Artificial intelligence (AI) is rapidly emerging as a central economic and technological force in 2026. Once a speculative buzzword, AI is now reshaping industries, driven by decisive corporate execution and increasing investor confidence. This year, for example, tech giants like Alphabet and Tencent are demonstrating how AI can drive growth, market differentiation, and long-term earnings power.

These developments highlight a fundamental shift: AI is no longer a peripheral experiment but a central element of corporate strategy and market value for leading tech firms in both the U.S. and China. It is clear that this is not just a temporary trend but a defining force shaping the future of business.

Benefit from AI Adoption

The benefits of AI adoption are increasingly visible both economically and geopolitically. As AI moves from theoretical research into practical applications, it is performing complex tasks across business, defense, and critical infrastructure. A recent U.S. policy permitting the export of H200 AI chips to select Chinese firms marks a notable development. In exchange for rare earth supplies critical to U.S. technology production, this move could enhance China’s domestic AI computing capacity and accelerate the adoption of advanced AI models across commercial and industrial sectors. This underscores how access to critical hardware remains a central lever in the global competition for AI leadership.

Meanwhile, financial markets are reflecting AI’s transformative impact. Technology stocks with deep AI integration continue to benefit broader equity indices, particularly companies that sit at the core of AI infrastructure, such as semiconductor manufacturers, cloud service providers, and data center operators. The so-called “Magnificent Seven” Nvidia, Microsoft, Alphabet, Amazon, Meta, Apple, and Tesla have been the primary beneficiaries of this trend.

