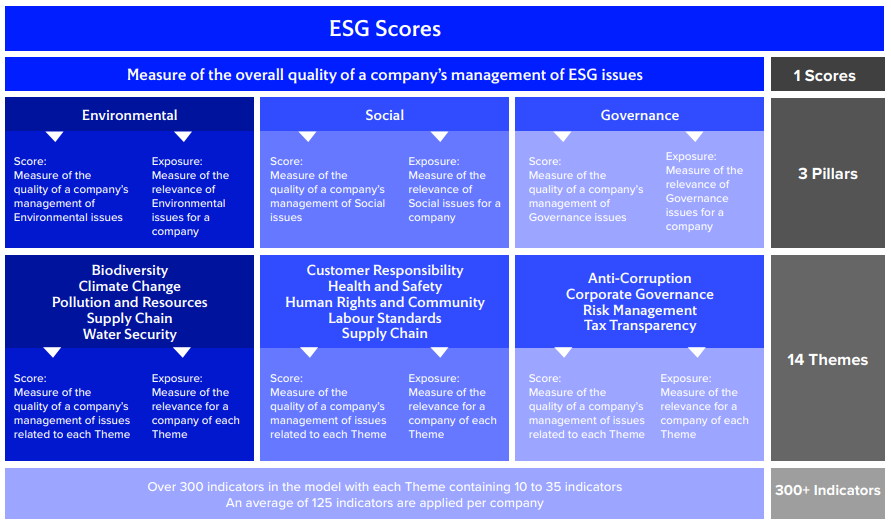

Environmental, Social, and Governance (ESG) considerations have grown increasingly vital for investors as central benchmarks in their investment decisions. FTSE4Good Bursa Malaysia Index and FTSE4Good Bursa Malaysia Shariah Index launched in Dec 2014 and June 2021 respectively, are designed to measure the performance of Malaysian companies that demonstrate strong Environmental, Social, and Governance (ESG) practices. The constituents of the FTSE4Good Bursa Malaysia Index are selected from the FTSE Bursa Malaysia EMAS Index and undergo screening according to well-defined Environmental, Social, and Governance (ESG) criteria. Exhibit 1 outlines the ESG scoring structure, which comprises 3 pillars and 14 themes under each pillar.

Exhibit 1. ESG Scoring criteria, source: FTSE Russell

In order to be included in the FTSE4Good Bursa Malaysia Index or Shariah Index, Malaysian companies must have an overall ESG Score of 2.9 or above out of 5. This ensures only companies demonstrating strong management of ESG risks are included. As of Dec 2023, there are 108 constituents in FTSE4Good Bursa Malaysia Index and 87 constituents in FTSE4Good Bursa Malaysia Shariah Index.

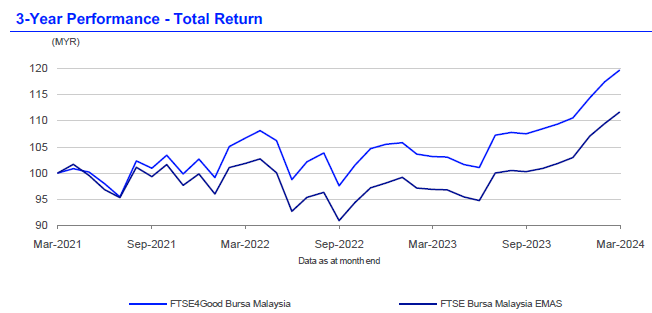

Historically, data indicates a positive correlation between ESG performance and financial outcomes. Companies that demonstrate robust ESG practices are generally more likely to have a better long-term financial performance, which is often reflected in the company’s share price. As shown in Exhibit 2, the FTSE4Good Bursa Malaysia Index has outperformed the FTSE Bursa Malaysia EMAS Index in terms of returns over both 3-year and 5-year periods.

Exhibit 2. Performance of FTSE4Good Bursa Malaysia vs FTSE Bursa Malaysia EMAS, as of 31st March 2024

How ESG can benefit a company financially?

