Global markets have rebounded strongly in November with the 10-year U.S. Treasury yield stabilising around the 4.40% range after hitting 5% a month ago, reflecting a shift in market expectations towards a potential end to the Fed’s rate-hiking.

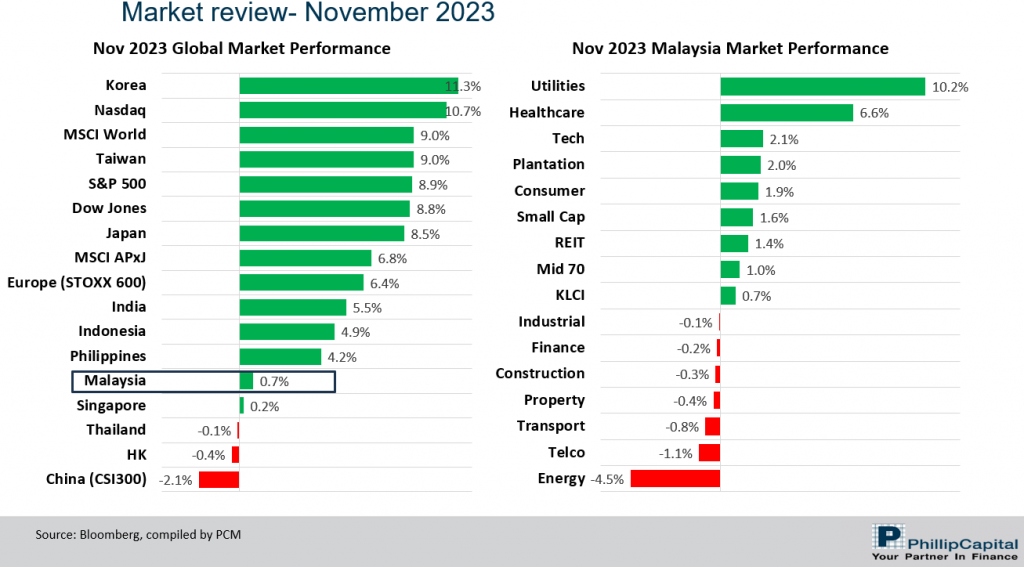

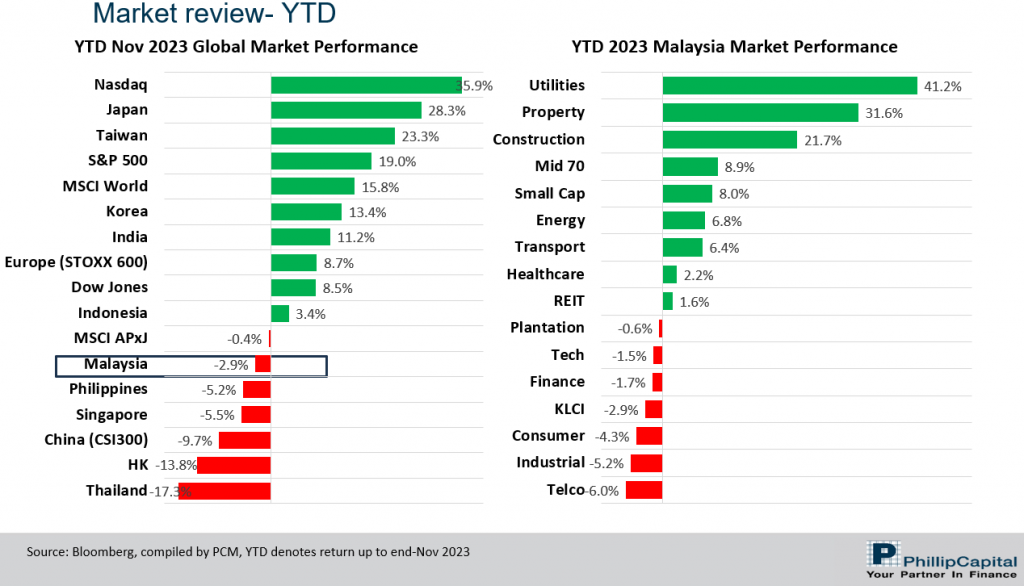

The MSCI Asia Pacific Ex-Japan Index (+6.8%) lagged the MSCI World Index (+9.0%) mainly due to underperformance in the China/HK market. China CSI300 (-2.1%) and HK (-0.4%) weakened as manufacturing activity contracted for the 2nd month, signalling momentum loss and scepticism on China stimulus & recovery plans. South Korea (+11.3%) greatly outperformed all major indices, rebounding from October’s rout as exports accelerated amid a rebound in semiconductor demand. Taiwan (+9.0%) also fared well in November despite cutting its growth outlook and signs of economic contraction. India (+5.5%) on the other hand beats growth estimates thanks to gains in manufacturing and government spending (see Exhibit 1).

