Market Review (December 2025)

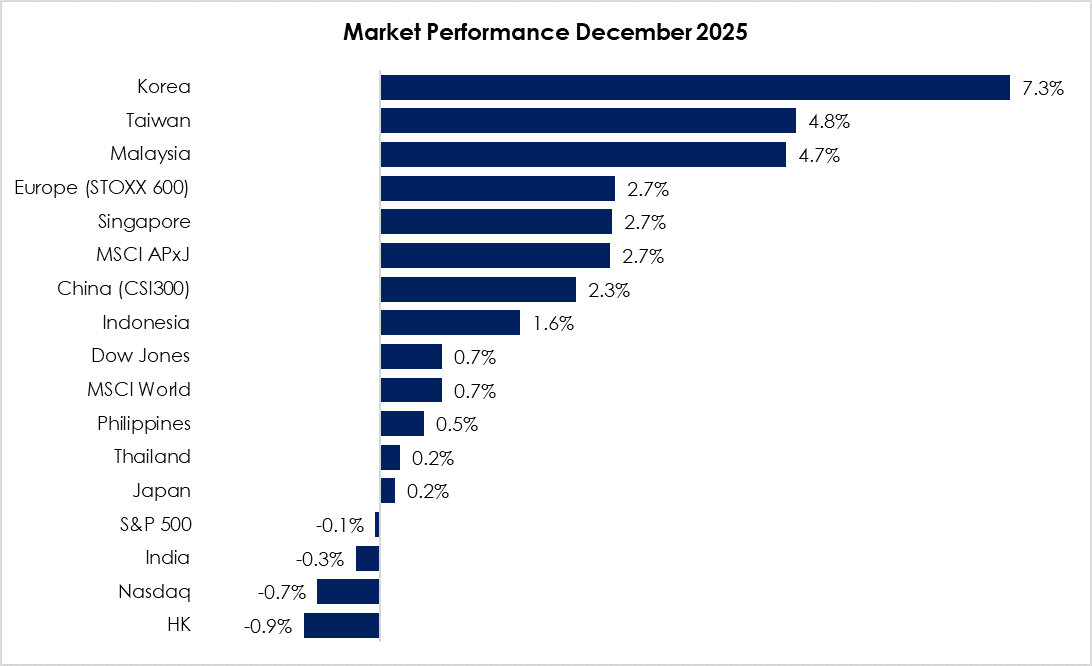

The MSCI Asia Pacific Ex-Japan Index (+2.7%) dashed past the MSCI World Index (+0.7%) for a decisive lead to close off 2025, as the Asia Pacific markets gained an impressive 26.8% for the year, outperforming the global index by 7.3%. South Korea (+7.3%) was the runaway star for the month and year (+75.6%) as the AI theme boosted DRAM names due to a supply squeeze. Taiwan (+4.8%) followed suit, as demand for advanced packaging also surged in tandem with HBM/DRAM demand. Malaysia (+4.7%) trailed closely behind, as year-end window dressing helped lift big cap names. Fortunately, even the worst performer in December closed somewhat flattish, with Hong Kong dropping only 0.9% mom as investors flocked towards crowded AI stocks.

Exhibit 1: Market Performance December 2025

Source: Bloomberg, PCM, 31 December 2025

On the monetary policy front, the Federal Reserve (Fed) cut its interest rate by 25 bps to 3.50%-3.75% in the December FOMC meeting. The European Central Bank (ECB) held its deposit rate unchanged at 2.0%. The Bank of England cut the Bank Rate by 25 bps to 3.75%. In Asia, the People’s Bank of China (PBoC) maintained the one-year LPR at 3.0% and the five-year LPR at 3.5%. Finally, the Bank of Japan (BOJ) hiked interest rates by 25 bps to 0.75%, the highest in 30 years.

The FBMKLCI Index gained 4.7% month-on-month (m-o-m) in December, closing at 1,680.11 points. Meanwhile, the Mid 70 Index declined 0.3%, while the Small Cap Index rose marginally by 0.4%. On a year-to-date (YTD) basis, the FBMKLCI Index gained 2.3% year-on-year (y-o-y), while the Mid 70 Index and the Small Cap Index declined 10.8% and 12.2%, respectively.

