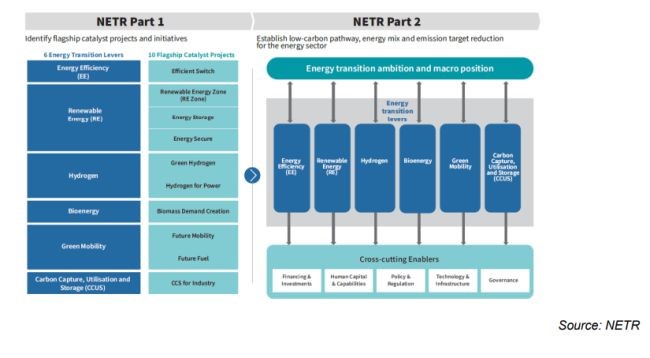

The energy transition has become increasingly vital on a global scale, with many countries implementing strategies and objectives to reduce their carbon footprints and achieve net-zero emissions. Malaysia has joined this effort by launching the National Energy Transition Roadmap (NETR) Part 1 and 2 on 27 July 2023 and 29 August 202 respectively, with the objective to achieve net-zero emissions by 2050.

Exhibit 1. NETR Part 1 & 2, source: Ministry of Economy

Renewable energy, defined as energy derived from natural sources that are replenished at a higher rate than they are consumed, is playing a crucial role in the global shift toward sustainable energy systems.

There are various types of renewable energy, among the most prominent types is solar energy, which harnesses sunlight through two primary technologies: photovoltaic (PV) systems and solar thermal systems. PV systems convert sunlight directly into electricity using semiconductor materials like silicon, and are widely used in residential, commercial, and utility-scale applications. Solar thermal systems, on the other hand, capture and concentrate sunlight to produce heat, which can be utilized for electricity generation or direct heating, such as in solar water heaters and concentrated solar power (CSP) systems.

Tenaga Nasional Berhad, has been designated as the leader to spearhead the Large-Scale Solar Parks project across five states in Malaysia, as part of a flagship catalyst initiative under NETR that expects to generate 100mw deployment per site. In addition, Sime Darby Property is constructing a 4.5MW solar capacity project across 450 homes in the City of Elmina and Bandar Bukit Raja. Each house will have up to 10kW solar capacity, with the generated energy being purchased by commercial and industrial users within the township.

Hydropower, or hydroelectric power, generates electricity by utilizing the energy of flowing water. Large-scale hydropower projects typically involve dams that store river water in reservoirs, releasing it to flow through turbines and generate electricity. The Hybrid Hydro-Floating Solar PV (HHFS) project, another NETR flagship catalyst project, will be constructed in four phases from 2023-2040 and expected to generate 2.5GW of power.

Biomass energy, is derived from organic materials such as plants, agricultural residues, and animal waste, which can be converted into electricity, heat, or biofuels like ethanol and biodiesel. Biomass power plants burn these materials to produce steam, driving turbines to generate electricity, while biofuels provide sustainable alternatives to traditional transportation fuels. A pilot phase of co-firing at the existing 2100MW Tanjung Bin Power Plant, leading by Malakoff Corporation Berhad will commence in 2024 to scale up to a minimum of 15% biomass co-firing capacity by 2027. The biomass sources to be used in the project include: empty fruit bunch pellets, wood chips, wood pellets, bamboo pellets, coconut husk and rice husk.

Other notable renewable energy:

Geothermal energy: leverages heat from beneath the Earth’s surface for direct heating or electricity generation. Geothermal power plants utilize steam from underground hot water reservoirs to drive turbines connected to generators.

Wind energy: converting the kinetic energy of wind into mechanical power or electricity through wind turbines. In Malaysia, the potential to adopt wind energy is limited due to the low average wind speed, which reduce the efficiency of generating power from wind energy.

In summary, renewable energy sources such as solar, hydropower, biomass, geothermal and wind energy provide sustainable alternatives to fossil fuels. These technologies play a vital role in reducing greenhouse gas emissions, combating climate change, and ensuring a sustainable energy future.

Phillip Capital Management Sdn Bhd (PCM)’s offering in ESG

PCM offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies.

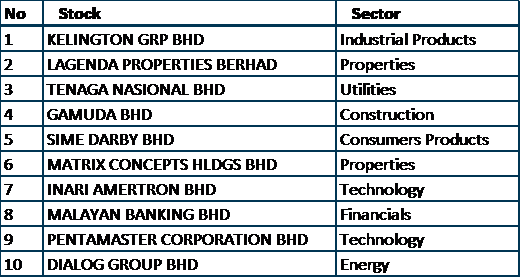

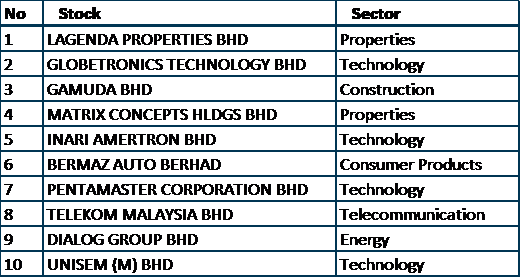

Here is the list of stocks in our ESG mandates:

Table 1. ESG Mandates – Top 10 stock list as of May 2024

Conventional ESG Portfolio

Shariah ESG Portfolio

We believe listed companies with good ESG practices will continue to benefit from the rising sustainability trend. Furthermore, we have pinpointed selected names within key sectors—Construction, Renewables, Utilities, and Property—that stand to benefit from the Net-Zero Transition Roadmap (NETR) and the policies outlined in Budget 2024. As companies enhance their ESG performance, we foresee a reduction in the risks associated with foreign labour dependency, a factor that historically affected industries such as Plantation, Construction, Gloves, and Electronic Manufacturing Services (EMS). With supply chains increasingly prioritising ESG criteria, ongoing government and corporate initiatives will help mitigate the risks of sanctions and reputational damage. This is crucial amid heightened ESG scrutiny, safeguarding trade opportunities.

We will consistently assess our holdings and adjust our portfolio as necessary to align with prevailing market conditions. Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty