The Hong Kong/China markets have softened in recent months, as concerns over an AI-related capex bubble and a less favorable outlook for Fed rate cuts triggered sharp global equity pullbacks, affecting Hong Kong/China, the US, South Korea, and Taiwan. The HSI fell -3.5% in October and -0.2% in November, though YTD November it remains up 28.9%. The CSI 300 was largely unchanged in October but declined -2.5% in November, with YTD gains at 15.0%.

Weak macro momentum also contributed to market selling in November. October data showed broad-based economic slowdown, with growth decelerating across industrial production, consumer spending, investment, and exports. This weakness likely continued into November, as the official manufacturing PMI remained in contraction at 49.2% (October: 49.0%) despite easing trade uncertainties. Meanwhile, the official non-manufacturing PMI fell below 50.0% to 49.5% (October: 50.1%), marking its first contraction since the post-pandemic reopening.

At the time of writing, the market is patiently awaiting the policy window—namely, the December Politburo meeting and the Central Economic Work Conference—for further signals on the government’s policy direction. We believe China’s policy support should remain pro-growth, and officials are likely to keep the 2026 GDP target near 5% (matching 2025’s goal) while maintaining a roughly 4% deficit ratio. The government will likely emphasize “steady growth” and more proactive fiscal and monetary easing, as in last year’s guidance.

On a separate note, investors should watch for signals from the Dec 13–14 FOMC decision. At the time of writing, the futures market is pricing in an 87% probability of a Fed rate cut. Further Fed easing could provide China with additional policy flexibility, as we saw in September 2024, such as lowering interest rates. This could benefit broad market sentiment, with sector-specific gains in areas such as Property and Consumer.

Looking ahead, 2026 is the first year of the 15th Five-Year Plan – a “pivotal bridge” in China’s century-long modernization. The US–China trade war is likely to keep China focused on industrial upgrading and tech breakthroughs rather than purely boosting consumption. With great-power rivalry intensifying, policymakers emphasize “protecting national interests” while injecting long-term certainty into the economy. In practice, this means more support for advanced manufacturing and strategic industries (from EVs and green energy to semiconductors) even as domestic demand is nurtured. In sum, with external uncertainties rising, China will lean on its “historic initiative” of state-guided planning to find stability amid volatility.

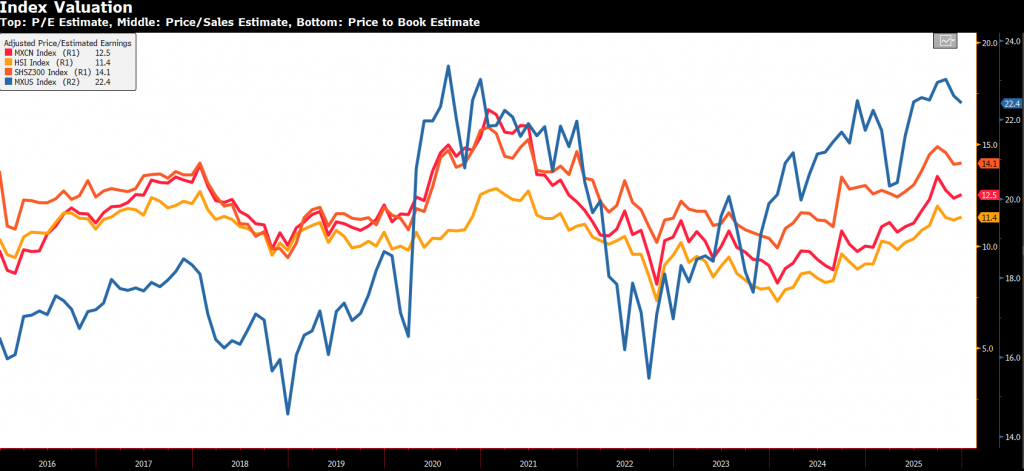

Our outlook for HK/China equities remains cautiously optimistic, with investor sentiment closely linked to policy developments both within the domestic economy and global (especially the US). While opportunities exist—particularly in sectors benefiting from structural tailwinds—a cautious and selective approach is warranted as markets navigate the uncertainties of 2025. Following the recent correction, valuations are now back to a more reasonable level. As of 30 November 2025, the HSI Index is trading at a 2026 P/E of 11.4x, compared with 12.5x for MSCI China and 14.5x for the CSI 300 Index, all notably below MSCI USA’s 22.4x.

Source: Bloomberg, 30 November 2025

Investors seeking HK/China exposure can consider our Managed UT Portfolio, which includes PMART UT, PMA UT, and PMART UT Flexi for targeted investment opportunities. Our portfolio is available in both Conventional and Shariah options. Separately, our platform also offers selected UT funds with exposure to HK/China-focused strategies.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.