2025 has been a strong year for U.S. equities, with the S&P 500 up 17.5% and the Nasdaq up 22.6% year-to-date as of 10 December 2025. This underscores technology’s continued role as a primary driver of market performance thus far. However, the U.S. economy has shown signs of weakness, primarily due to softer labour market dynamics, which have created a domino effect across sectors. For instance, in the manufacturing sector, the ISM reported that its manufacturing PMI fell to 48.2% in November from 48.7% in October.

As a result, equity markets softened in November amid weakening economic data alongside concerns over a potential AI-driven capital expenditure bubble, technology replacing human labour, and renewed uncertainty regarding the Federal Reserve’s (Fed) policy path. These factors contributed to heightened volatility as investors reassess earnings expectations heading into 2026.

Subsequently, in its meeting on 10 December 2025, the Fed opted to cut interest rates by 25 basis points, bringing the target range to 3.50%–3.75%, citing a combination of weakening labour market conditions and inflation moving further above the central bank’s 2% target. The situation leading to the above includes the “DOGE Impact,” which emerged as a major factor contributing to job cuts in 2025. Layoffs in October surged 175% year-over-year, reaching 153,074. From the start of the year through the end of October, employers announced a total of 1,099,500 job cuts, a 65% increase from 664,839 during the same period last year.

Other factors influencing the Fed’s decision included ongoing labour market uncertainty. U.S. job openings barely moved in October, totalling 7.7 million, which means there are now more unemployed individuals than available job openings. Additionally, the recent 43-day government shutdown disrupted economic activity, leaving an estimated 1.4 million federal employees furloughed or working without pay, which dampened both consumer and business confidence.

We expect 2026 to be a transitional year for the U.S. economy, characterized by slower GDP growth, moderating inflation, persistent political polarization, and ongoing U.S.–China tensions. Government’s priorities are likely to remain focused on advanced manufacturing, AI infrastructure, and semiconductors, including policies related to AI-chip exports to China.

According to the Trump administration, the decision to allow the export of Nvidia’s H200 chips to China reflects a strategic balance of economic and geopolitical considerations.

In this case of permitting Nvidia to maintain access to the world’s largest single market for AI hardware, the U.S. helps ensure the continued global competitiveness of one of its most important technology companies. This access, in turn, supports the broader U.S. leadership position in semiconductor innovation. Furthermore, keeping American chips embedded in China’s AI ecosystem serves a longer-term strategic purpose: it allows the U.S. to retain a measure of influence and leverage over the technological development of a key geopolitical rival.

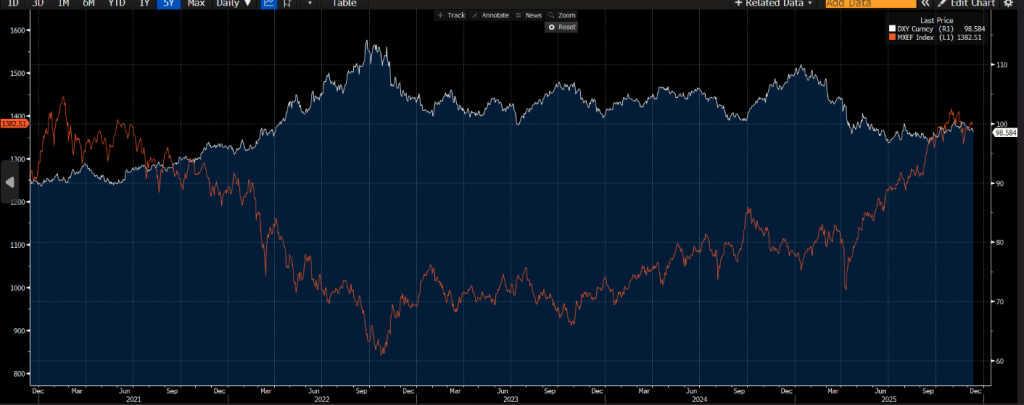

We believe that the ongoing rate cuts will benefit rate-sensitive sectors such as technology, real estate, consumer discretionary, communication services, and industrials. Lower interest rates can help ease financial conditions, support economic activity, and reinforce equity performance, particularly in sectors most sensitive to the cost of capital. Following these rate cuts, emerging markets are poised to outperform U.S. stocks as dollar weakness persists. A weaker dollar serves as a tailwind by making their assets more affordable for foreign investors, boosting trade competitiveness, easing debt burdens, and attracting capital, all of which can support stronger stock performance in these regions.

Figure 1: The Dollar Index has inverse correlation with MSCI Emerging Market Index

Source: Bloomberg, 11 December 2025

Our Thoughts

The outlook for equities remains cautiously constructive, with sentiment closely tied to the Fed’s ability to balance inflation control with support for economic activity as we move through 2026. Our assessment suggests that technology, AI, semiconductors, and digital infrastructure remain key long-term growth themes, with earnings growth in tech set to reaccelerate thanks to ongoing AI investment. Overall, 2026 appears to be a year of transition and opportunity, where careful navigation of volatility and a focus on structural growth sectors will be critical for investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.