What Is Sustainable Finance?

At its core, sustainable finance refers to financial activities that take environmental, social, and governance (ESG) factors into account. In other words, when investments are made, consideration is given to issues such as climate change, workers’ rights, ethical leadership, and long-term sustainability. Ultimately, the goal is to support businesses and projects that contribute positively to the world while still generating financial returns. As a result, this shift has led to the rapid growth of sustainable finance, a system that supports economic growth while protecting the environment and promoting social well-being.

Why Is Sustainable Finance Growing?

One major reason for the rise of sustainable finance is increased awareness of global challenges. Issues such as climate change, pollution, and social inequality have highlighted the need for more responsible business practices. As a result, governments, companies, and individuals increasingly recognise that traditional financial systems can worsen these problems if sustainability is not embedded within their investment mandates.

To address these concerns, sustainable finance has expanded through a range of approaches that align financial returns with environmental and social objectives. These include (i) green bonds, which finance environmentally friendly projects with high levels of transparency; (ii) impact investing, which integrates sustainability goals into investment mandates by supporting projects that reduce environmental harm while also addressing social issues such as poverty and gender equality; (iii) microfinance, which provides essential financial services to low-income individuals and small businesses; (iv) and green investments, which prioritise industries such as renewable energy that contribute to long-term sustainable development.

Types of Sustainable Investments

There are several approaches within sustainable finance. Firstly, sustainable funds are directed toward companies that demonstrate strong environmental, social, and governance practices. For example, a leading US based technology company specialising in computer manufacturing has committed to becoming carbon negative by 2030 and has made substantial investments in renewable energy sources. Secondly, sustainable investments also encompass companies whose core business models are fundamentally aligned with environmental solutions. For instance, another American enterprise that is a leader in sustainable transportation and clean energy solutions, including electric vehicles, solar energy, and energy storage, is widely recognised for its strong commitment to environmental sustainability. Finally, impact investing places particular emphasis on generating measurable positive outcomes, such as reducing carbon emissions or improving access to education and healthcare.

A Rapidly Expanding and Competitive Market

Over the past decade, ESG investing has evolved from a niche concept into a central pillar of global capital markets. This momentum became especially evident from 2018 onward, as ESG assets grew rapidly from USD 22.8 trillion in 2016 to USD 30.6 trillion in 2018.

Consequently, driven by increased investor demand and corporate adoption of ESG practices, the global value of ESG assets is projected to reach $35–$50 trillion by the end of 2025, with the potential to hit $53 trillion. This would account for over a third of total global assets under management (AUM), further supported by tighter regulatory requirements.

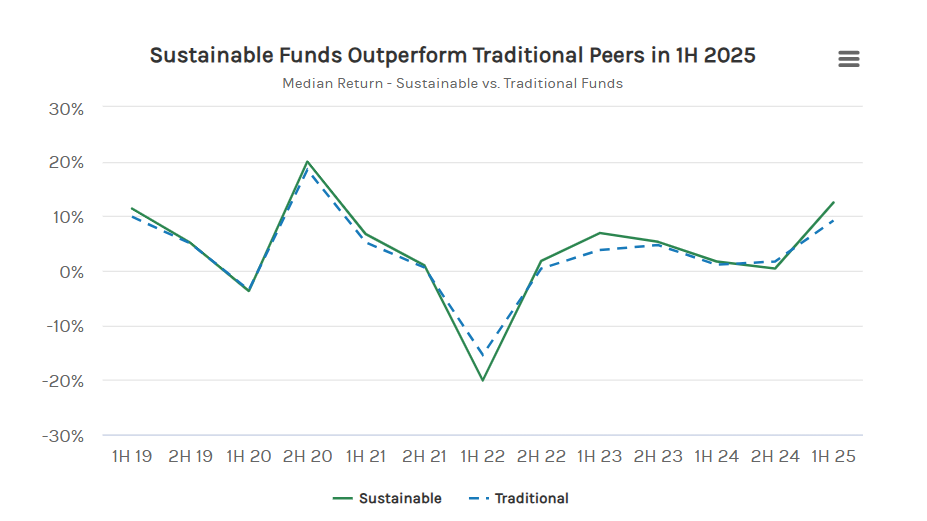

ESG Funds Lead in Market Performance

Beyond asset growth, sustainable investing has also demonstrated competitive financial performance. In the first half of 2025, sustainable funds outperformed traditional funds, driven largely by their higher exposure to European and other international markets. This outperformance has strengthened investor confidence, reinforcing the perception that ESG investing can deliver both ethical value and attractive financial returns.

Source: Morgan Stanley Institute for Sustainable Investing analysis of Morningstar data as of June 30th 2025

The Global Impact of Sustainable Investment

One of the most tangible benefits of impact driven investment lies in its contribution to economic stability and sustainable growth. In particular, by integrating environmental, social, and governance (ESG) considerations into risk assessment and capital allocation, investors and financial institutions are better positioned to anticipate long term risks, including climate change, resource scarcity, regulatory shifts, and social inequality. As a result, risk management strategies that incorporate these factors are no longer optional; they have become essential for safeguarding investment portfolios and maintaining overall market stability.

At the same time, innovation in sustainable financial instruments such as green bonds, sustainability linked loans, and blended finance mechanisms has expanded the range of tools available to investors. Moreover, these instruments not only support environmentally responsible projects but also direct capital toward sectors that are critical for long term economic development and resilience.

Beyond financial markets, financial institutions play a pivotal role in accelerating the transition to sustainable development, particularly by introducing customised financing options for renewable energy investments. Consequently, such initiatives incentivise the adoption of clean energy by reducing upfront costs and improving affordability. In this context, Malaysia has taken a proactive approach to promoting solar energy through government-backed programmes under Budget 2024, as of March 2024. Notably, the Green Technology Financing Scheme offers financial support to businesses investing in green technologies, while the Solar For Rakyat Incentive Scheme provides cash rebates to homeowners installing solar panels. Overall, these policies illustrate how coordinated public and private efforts can accelerate the transition to clean energy while simultaneously expanding financial inclusion.

Conclusion

In conclusion, sustainable finance represents a new way of thinking about money and responsibility. By focusing on the future rather than short-term gains, sustainable finance helps protect the planet, support communities, and build a stronger global economy. Therefore, as awareness continues to grow, sustainable finance is likely to play an even bigger role in shaping the world ahead.

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.