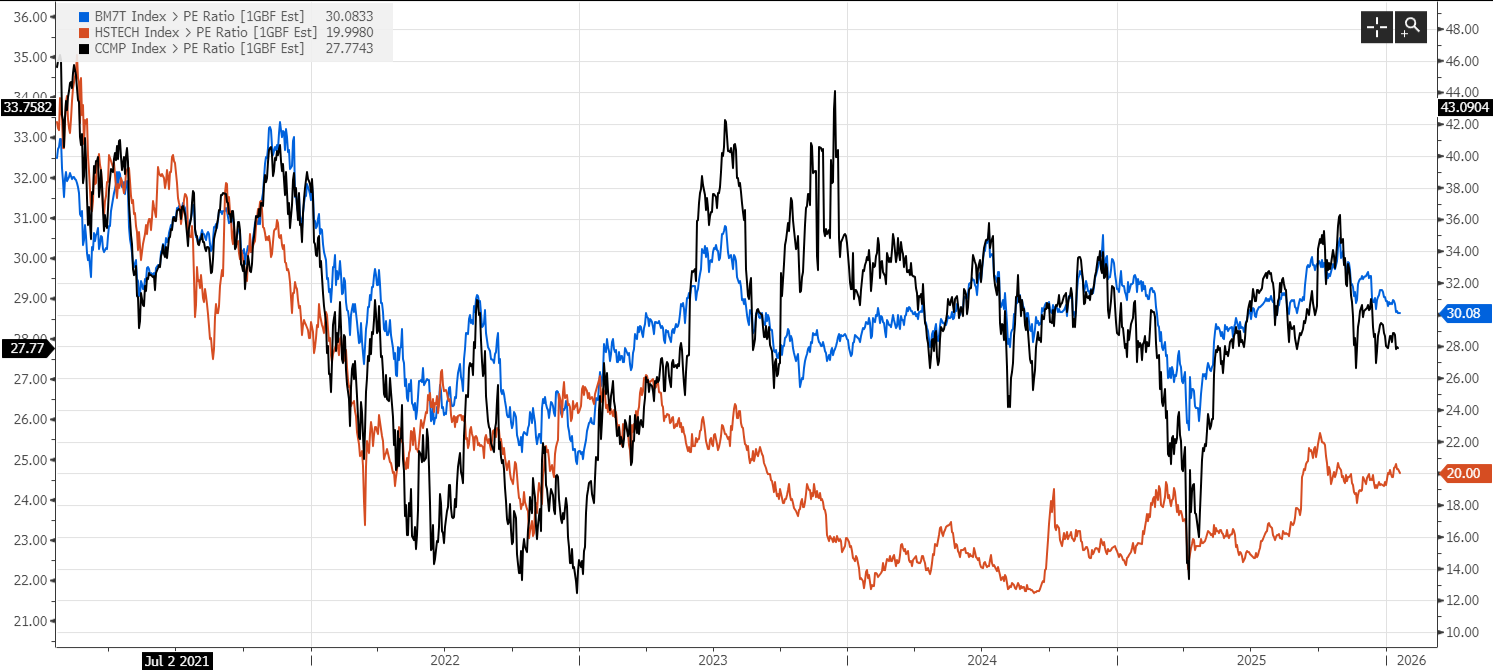

From a valuation perspective, this leadership is reflected in premium multiples but it also embeds material risk. The Magnificent Seven currently trade at a forward P/E ratio of approximately 30.1x, compared with about 27.8x for the Nasdaq Index (Exhibits 1 and 4). At these levels, investors are effectively paying today for decades of future earnings growth. Assuming earnings remain constant, it would take roughly 30 years for investors to recoup their purchase price through profits alone, underscoring how dependent current valuations are on sustained, above-trend growth and requiring investors to exercise caution around execution and growth risks.

These elevated P/E ratios nonetheless reflect the market’s belief that AI leadership is translating into tangible performance outcomes. AI adoption is strengthening corporate profitability, reinforcing competitive advantages, and reshaping global industry dynamics. Collectively, these trends position AI as a core driver of valuation, differentiation, and long-term earnings power

Exhibit 1: Index performance against Peers

Source: Bloomberg, PCM, 20 January 2026

AI as a Cornerstone of Global Growth and Investment

As AI continues to drive corporate valuations in 2026, it is a critical moment for investors to reassess long-term exposure to AI-driven companies. Companies such as Alphabet and Tencent, with extensive resources are well-positioned to translate AI leadership into sustained earnings growth. Moreover, as AI becomes embedded in advertising, cloud services, gaming, and productivity software, leading technology stocks are increasingly seen as essential digital infrastructure rather than speculative ventures.

In this case, U.S. still remains a highly attractive investment destination, driven by ongoing innovation and new initiatives. In particular, sustained leadership in artificial intelligence, cloud infrastructure, advanced computing, automation, and sustainable technologies.

In contrast, the Hang Seng Tech Index trades at a significantly lower P/E ratio of approximately 20.0x (Exhibit 3), as investors favor the Nasdaq for its greater international revenue exposure, deeper market liquidity, and more predictable regulatory environment, which support higher valuation multiples and stronger long-term growth visibility. These structural advantages support valuation stability and provide clearer long-term growth visibility, justifying its relatively higher valuation multiple.

Nevertheless, China continues to innovate. For example, Alibaba recently upgraded its flagship AI app, Qwen App, into a “super app” that integrates services across its ecosystem including Taobao, Alipay, Fliggy, and Amap. Acting as a catalyst for seamless daily life, the app allows users to handle multi-step tasks through a single voice or text request. The upgrade is now open for public testing in China.

Exhibit 2: Nasdaq Composite Index 5-Year P/E Chart

Source: Bloomberg, PCM, 20 January 2026

Exhibit 3: Hang Seng Tech Index 5-Year P/E Chart

Source: Bloomberg, PCM, 20 January 2026

Exhibit 4: Magnificent 7 Index 5-Year P/E Chart

Source: Bloomberg, PCM, 20 January 2026

AI’s Transition from Innovation to Necessity

The focus on AI has influenced market valuations, driving incremental changes in AI-related indices. The premium assigned to AI-enabled firms signals expectations of higher productivity, operating leverage, and defensible competitive advantages. While volatility remains inevitable especially amid U.S.– China policy uncertainty whereas prevailing trend favors firms with key resources and global reach. The key takeaway is unambiguous: AI has crossed the threshold from innovation to necessity. For businesses, governments, and investors alike, AI is no longer optional it is foundational. Those who recognize this shift early and align their strategies accordingly are best positioned to benefit as AI continues to redefine economic growth, competitive power, and market leadership in the years ahead.

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.