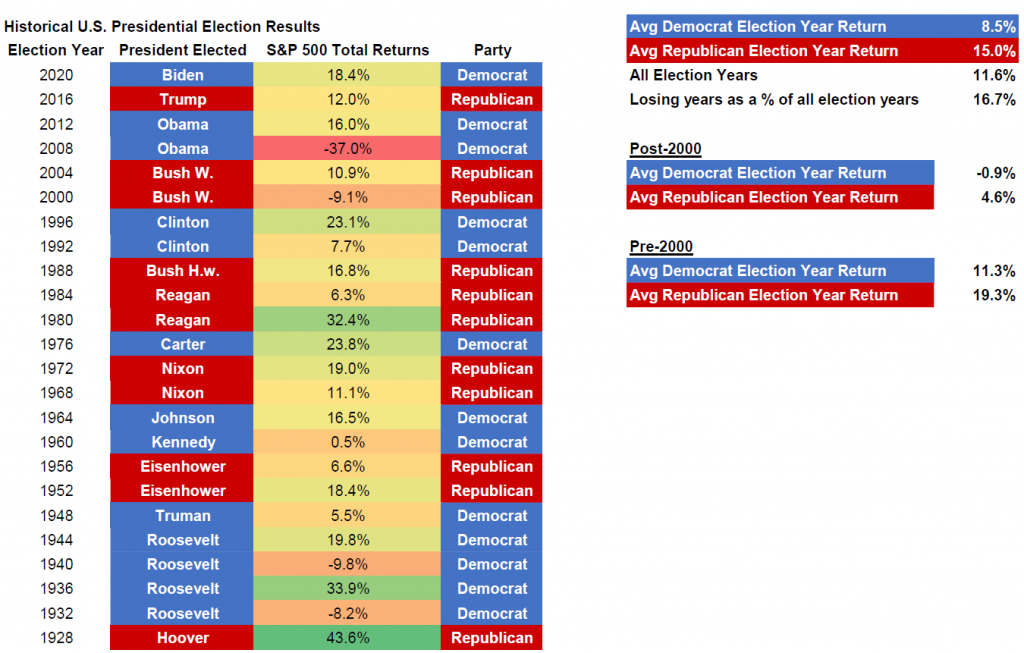

With Trump’s return for a second presidential term, investors should now shift their focus to how to strategically position themselves moving forward. We argue that market performance does not necessarily depend on the outcome of the U.S. presidential election.

Notably, “Change Election” has become the new norm in the U.S. Since 2000, 10 out of 12 federal elections—including all of the last five—have led to a change in the party controlling the House, Senate, and/or the White House (see Figure 1). This trend significantly exceeds the average from the 1960s to the 1990s, during which only one or two elections per decade resulted in a shift in party control. Despite this, the S&P 500 index has historically returned about 10% per year on average before adjusting for inflation, although the market tends to be more volatile during election years.

Another observation is that the S&P 500 Index posted negative returns in 2000 and 2008, with losses of -9.1% and -37.0%, respectively. However, these declines, arguably, were not a result of the election outcomes, but rather were driven by the dotcom bubble and the global financial crisis. Lastly, it is notable that the market tends to perform better during Republican election years, with the average return reaching 15.0%. Disclaimer: Past performance does not guarantee future results.

Figure 1: Historical U.S. Presidential Election Results

Source: PCM

Tariff itself is reflationary

Donald Trump’s 2024 trade policies are expected to mirror his “America First” approach from his first term, focusing on reducing the U.S. trade deficit, protecting American jobs, and challenging perceived unfair trade practices, especially with China. Key proposals include 10% blanket import duties on all imported goods and a 60% tariff on Chinese goods. These measures are likely to provoke retaliation from countries like China, the EU, Canada, and Mexico, escalating tariffs and increasing import costs. This could lead to higher prices for U.S. consumers and reduced demand both domestically and abroad. In the short term, this could slow global trade and manufacturing, potentially triggering a phase of global reflation—driven by supply chain disruptions, increased costs, and weaker demand. Over the long term, the global economic balance may shift as nations diversify trade partners, potentially diminishing U.S. economic influence and reshaping international trade dynamics. The dollar may also strengthen during inflationary periods as the Federal Reserve is likely to tighten monetary policy.

Malaysia stands to benefit from Trade War 2.0?

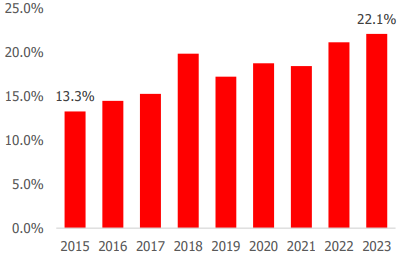

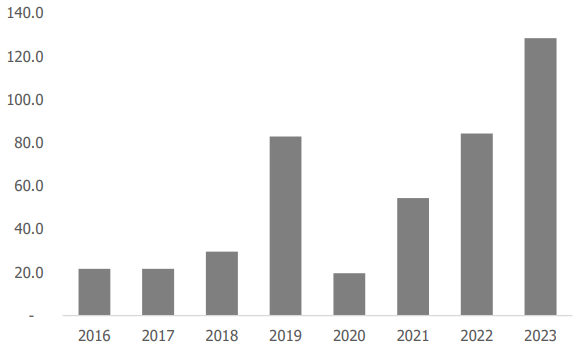

Based on the past experience, Malaysia stands to benefit from the intensification of US-China trade war. In fact, following the first trade war, re-exports have grown significantly, accounting for 22.1% of Malaysia’s total exports in 2023, up from 18.6% in 2019 (see Figure 2). Foreign direct investment (FDI) also surged, rising from RM21.6 billion in 2016 to RM128.4 billion in 2023 (see Figure 3). Key sectors attracting FDI include electrical and electronics, semiconductors, green technology, machinery, and medical devices. Malaysia’s strategic location and improving infrastructure are key factors in this trend.

Figure 2: Ratio of Re-Export Vs Total Export (%)

Source: MIDF

Figure 3: Malaysia Total Approved Manufacturing Projects from Foreign Countries (2016 – 2023)

Source: MIDF

Market Positioning

As Trump returns for a second term, investors will need to embrace volatility, recognizing that his policies may introduce uncertainty, but also potential opportunities for growth and market adjustments in a dynamic environment. We maintain a cautiously optimistic outlook on the U.S. market, as corporate earnings remain resilient alongside positive economic data. Additionally, Trump’s proposal to reduce the corporate tax rate to 15% could enhance companies’ earnings prospects. Export-driven economies like China, Taiwan, Korea, Japan, and Mexico may face heightened competition from the U.S. However, the full impact is likely to be felt over the long term, as companies may find it difficult to quickly source cheaper alternatives in the short term. On the other hand, Australian and Indian companies with significant U.S. operations may benefit from the lower tax rate. Malaysia, as previously mentioned, will continue to benefit from trade diversion.

For investors favoring Malaysia, we encourage them to consider the following investment mandates.

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Alternatively, investors can explore PMART UT, Managed UT, and PMART UT Flexi for a more diversified exposure, encompassing markets such as the U.S., China, Malaysia, and others.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.