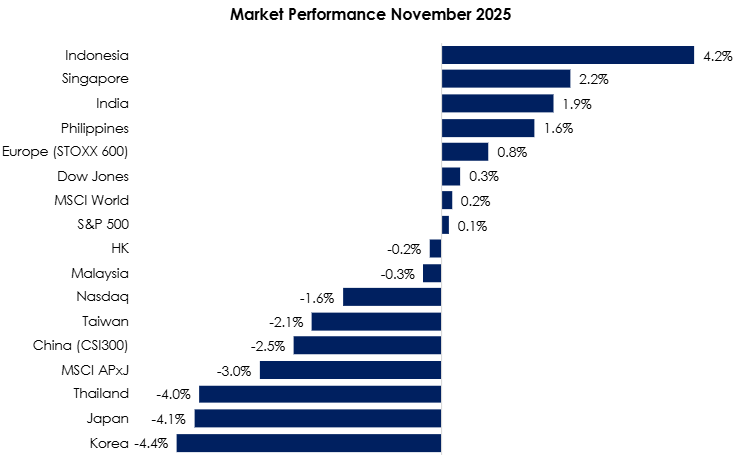

The MSCI Asia Pacific Ex-Japan Index (-3.0%) broke its 2-month hot streak and tumbled against the MSCI World Index (+0.2%) as key Asian powerhouses led to the downside. Indonesia (+4.2%) bucked the regional trend, rallying to a record high on strong economic data and prospect for further rate cuts. Singapore (+2.2%) also charted new all-time highs despite slower GDP growth but offset by strong pharmaceutical and electronics factory output. Not to be left behind, India (+1.9%) continued its rally and closed November a smidge above past record high, propelled by exceptional GDP growth beating forecasts. On the other hand, South Korea (-4.4%) faced a correction with its sharpest decline since Jan’24 as Big Tech names tumbled on renewed concerns of an AI bubble. Thailand (-4.0%) erased October’s recovery gains as widespread flooding threatens its economy. China (-2.5%) markets slid as its economy recorded its weakest factory output and retail sales growth in over a year (see Exhibit 1).

Exhibit 1: Market Performance November 2025

Source: Bloomberg, PCM, 30 November 2025

On the monetary policy front, the Bank of England (BOE) kept its interest rate at 4.00%. In Asia, the People’s Bank of China (PBoC) maintained the one-year LPR at 3.0% and the five-year LPR at 3.5%. Finally, Bank Negara Malaysia (BNM) kept the Overnight Policy Rate (OPR) unchanged at 2.75% following its Monetary Policy Committee (MPC) meeting in November.

The FBMKLCI Index fell 0.3% month-on-month (m-o-m) in November, closing at 1,604.47 points. Meanwhile, the Mid 70 Index declined 1.2%, while the Small Cap Index dropped 5.7%.

Sector-wise in November, the top-performing sectors were Finance, Property, and Plantation, which rose 2.5%, 2.4%, and 1.0% m-o-m, respectively. The worst-performing sectors were Technology, Utilities, and Healthcare, which lost 8.9%, 8.3%, and 6.8% m-o-m, respectively. Foreign investors continued to be net sellers in November, recording outflows of RM1.1 billion. Separately, in November, there were five listings on the ACE Market (Farmiera Bhd, PMW International Bhd, Aquawalk Grp Bhd, Polymer Link Holdings Bhd, and Foodie Media Bhd).

For the month of November, WTI crude oil plunged 4.0% m-o-m, closing at US$58.6 per barrel, while Brent oil fell 2.9% to US$63.2 per barrel. Crude palm oil closed at RM4,099/MT, down 2.1% from the previous month, while spot gold rose 5.6%, ending the month at US$4,218.3/oz. Currency-wise, the Malaysian ringgit appreciated 1.4% m-o-m against the greenback to RM4.1328/USD. Meanwhile, the Dollar Index lost 0.4% at 99.5 points.

Equity Market Outlook & Investment Strategy

Malaysia

We remain constructive on the Malaysia market, supported by multiple tailwinds. Expectations of a Fed easing cycle from 4Q25 into 2026 should improve global liquidity and risk appetite across Asia. Furthermore, Malaysia’s growth outlook remains supported by resilient fundamentals, firm consumption, rising investments, and ongoing structural reforms under key national blueprints. In the near term, the KLCI may face volatility as investors assess the post-Sabah election outcome and the likelihood of a cabinet reshuffle, which could strengthen Federal–Sabah ties and signal greater inclusivity. With Hajiji Noor sworn in for a second term, the new coalition government is expected to align more closely with the PM’s Madani administration and national priorities. Looking further ahead, firm local institutional demand, a stronger ringgit, undemanding CY26 P/E of 14.2x, and historically low foreign ownership of 19.0% (as of November) continue to underpin an attractive risk-reward backdrop.

Regional

We remain neutral on global equities, mainly the US, as elevated valuations and heavy concentration in a few mega-cap technology names limit broad market upside despite still-robust earnings growth. However, we remain constructive on Asia Pacific ex-Japan equities, particularly in North Asia, supported by a weaker US dollar and a more dovish Federal Reserve. Further easing by the Fed would give Asian central banks greater flexibility to lower interest rates, which in turn could further support regional market sentiment. We maintain a barbell strategy through 2025, combining quality growth opportunities with defensive income assets to navigate potential volatility.

Fixed Income Outlook & Strategy

Malaysia

MGS yields are expected to remain broadly stable with a slight downward bias, supported by resilient domestic fundamentals, steady foreign inflows, and constructive supply conditions, while geopolitical and weather-related risks could introduce temporary volatility; in this environment, a slightly longer duration stance or a barbell strategy—balancing long-end exposure with short maturities—remains favourable to capture potential yield compression while managing event risks.

Regional

UST yields exhibited a gradual softening bias over the month as markets reassessed the policy outlook in response to emerging labour-market slack and increasingly dovish commentary from Federal Reserve officials. Indicators such as rising layoffs, weaker ADP employment data, subdued retail sales, and declining consumer confidence signalled cooling economic momentum, reinforcing expectations that the Fed may deliver a December rate cut. However, the decline in yields was moderated by lingering uncertainty from delayed data releases following the government shutdown, pockets of hawkishness in the FOMC minutes, and weaker demand at long-tenor auctions. Despite these cross-currents, the balance of data and communication points to a softer rates trajectory, keeping UST yields on a downward glide path heading into December.

European Central Bank President Lagarde said the central bank is well-positioned with borrowing costs currently at the “right level”. She added that the scope of risks to the inflation outlook has narrowed. Overall, she expressed optimism about the euro-area expansion, saying it has been more resilient than anticipated.

China’s official PMIs came in below expectations in November, with both the manufacturing and non-manufacturing activities in contraction (reading

Taiwan’s GDP surged 8.21% y/y in 3Q25, recording the strongest quarterly growth rate in more than four years. The growth in 3Q25 was revised up 0.57ppt from the advance estimate. The economy also rose sequentially for the 10th straight quarter, up 1.71% q/q s/adjusted basis on top of 2.54% q/q in 2Q25. The significant outperformance was due to the rapid increase in AI applications and infrastructure building globally, which fuels demand for Taiwan’s electronic components and ICT exports. Following the robust growth, Taiwan raised its GDP forecast for 2025 to 7.37% from 4.45% previously. For 2026, the GDP is expected to grow by 3.54%.

Strategy for the month

We remain neutral on global equities, mainly the US, as elevated valuations and heavy concentration in a few mega-cap technology names limit broad market upside despite still-robust earnings growth. However, we remain constructive on Asia Pacific ex-Japan equities, particularly in North Asia, supported by a weaker US dollar and a more dovish Federal Reserve. Further easing by the Fed would give Asian central banks greater flexibility to lower interest rates, which in turn could further support regional market sentiment.

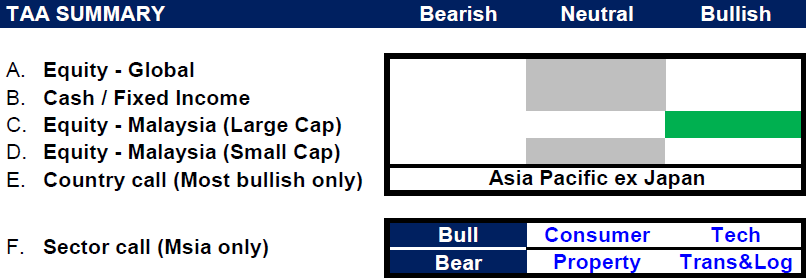

In Malaysia, we are turning bullish on large-cap equities and remain neutral on small-cap equities. Other supportive factors further strengthen the KLCI’s risk–reward profile, including seasonal strength in Q4 with 10- and 20-year average returns of +2.0% and +2.4%, respectively, ringgit appreciation of more than 6% YTD, attractive CY2026 valuations at 13.9x P/E versus a 5-year mean of 17.2x alongside a 4.1% dividend yield, and record-low foreign shareholding of 18.7% as of September, signalling ample re-rating potential.

Sector-wise, we overweight Consumer and Technology sectors, supported by resilient domestic demand, strong earnings visibility, and structural growth trends, which position these sectors to benefit from both cyclical recovery and long-term market opportunities. Meanwhile, we remain underweight on the Property and Transport & Logistics sectors.

Exhibit 2: PCM’s monthly strategy snapshot

Source: PCM, 30 November 2025

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.