Sector-wise in December, the top-performing sectors were Finance, Industrial, and Plantation, which rose 6.1%, 5.9%, and 3.1% m-o-m, respectively. The worst-performing sectors were Construction, Technology, and Utilities, which lost 4.8%, 3.5%, and 0.9% m-o-m, respectively. On a YTD basis, Plantation, REITs, and Finance were the only top performing sectors, gaining 8.8%, 8.3%, and 2.8% y-o-y, respectively. The worst-performing sectors were Healthcare, Technology, and Telecommunication Services, losing 35.9%, 14.5%, and 13.6% y-o-y, respectively. Foreign investors continued to be net sellers in December, recording outflows of RM2.0 billion, bringing the cumulative outflows year-to-date RM22.3 billion, 5.3x higher than 2024’s RM4.2 billion of outflows. Separately, in December, there were four listings on the Main Market (Geohan Corporation Bhd, Orkim Bhd, LAC Med Bhd, and Wasco Greenergy Bhd), two listings on the ACE Market (PSP Energy Bhd and BMS Holdings Bhd), and one listing on the LEAP Market (Croesus IT Holdings Bhd).

For the month of December, WTI crude oil declined 1.9% m-o-m, closing at US$57.4 per barrel, while Brent oil fell 3.7% to US$60.9 per barrel. Crude palm oil closed at RM3,998/MT, down 2.5% from the previous month, while spot gold rose 2.9%, ending the month at US$4,341.1/oz. Currency-wise, the Malaysian ringgit appreciated 1.8% m-o-m against the greenback to RM4.0603/USD. Meanwhile, the Dollar Index lost 1.1%, ending at 98.3 points.

Equity Market Outlook & Investment Strategy

Malaysia

Following robust gains in December, we do not rule out the possibility of profit-taking, as investors continue to digest heightened geopolitical risks. These include the reported capture of Venezuelan President Maduro by the US, the potential for US intervention in Iran should civil unrest escalate, and ongoing tensions between China and Japan. That said, Malaysia’s fundamentals remain supportive, underpinned by solid GDP growth (2025/26: 4.7%/4.3%), undemanding valuations (2026F P/E: 14.5x vs 5-year mean of 17.2x), a strengthening ringgit (+9.3% vs end-2024), and healthy core earnings growth of 6-8% in CY26. Private consumption is set to remain the main growth driver in 2026, supported by a tight labour market, steady wage growth, and strong household confidence, with high-value sectors like AI, data centres, and advanced manufacturing further boosting growth.

Regional

As we move through 2026, global equities are expected to post moderate gains, supported by solid earnings growth, though valuation concerns persist. For investors, geopolitical developments, AI-related capital expenditure monetization, and concentration risks are key factors. The current Fed rate-cut cycle should support equities, with Asian markets potentially able to ease further given elevated real rates. In this environment, we recommend a barbell strategy focused on quality growth and income to navigate potential volatility.

Fixed Income Outlook & Strategy

Malaysia

Looking ahead to 2026, Malaysia’s government bond market is expected to remain fundamentally well-supported, underpinned by resilient domestic demand, a credible fiscal consolidation path, and a stable sovereign rating profile. With growth likely to stay close to potential and inflation contained, monetary policy is expected to remain broadly accommodative, limiting the risk of a sustained sell-off in local yields. While external headwinds, particularly US rate volatility and the gradual normalisation of Bank of Japan policy, may generate episodic upward pressure, these are likely to be absorbed by steady onshore demand, a narrowing UST–MGS yield differential, and continued foreign participation supported by a firm ringgit.

Regional

US Treasury yields were more volatile but trended modestly higher over the month, reflecting the persistence of restrictive financial conditions amid a resilient US economy. A hawkish tilt in the FOMC’s guidance, coupled with solid GDP growth and continued labour market strength, reinforced the “higher-for-longer” narrative and kept term premia elevated. While softer inflation prints and occasional dovish commentary from Fed officials tempered the rise in yields, these factors were insufficient to trigger a sustained rally. In addition, rising Japanese government bond yields prompted portfolio reallocation effects that added marginal upward pressure on Treasuries. Looking ahead, UST yields are likely to remain rangebound with a mild upward bias, as markets weigh signs of gradual disinflation against still-firm growth and labour market conditions.