- Enhanced Risk Management and Legal Compliance

ESG practices help companies identify and mitigate risks. Environmental practices can reduce the risk of large-scale disasters and their associated costs, while strong governance can reduce the risk of scandals or legal issues that might lead to financial penalties or a damaged reputation. Strong governance and compliance with environmental and social regulations can also help a company avoid legal penalties, which can be substantial. Engaging in proactive ESG practices ensures that a company not only adheres to current regulations but also is equipped for potential future shifts in legislation.

- Cost Reductions

Investing in energy-efficient technologies and sustainable practices often leads to significant savings in energy, water, and waste management costs. Additionally, ESG initiatives can streamline operations and improve resource efficiency across departments, further driving down costs.

- Improved Access to Capital and Lower Financing Costs

Companies with good ESG ratings may have better access to “green” loans or bonds, which often come with lower interest rates compared to conventional financing. Additionally, strong ESG profiles can attract investment from funds that prioritize sustainable investments, potentially increasing demand and lowering capital costs.

- Employee Productivity and Retention

ESG initiatives can lead to a healthier, more engaging, and inspiring workplace, increasing employee satisfaction and productivity. Higher productivity typically means better outputs and lower operational costs. Furthermore, high employee retention rates reduce the costs and disruptions associated with hiring and training new staff.

- Reputation and Brand Loyalty

A strong ESG record can significantly enhance a company’s reputation, protecting and potentially increasing its market share. Reputation is a vital asset that can influence customer decisions, attract quality partnerships, and differentiate a company in crowded markets.

ESG Leaders in Malaysia

Adoption of ESG is becoming essential for the Malaysian companies due to the long-term benefits it provides. Here are some companies leading in ESG practices (the list is not exhaustive).

Malayan Banking Berhad (Maybank)

Maybank is at the forefront of actively enhancing its ESG practices. It was the first Malaysian bank to launch its own Sustainable Product Framework (SPF), which aims to provide clear guidance for Maybank’s business teams in developing a range of green, social, and sustainable products. These products span various sectors including corporate lending, debt and equity capital markets, trade financing, retail financing, insurance, asset and wealth management, derivatives, and deposits.

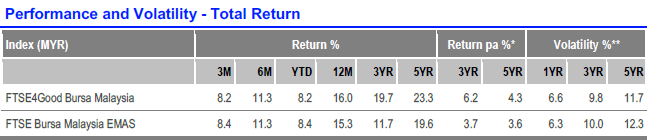

According to its latest 2023 Sustainability Report, Maybank is making significant progress toward achieving its four sustainability commitments. Since 2021, Maybank has mobilized a cumulative total of RM68.48 billion in sustainable finance, approaching its 2025 target of RM80 billion. Additionally, Maybank has successfully reduced its Scope 1 and 2 emissions by 49%, surpassing the annual target of 43.5%, as shown in Exhibit 3.

Exhibit 3. Sustainability commitments of Maybank, source: Maybank Sustainability Report 2023

Tenaga Nasional Berhad (TNB)

As Malaysia’s primary electricity utility company, TNB has been on a path of energy transition since 2016, aspiring to become a leading provider of sustainable energy solutions both domestically and internationally. Committed to achieving net zero emissions by 2050, TNB has entered into multiple Memoranda of Understanding (MoUs) with both local and international partners. These agreements span a range of energy technologies, including solar parks, the integration of hydrogen and ammonia into power plants, interconnections, and electric vehicles. With the launch of National Energy Transition Roadmap (NETR), TNB is set to develop around three gigawatts of new solar and hydro-solar hybrid capacity under its purview, signalling a renewed focus into the domestic renewable energy (RE) landscape. We are positive that TNB’s leadership in the energy transition and its goals for achieving net zero carbon emissions will receive solid support from the Government.

Phillip Capital Management Sdn Bhd (PCM)’s offering in ESG

PCM offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies.

