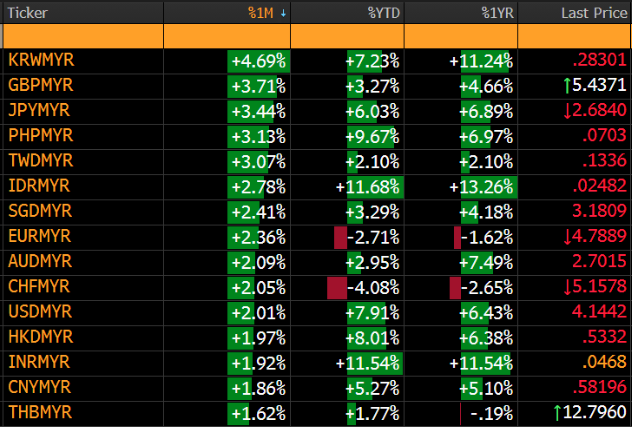

At the time of writing, the Malaysian Ringgit has strengthened to around RM4.1442 against the US dollar, reaching its highest level in 13 months and positioning it as the best-performing currency in Asia. The appreciation reflects a combination of domestic economic resilience, positive investor sentiment, and supportive macroeconomic fundamentals.

Exhibit 1: Ringgit Performance against Peers

Source: Bloomberg, 11 November 2025

The Ringgit’s recent strength is supported by several factors. Malaysia continues to record a robust trade surplus, driven by strong exports in electronics, palm oil, and other commodities, which bolster foreign exchange inflows. On the capital flows side, the equity market saw RM19 billion in outflows year-to-date through October 2025, while the bond market experienced RM12 billion of inflows as of September 2025 (October data was not available at the time of writing).

The domestic currency’s performance is also being supported by credible fiscal and monetary policies. Sovereign credit ratings from S&P Global Ratings (A-) and Moody’s (A3) were recently affirmed, signaling Malaysia’s stable economic outlook and effective policy management. Investors view this as a signal of strong governance, enhancing Malaysia’s attractiveness for both foreign direct investment and portfolio allocations.

Broader macro conditions have further contributed to the Ringgit’s strength, with the US dollar showing relative weakness amid slowing growth and softer consumer sentiment. Unlike many regional peers, Malaysia’s domestic policies and external balance provide a more solid foundation for sustained currency stability, rather than short-term speculative gains.

Impact of Strong Ringgit on Companies and Portfolio Decisions

A stronger Ringgit has mixed implications for companies and investment portfolios. For companies, importers (Consumer sectors) and businesses with significant foreign debt benefit from lower costs and reduced repayment burdens, while firms planning overseas expansion find it cheaper to invest abroad. Conversely, export-oriented companies (Technology, Chemical, Furniture sectors) face challenges as their products become more expensive for foreign buyers, potentially reducing demand and squeezing profit margins.

From a portfolio standpoint, movements in the Ringgit can significantly impact investments in foreign currencies. For assets such as US equities, European stocks, or overseas bonds, returns are initially denominated in the respective foreign currency (e.g., USD or EUR). If the Ringgit strengthens against these currencies, the Ringgit value of those foreign returns may decline, rather than increase. Conversely, when the Ringgit weakens, foreign investments tend to generate higher returns in Ringgit terms. Investors who hedge their currency exposure through instruments like currency-hedged funds or derivatives are less affected by such fluctuations; a stronger Ringgit in this case reduces currency risk and provides more stable, predictable returns. In essence, unhedged foreign holdings may see reduced Ringgit -denominated gains when the Ringgit is strong, whereas hedged foreign investments and domestic equity or bond portfolios can benefit from greater stability and lower volatility in a strong currency environment.

We believe Malaysia equities could become a beneficiary of reflation from the potential weakening USD vs. the Ringgit. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.