Personalized Private Mandate Portfolio just for YOU!

Invest in Phillip Managed Account for Retirement (PMART) Directly from Your EPF Akaun Persaraan.

Phillip Capital Management Sdn Bhd (PCM) proudly leads as the FIRST 🏆 Fund Management Institution (FMI) under the Members Investment Scheme to introduce Phillip Managed Account for Retirement (PMART) on the i-Invest platform. Starting from 24th January 2024, EPF has announced that its members can now invest, switch, or redeem their Private Mandate Portfolios through the secure and user-friendly online transaction portal (i-Invest) within the i-Akaun (member) portal.

Through i-Invest (i-Akaun), EPF members can also effortlessly view their Private Mandate Portfolios and select the PMART products they wish to invest.

Start your investment journey with us today from RM5,000*!

*Terms & Conditions Apply.

What is Private Mandate?

Private Mandate is a bespoke wealth management solution. In this approach, investment decisions are made by an investment manager based on the agreed-upon risk levels. This option is favored by corporate entities and high-net-worth investors seeking to entrust the responsibility to a seasoned professional with ample resources for vigilant monitoring and adept navigation through market uncertainties.

What is PMART?

Phillip Managed Account for Retirement (PMART) is a diversified investment portfolio comprising shares, ETFs, and unit trusts, meticulously managed by Phillip Capital Management Sdn Bhd.

This exclusive opportunity is open to all EPF members with substantial savings in their EPF Akaun Persaraan (Formerly known as Account 1), as an EPF-approved Fund Management Institution (FMI).

Take the reins of your financial future with PMART, providing EPF members with a flexible alternative to have their savings skillfully managed by us.

Navigate Your Investment Portfolio 🎯

Steer Your Private Mandate with Your Decisions

- Invest with Confidence

EPF members can securely manage Private Mandate portfolios with i-Invest (i-Akaun).

- Total Control at Your Fingertips

Manage Private Mandates and choose PMART products with your EPF Akaun Persaraan.

- Visibility and Flexibility

Explore and tailor your PMART products effortlessly with i-Invest (i-Akaun).

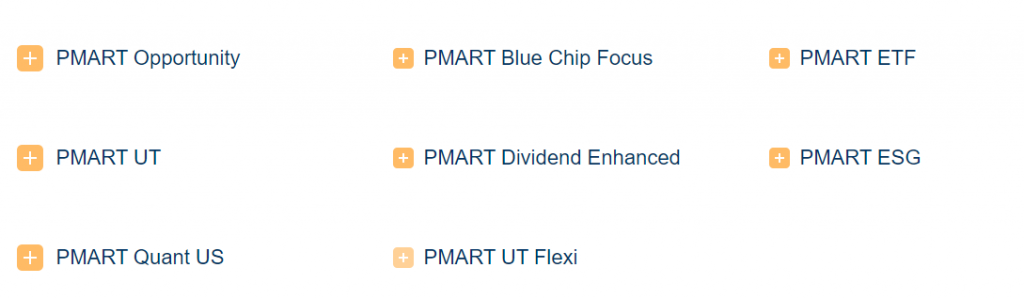

Our Products

How do I start?

Step 1:

Log into EPF i-Akaun (Member)

Step 2:

Click on i-Invest > Transaction > Buy.

Step 3:

Choose your preferred Fund Management Institution (FMI) and select the Private Mandate Portfolio(s) you wish to invest in, with a minimum investment of as low as RM5,000.

Step 4:

Choose “Phillip Capital Management Sdn Bhd” as your preferred investment option.

Step 5:

Complete the transaction by signing up or logging in to your PhillipInvest account and enter the TAC code verification.