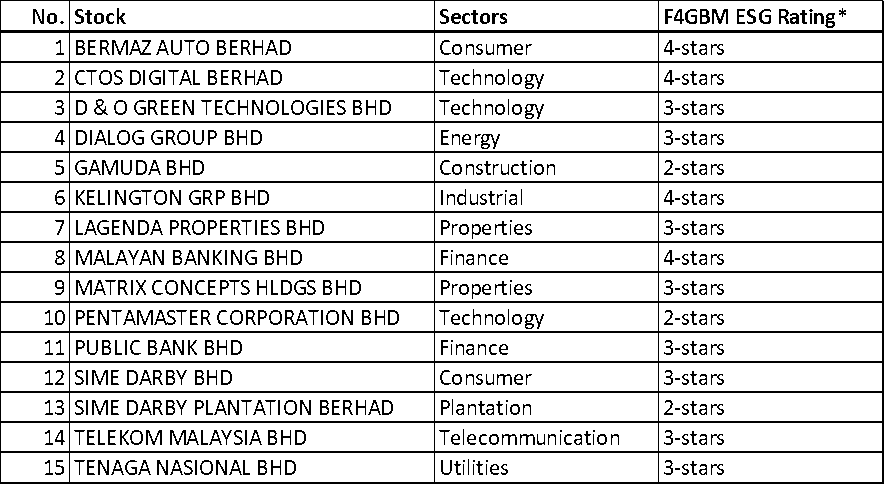

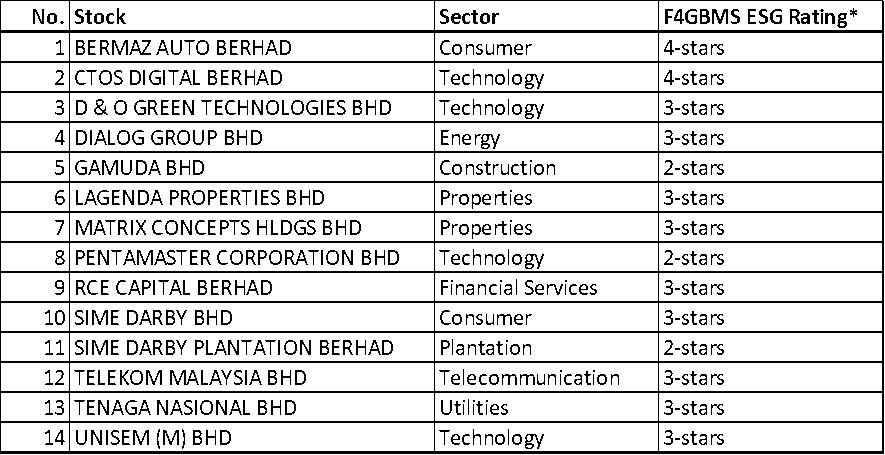

Here is the list of stocks in our ESG mandates.

Table 1: ESG Mandates – Stock List as of March 2024

Conventional ESG Portfolio

Shariah ESG Portfolio

* ESG Ratings of Public Listed Companies (PLCs) assessed by FTSE Russell in accordance with FTSE Russell ESG Ratings Methodology, December 2023 – link

How our holdings could harness the benefits of increasing ESG trend?

We believe listed companies with good ESG practices will continue to benefit from the rising sustainability trend. Furthermore, we have pinpointed selected names within key sectors—Construction, Renewables, Utilities, and Property—that stand to benefit from the Net-Zero Transition Roadmap (NETR) and the policies outlined in Budget 2024. As companies enhance their ESG performance, we foresee a reduction in the risks associated with foreign labour dependency, a factor that historically affected industries such as Plantation, Construction, Gloves, and Electronic Manufacturing Services (EMS). With supply chains increasingly prioritising ESG criteria, ongoing government and corporate initiatives will help mitigate the risks of sanctions and reputational damage. This is crucial amid heightened ESG scrutiny, safeguarding trade opportunities.

We will consistently assess our holdings and adjust our portfolio as necessary to align with prevailing market conditions. Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.