Understanding Private Mandates and Why Performance May Vary from Model Portfolios

Investing through a private mandate can be an excellent way to tailor your portfolio to your financial goals, risk appetite, and personal preferences. However, for many investors, especially those new to the concept, the mechanics of how a private mandate works and why returns may differ from expectations can be confusing.

At Phillip Capital Management Sdn Bhd (PCM), we aim to demystify these concepts and ensure that our clients are well-informed when making decisions on their investments. This article will help you understand how private mandates are structured, the purpose of model portfolios, and why individual performance results may vary from those seen in marketing and promotional materials.

What Is a Private Mandate?

A private mandate is a customised investment portfolio managed on your behalf by a professional investment team. Unlike a unit trust or mutual fund, where many investors pool their money into a single fund, a private mandate is a segregated portfolio, with the following features:

- You retain the ownership of the assets in your account;

- Your portfolio is designed based on your individual objectives, risk profile, and any specific instructions (such as Shariah compliant),

- The investments are managed actively or passively, depending on the mandate of the portfolio, and

- Your portfolio’s transactions and holdings are more transparent, as all transactions are available for your record.

Model Portfolios vs. Actual Client Portfolios: Why are there sometimes gaps in the performance?

When PCM presents investment strategies, we often use model portfolios. These are the hypothetical portfolios designed to illustrate an investment approach, showing how a certain asset mix (like equities, bonds, or global ETFs) might perform or have performed under different market conditions. Fund managers use model portfolios as a strategic guide when building up clients’ actual portfolios.

However,

Model portfolios are not real portfolios, and your actual performance may differ due to the following factors:

- Portfolio Size and Cost Structure

Smaller portfolios may incur higher relative brokerage costs per transaction. While these fees may seem small individually, over time they can impact overall returns.

- Timing of Capital Injections and Withdrawals

Model portfolios typically assume a one-time investment with no changes. In reality, clients may inject or withdraw capital at different times. These changes affect the performance of the portfolios, depending on the timing of the injections and withdrawals of the funds and whether assets/stocks need to be bought or sold.

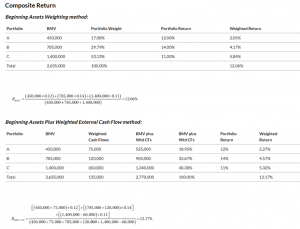

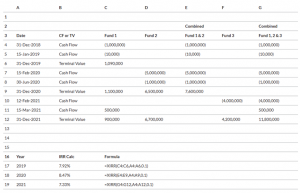

Performance evaluation can be either time weighted rate of return or money weighted rate of return.

Figure 1.1: Illustration Composite Time-weighted Returns

Source: Composite Return, Provision 2.A.36, GIPS® Standards Handbook for Firms

A money-weighted return (MWR) is a return that reflects the change in value and the timing and size of external cash flows. One commonly used method for calculating an MWR is to calculate an internal rate of return (IRR). In general, the IRR is the implied discount rate or effective compounded rate of return that equates the present value of cash outflows with the present value of cash inflows.

Figure 1.2: Illustration of money-weighted rate of return.

Source: Composite Return, Provision 2.A.39, GIPS® Standards Handbook for Firms

- Transaction Timing

Even if two clients choose the same strategy, the timing of purchases or sales may differ based on when cash/stock injections into the portfolios are made, when money is withdrawn from the portfolios, market conditions and the tactical asset allocations at the time. This can create performance discrepancies between clients’ and model portfolios.

- Mandate Differences

Some clients request specific investment preferences. For example, a Shariah-compliant mandate will exclude certain sectors (like conventional banking or alcohol), while others may opt for a global equity focus or ESG-compliant strategies. These mandate customisations result in variations in holdings and, by extension, performance. In addition, clients may ask the fund manager to change the mandate after the initial mandate type decided upon during account opening. The timing of the mandate change also affects the performance of the clients’ portfolios and usually cause the difference in the performance of the clients’ portfolios against the model portfolios.

Does That Mean Model Portfolios Are Misleading?

Not at all. Model portfolios are a helpful starting point. They show the result of the strategy behind portfolio construction and provide a baseline to measure strategy performance. However, it is important to remember that your actual portfolio is personalised, and outcomes vary based on the decisions, preferences, and timing of the investments made for each portfolio.

That is why performance figures shown in presentations or brochures may not exactly reflect what individual clients’ experience. However, such differences are expected to smooth out over time.

Past Performance Is Not A Promise

Another important point is that past performance is not necessarily indicative of future results. Even the best-performing strategies go through cycles, and markets are also influenced by external factors beyond fund managers’ control, such as geopolitical events and political changes besides economic and financial factors.

Potential clients are advised to consult a qualified investment adviser before making any investment decisions.

Disclaimer:

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.