China’s December Manufacturing PMI rose to 50.1, back in the expansionary zone for the first time since March. The non-manufacturing PMI also improved to 50.2 (+0.7pt mom), driven by a rebound in construction activity, while the services PMI remained slightly contractionary, indicating weak domestic demand. Enterprise PMI showed divergent trends, with large firms leading the improvement. Overall, the December data suggest an uneven recovery, despite the positive headline numbers.

The Bank of Japan’s December Summary of Opinions underscores a firm shift toward continued policy normalisation. Policymakers broadly agreed that further interest-rate hikes and a gradual reduction in monetary accommodation are warranted to achieve sustainable price stability. Confidence has strengthened that Japan can sustain a virtuous cycle of wage growth and inflation, underpinned by solid corporate profitability and persistent inflationary pressures, partly driven by currency effects. Several members warned that postponing action would entail considerable risks, as real interest rates remain well below neutral. Consistent with this view, the BoJ raised its policy rate by 25 bps to 0.75% in December, the highest level since 1995

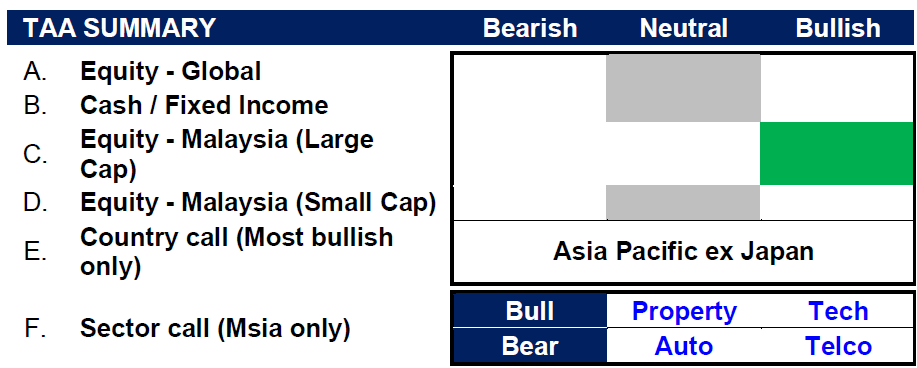

Strategy for the month

We remain neutral on global equities, mainly the US, as elevated valuations and heavy concentration in a few mega-cap technology names limit broad market upside despite still-robust earnings growth. However, we remain constructive on Asia Pacific ex-Japan equities, particularly in North Asia, supported by a weaker US dollar and a more dovish Federal Reserve. Further easing by the Fed would give Asian central banks greater flexibility to lower interest rates, which in turn could further support regional market sentiment.

In Malaysia, we are maintaining our bullish view on large-cap equities and remain neutral on small-cap equities. Sector-wise, we overweight Property and Technology sectors, supported by resilient domestic demand, strong earnings visibility, and structural growth trends, which position these sectors to benefit from both cyclical recovery and long-term market opportunities. Meanwhile, we remain underweight on the Auto and Telco sectors.

The underweight stance reflects continued margin pressure in the Auto sector, driven by weak consumer demand, lower total industry volumes (TIV), and elevated inventory levels. Limited pricing flexibility, higher input costs, and increased promotional activity to clear excess stock are weighing on profitability, while visibility on a near-term demand recovery remains low.

In the Telco sector, the underweight position is driven by sustained pressure from elevated capital expenditure requirements related to network expansion and spectrum investments. At the same time, intense competition and regulatory constraints are limiting pricing power, resulting in muted revenue growth and constrained free cash flow generation in the near term.

Exhibit 2: PCM’s monthly strategy snapshot

Source: PCM, 31 December 2025

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

TAA_Presentation_Deck_Dec-13.01.2026.pdf

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.