Exhibit 1: Nov 2023 & YTD 2023 Market Performance

In the US, the likelihood of a “no landing” scenario has increased, driven by unexpectedly robust growth attributed to post-pandemic factors (such as excess savings). Our base case sees continued moderation of inflation and growth in the US but also acknowledges the underlying resilience of the economy. Separately, we expect a moderate growth recovery for China towards end-2023 supported by policy stimulus. China will reassess its focus on economic growth by re-engaging economic relationships with various countries, stabilising the property sector, and maintaining fiscal credit expansion and expansionary monetary policies. Separately, China regulators have come up with three “not lower than” rules and a whitelist to step up credit support for property developers.

Back home, foreign investors returned as the net buyer with buying value of RM1.5bn after some RM2.2bn outflow last month. Foreign investors favoured Utilities, Healthcare, and Financial Services sectors in November, whereas Consumer and Energy sectors witnessed the largest outflows. Consequently, there were moderate gains observed in FBM KLCI, FBM Mid 70, and FBM Small Cap indices during November.

The recent Q3 results presented a mixed picture: construction and glove sectors beat, banks were in line, while property, tech, and industrial sectors fell below expectations. Nevertheless, there has been growing optimism in Malaysia’s market due to political stability (post-state election) and potential benefits from the New Energy Transition Roadmap, the New Industrial Master Plan 2030 and projected improvement to the budget deficit detailed in the Budget 2024. KLCI is supported by an undemanding valuation (13.1x forward P/E vs 10Y average 16.6x) accompanied by an all-time low of foreign shareholding of 19.6% (as at Nov 2023).

Strategy for the month

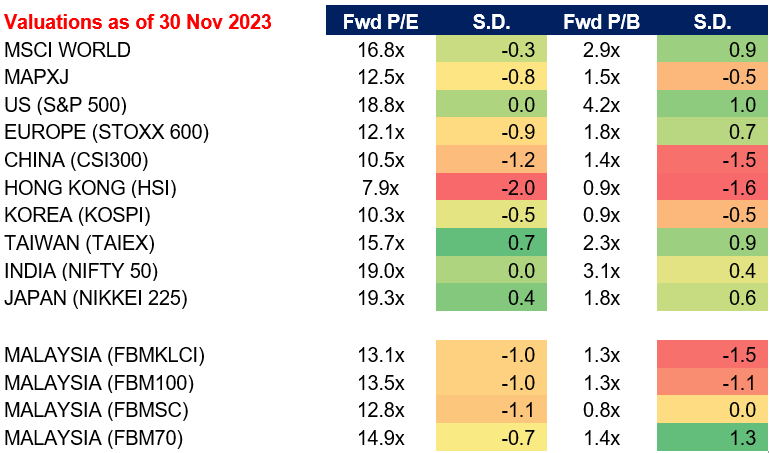

On the global front, we remained Overweight in HK/China supported by attractive valuation (CSI300 – 10.5x forward P/E, -1.2 standard deviation below its 5-year mean; HSI – 7.9x forward P/E, -2.0 standard deviation below its 5-year mean) and supportive policy stimulus. In Malaysia, we remain positive on large-cap stocks considering the potential for a favourable performance in December (92% hit rate since GFC, according to HLIB). Our stance on small-cap stocks has slightly improved from last month but we remain selective, focusing on companies with robust earnings growth potential and led by quality management. Sector-wise, similar to the previous month, we continue to favour the Construction sector due to Budget 2024, rollout of infrastructure projects, and the National Energy Transition Roadmap. We hold a selective optimistic view on specific companies within the Industrial sector that will benefit from trade diversion and the ongoing recovery narrative. Conversely, the Telco sector faces challenges due to intense competition, and the Consumer sector’s outlook dims due to an increase in the Sales and Services Tax (SST) to 8% and the introduction of a 5–10% luxury goods tax in Budget 2024. However, certain consumer stocks may offer some potential as beneficiaries of a weakening dollar, leading to improved margins, alongside various financial aid and subsidies.

Exhibit 2: Selected Market Indices Valuations

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

Phillip Capital Malaysia offers a comprehensive suite of financial services including managed accounts and unit trusts, that may suit your investment preferences and financial goals. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors.

Click here to learn more

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies.

To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link. We like these companies because they have received high ESG ratings, which we believe can contribute to their long-term sustainability, responsibility, and profitability.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Separately, for investors who would like to have regional exposure, PMART UT, is a portfolio of EPF approved unit trust funds managed by award-winning fund managers. It allows investors to invest in multiple unit trust funds through a single investment and is reviewed and adjusted regularly or as needed in response to major events. Separately, PMA UT is ideal for cash investors seeking a tailored investment solution via investment in multiple unit trust funds through a single investment. We offer both conventional and Shariah-compliant options to accommodate the preferences of all investors. We also offer both Moderate and Aggressive mandates that cater to different investors’ level of risk appetite. Separately, we also like US market where we are of the view that quality of earnings is much better, as such we have also introduced PMART Quant US for those who can take foreign currency/market volatility and single market exposure.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.