In our previous article, we discussed the first stage of the National Energy Transition Roadmap (NETR), which the government introduced on July 27, 2023. The unveiling of the second phase on August 29, 2023, marked a significant step forward in Malaysia’s journey towards a low-carbon future. Both two phases are viewed as Malaysia’s commitment to transitioning towards cleaner energy, and have the potential to catalyse the development of technical expertise and the generation of employment opportunities within Malaysia’s burgeoning green economy.

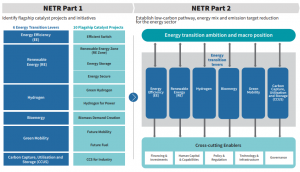

Figure 1: Parts 1 and 2 of NETR

Source: National Energy Transition Roadmap (NETR)

In the second phase of the NETR, there are 50 outlined initiatives distributed across 6 Energy Transition Levers and 5 Cross-cutting Enables (Figure 1). This complements the initial 10 Flagship Catalyst Projects introduced in Phase 1. It is projected that the successful execution of the NETR will contribute to a continuous annual growth rate (CAGR) of 8.4% in the GDP value from MYR25bn in 2023 to MYR220bn and generate 310,000 jobs in 2050.

Key initiatives within the NETR framework aimed at facilitating the energy transition process encompass the following:

1. Establishment of a National Energy Transition Facility, with an initial seed fund of RM2bn.

2. Adoption of green and sustainable finance instruments.

3. Implementation of a carbon pricing mechanism.

4. Introduction of complementary policies, including the National Gas Roadmap, Nationally Determined Contribution Roadmap, National ESG Industry Framework, Hydrogen Economy and Technology Roadmap, and the National Biomass Action Plan.

5. Positioning natural gas to support the transition in the energy landscape.

6. Development and deployment of green skills while raising awareness.

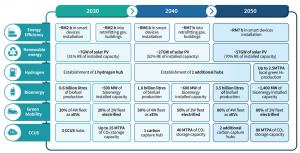

Separately, according to Prime Minister Anwar Ibrahim, it is projected that a minimum investment of RM1.2tn will be necessary to facilitate a responsible energy transition from 2023 to 2050. In this decade alone, the government will need to allocate between RM60bn and RM90bn for essential spending such as expanding public transportation, enhancing grid infrastructure, and upskilling the workforce. Figure 2 and Figure 3 show some of the long-term targets upon 2050 across the six energy transition enablers. In addition to the commonly mentioned objectives of achieving a 70% renewable energy installed capacity and becoming coal-free by 2050, there are also notable targets concerning Carbon Capture, Utilization, and Storage (CCUS) with plans for 3 to 6 CCUS clusters and a CO2 storage capacity of 40 to 80 mtpa. Furthermore, there are goals related to hydrogen, including the production of up to 2.5 mtpa of green hydrogen, the establishment of three hydrogen hubs, and 100% green hydrogen feedstock phase off. Additionally, bioenergy goals encompass achieving a capacity of 3.5 bn liters for biofuel production and generating 1.5 GW of bioenergy power. These targets are further detailed with specific milestones to be reached by 2030 and 2040. Additionally, they offer various investment opportunities across different phases of their implementation.

Figure 2: Targets across NETR’s six energy transition levers

Source: National Energy Transition Roadmap (NETR)

Figure 3: Potential investment opportunities and impact of NETR’s Responsible Transition

Source: National Energy Transition Roadmap (NETR)

Who are the beneficiaries?

In our previous article, we shared that energy giant Tenaga stands to benefit (the most) through a shift to renewable energy and reduced reliance on conventional fuels. Initiatives include collaborative Renewable Energy Zones with SMEs, cooperatives, and hybrid hydro-floating solar systems with a 2500MW capacity. Partnerships with PETRONAS aim to reduce emissions by co-firing green hydrogen and ammonia. Malakoff may benefit from new gas plant expansion in the future following their retirement of existing coal plants. Local solar contractors will gain from the expanding renewable energy sector, while Sime Darby Property plans residential solar solutions in areas like the City of Elmina and Bandar Bukit Raja. For Battery Energy Storage Systems (BESS), there is no clear winner yet, but we notice few listed companies, like Citaglobal and Genetec Technology, formed a JV (Citaglobal Genetec BESS) recently to develop RE power storage solutions.

Identify investment opportunities – Phillip Managed Account for Retirement (PMART) and Phillip Managed Account (PMA) ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies.

To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link. We like these companies because they have received high ESG ratings, which we believe can contribute to their long-term sustainability, responsibility, and profitability.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.