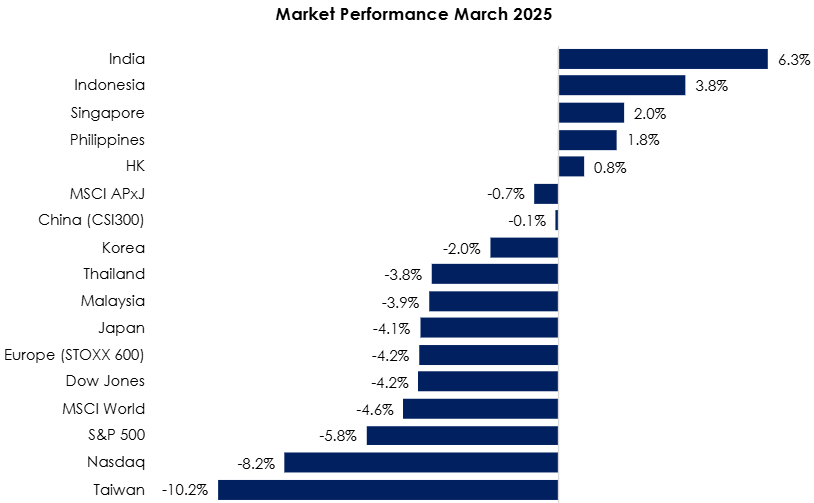

The MSCI Asia Pacific Ex-Japan Index (-0.7%) largely outperformed the MSCI World Index (-4.6%) as US geopolitics and tariff threats took a heavier toll on home turf than on its trade partners. India (+6.3%) led the Asia Pacific region as global rating agencies Fitch and Moody’s reaffirmed India’s 6.5% GDP growth trajectory this year, the highest among both advanced and emerging economies. Indonesia (+3.8%) bounced back in March but was still a long way from recovering from its February 11.8% decline, fuelled by scepticism over President Prabowo’s radical welfare measures. Singapore (+2.0%) trailed slightly behind, with the buzz around the Johor-Singapore Special Economic Zone lifting investor sentiment. On the flipside, Taiwan (-10.2%) market plummeted as looming US tariff threats cast a huge overhang on semiconductor exports. Europe (-4.2%) and Japan (-4.1%) also declined significantly, as the Trump Administration’s populist ambitions put pressure on the US’s relationships with its oldest and strongest allies (see Exhibit 1).

Exhibit 1: Market Performance March 2025

Source: Bloomberg, PCM, 31 March 2025

On the monetary policy front, the Federal Reserve kept its policy rate unchanged at 4.25%–4.50%. Separately, the European Central Bank (ECB) lowered interest rates by 25 basis points to 2.50%, while the Bank of England (BoE) kept its rates unchanged at 4.50%. Meanwhile, in Asia, the Bank of Japan (BoJ) maintained its key short-term interest rate at 0.50% during its March meeting. Finally, the People’s Bank of China held the medium-term lending facility rate at 2.0% and kept the 1-year and 5-year loan prime rates unchanged at 3.1% and 3.6%, respectively.

The FBMKLCI lost 3.9% in March, closing at 1,513.65. In contrast, the Small Cap Index fell by 2.1%, while the Mid 70 Index decreased by 2.2%. Sector-wise, March top performing sectors were Energy and Utilities, up 0.5% and 0.2% respectively. The worst performing sectors were Telecommunications, Finance, and Healthcare, which saw declines of 6.4%, 4.9%, and 4.3%, respectively. Foreign investors continued to be net sellers for the sixth consecutive month in March, recording net sell flows of RM4.6bn, with outflows totaling RM17.7bn over the past six months. Separately, in March, there were two listings on the Main Market (Pantech Global Bhd and HI Mobility Bhd) and four listings on the ACE Market (Saliran Group Bhd, Lim Seong Hai Capital Bhd, Wawasan Dengkil Holdings Bhd, and Chemlite Innovation Bhd). Finally, Bank Negara Malaysia (BNM) kept the Overnight Policy Rate (OPR) at 3.00% during its March Monetary Policy Meeting.

Equity Market Outlook & Investment Strategy

The present market volatility and uncertainties are not over yet. While the market provides investment opportunities for those with cash and holding power, heightened market risk is still ongoing. The market will still swing depending on the outcome of the tariff war especially between US and China. China is more determined to retaliate as US is fighting a tariff war against all other countries including its close allies, though it is deferred for 90 days.

The strategy is to accumulate on stocks that are least affected by the tariff war and risk of economic slowdown, (we do not think there will be a recession barring unforeseen circumstances) yet have experienced disproportionate share price declines. Fear and forced selling on margin accounts may provide good investment opportunities to pick up some quality stocks on discriminate and involuntary selling. Last advice – be nimble, accumulate gradually and selectively.

