Budget 2025 builds on the foundations of Budget 2024, showcasing the government’s commitment to strengthening the country’s fiscal position. In our latest article, we outlined the key measures from Budget 2025 and shared our insights on its implications. Within the context of ESG, we recognize the government’s strong dedication to advancing the ESG agenda. Certainly, there are numerous initiatives outlined in the Budget 2025, but in this write-up, we only emphasise a few of them.

- Carbon Tax Introduction: A Carbon Tax on the iron, steel, and energy industries is set to be introduced by 2026, with details on its structure and applicability still pending. Hence, going forward, heavy carbon emitters will soon be penalised via the carbon tax in 2026.

- Investment Incentives: Tax allowances and income tax exemptions will be offered for Carbon Capture, Utilisation, and Storage (CCUS) initiatives as well as smart logistics.

- Economic Cluster Development: Allocations and incentives will foster growth in less-developed states by establishing economic clusters based on local strengths (e.g., renewable energy in Perlis and Sabah; chemical industries in Pahang and Terengganu) to promote investments in 21 economic sectors.

- Increased National Energy Transition Facilitation Fund: The fund will be raised to MYR300 million for 2025 (up from MYR100 million in 2024).

- Extension of Net Energy Metering (NEM): The NEM program is extended until June 30, 2025, with increased quotas for solar PV installations.

- Green Technology Financing Scheme (GTFS) 5.0: Implementation of GTFS 5.0 with funding of MYR1 billion until 2026 to support green technology projects.

- Investment in Infrastructure: UEM Lestra and TNB will invest MYR16 billion to enhance transmission and distribution networks and decarbonize industrial areas.

- Energy Performance Contracts: All government agencies will adopt Energy Performance Contracts to achieve savings of up to 10% on electricity bills.

- Flood Disaster Preparedness: Nearly RM600 million allocated for the National Disaster Management Agency (NADMA) to prepare for flood disasters, including over RM300 million for immediate readiness and flood mitigation projects in key states (including Selangor and Pahang).

Our View

In the context of ESG, the introduction of a Carbon Tax in 2026 is expected to positively impact the Renewable Energy (RE) sector. Additionally, the Construction sector is likely to gain significantly from this Budget due to tendering of Flood Mitigation projects and Development Expenditure allocation of RM86bn. The RE and Utilities sectors will also benefit from the ongoing initiatives from National Energy Transition Roadmap (NETR).

Identify investment opportunities – Phillip Managed Account for Retirement (PMART) and Phillip Managed Account (PMA) ESG

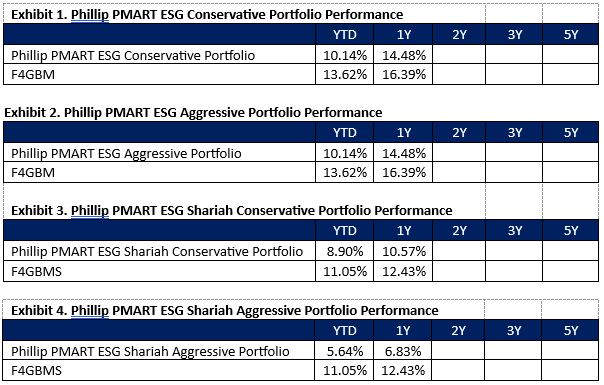

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies. Exhibits 1-4 show the performance for PMART ESG Conventional and Shariah.

Source: PCM, 30 Sep 2024

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.