Fixed Income Outlook & Strategy

Malaysia

Malaysia growth outlook for 2025 faces significant external uncertainties, particularly from more restrictive trade policies under Trump 2.0, including higher US import tariffs and potential retaliatory measures by affected trade partners. These developments could weigh on consumer confidence and business sentiment. BNM forecasts global GDP growth at 2.8% % – 3.3 % (2024: 3.2%) and world trade growth at 2.7% –3.2% (2024: 3.4%).

We maintain our view that BNM will keep the Overnight Policy Rate (OPR) at 3.0% in 2025. We continue to overweight corporate bonds over MGS/GII due to higher yields.

Regional

As widely anticipated, the Federal Reserve has maintained its monetary policy stance, keeping the Fed funds target rate range at 4.25% to 4.5%. The accompanying statement reiterates that “inflation remains somewhat elevated” and that both economic growth and labor market conditions remain “solid”. At the same time, the Fed announced a key shift in its quantitative tightening strategy, stating that beginning in April, it will slow the pace of balance sheet reduction from USD25bn to USD5bn.

In the Eurozone, weaker inflation and deteriorating growth prospects have strengthened the case for a further rate cut by the European Central Bank (ECB) in April. The ECB has already delivered six cuts since June 2024, including the latest reduction in March, which brought the key deposit rate to 2.50%.

The Bank of Japan’s (BoJ) summary of opinions from its March policy meeting highlighted how uncertainty over US tariffs complicates its plan to raise interest rates to address inflation above target. Policymakers are divided between focusing on domestic inflationary pressure – potentially reinforced by wage hikes – and the downside risks to Japan’s economic outlook. BoJ Governor Kazuo Ueda has signalled a readiness to raise interest rates but has yet to provide a clear timeline.

Strategy for the month

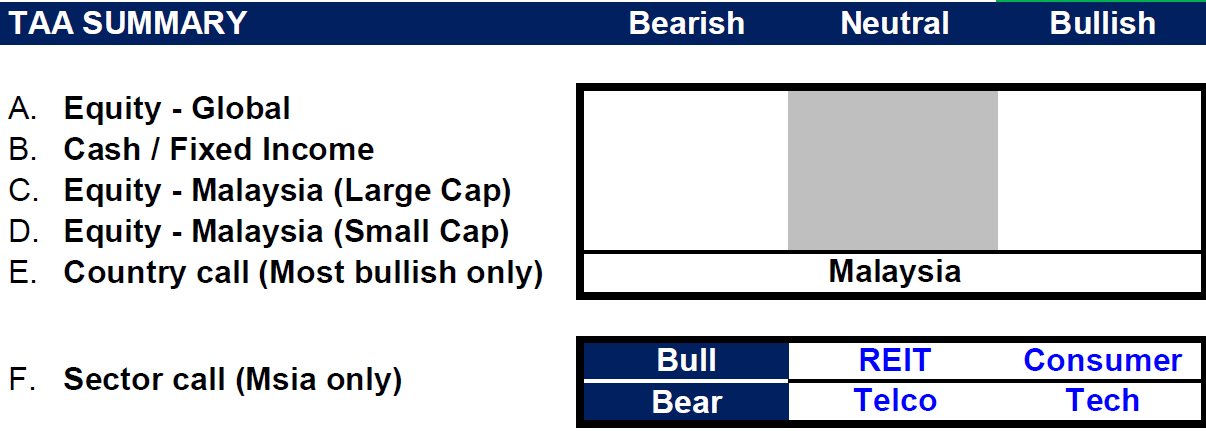

We are neutral on global equities as geopolitical risks and weak economic data continue to influence market sentiment. Many sell-side brokers now believe that tariffs have increased the likelihood of a U.S. recession. All markets we monitor, from East to West, are currently trading below their historical average valuations, reflecting a cautious investor sentiment.

Our Tactical Asset Allocation for the month indicates a preference for the Malaysian market, which has experienced a larger decline compared to others in the recent market correction, presenting a value opportunity. We maintain a neutral view on large-cap stocks due to balanced risk-reward and have shifted to neutral on small-caps amid macro uncertainties. Sector-wise, we are being selective with Consumer stocks, particularly focusing on downtrading trends. The sector could face challenges due to tariff risks, as decreasing production results in lower incomes and reduced consumer spending. That said, we anticipate that the government will increase support for domestic consumption policies to offset external pressures. Additionally, REITs are generally more stable in earnings and hence dividend yields as their rental incomes are normally locked in for several years.

We turned cautious on Banks with high foreign ownership due to potential quick exits in tough times, causing lower liquidity and falling stock prices. While an economic slowdown and reduced loan growth may indirectly impact banks, the effect should be mild as they are supported by high dividend yields. On the other hand, we remain underweight on the Technology sector due to increasing uncertainty around trade and industry policy changes under the new US administration, along with a sluggish demand recovery for consumer electronics and automotive, which could pose downside risks to sector earnings. Additionally, we maintain an underweight position on the Telco sector.

Exhibit 2: PCM’s monthly strategy snapshot

Source: PCM, 31 March 2025

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

TAA_Presentation_Deck_April-16.4.2025

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.