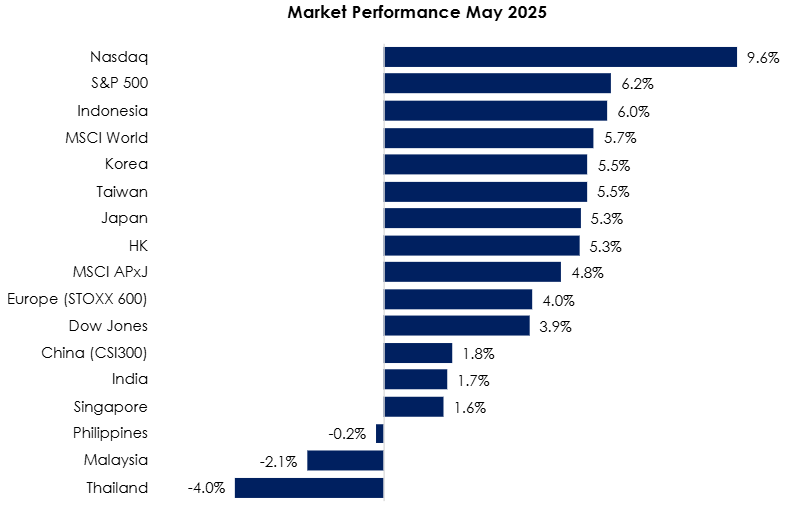

The MSCI World Index (+5.7%) pulled ahead of the MSCI Asia Pacific Ex-Japan Index (+4.8%) after three months of underperformance on the back of strong US market gains as it retraced April’s tariff-fuelled selloff. Indonesia (+6.0%) clinched Asia Pacific’s no. 1 spot for the 2nd month in a row, likely on news of easing tariff policies and a government economic stimulus package in June. South Korea (+5.5%) rallied strongly thanks to a policy rate cut amidst the tariff terror retrace, and only a week prior to their presidential election on 3 June. Taiwan (+5.5%) also performed exceptionally well, again as export curbs fizzled. In contrast, Thailand (-4.0%) declined even further to -17.9% year-to-date, solidifying them as the APAC’s hardest-hit nation from China’s capacity overflow. Malaysia (-2.1%) could not escape the “Sell in May, go away” adage, in part due to a string of weak corporate earnings and uncertainty over the replacement policy for Biden’s AI diffusion rule (see Exhibit 1).

Exhibit 1: Market Performance May 2025

Source: Bloomberg, PCM, 31 May 2025

On the monetary policy front, in May, the Federal Reserve (Fed) held interest rates steady at the 4.25% to 4.5% range during its meeting, as widely expected. Separately, the Bank of England (BoE) lowered interest rates by 25 basis points to 4.25%. In Asia, the People’s Bank of China (PBoC) cut the one-year LPR by 10 basis points to 3.0% and the five-year LPR by 10 basis points to 3.5%. Similarly, the Bank of Korea (BoK) cut interest rates by 25 basis points to 2.50%. Finally, the Bank Negara Malaysia (BNM) kept the overnight policy rate (OPR) unchanged at 3%.

The FBMKLCI lost 2.1% mom in May, closing at 1,508.35. In contrast, the Small Cap Index rose by 0.7%, while the Mid 70 Index increased by 1.6%. Sector-wise in May, the top-performing sectors were Construction, Property, and Technology, up 9.0%, 3.8%, and 3.2%, respectively. The worst-performing sectors were Healthcare, Consumer, and Telecommunications, which saw declines of 5.2%, 4.2%, and 2.4%, respectively. Foreign investors turned net buyers in May, recording RM1.0bn in inflows after seven consecutive months of net selling. However, foreign funds became net sellers again towards end of May.

Equity Market Outlook & Investment Strategy

Malaysia

1Q25 earnings release showed broad-based disappointments across oil & gas, consumer, technology, banking, automotive, non-bank financials, gaming, rubber gloves, telecommunications, and building materials sectors, while plantation and construction delivered the strongest year-on-year (yoy) earnings growth. Following a subdued May results season, we expect the market to adopt a wait-and-see approach amid continued foreign net outflows and political uncertainty under the Madini government ahead of the Sabah state election by end-2025. Furthermore, sentiment remains cautious due to concerns over a tariff-driven global slowdown, legal uncertainties tied to Trump’s trade policies, and potential domestic cost pressures from higher SST, RON95 fuel prices, and electricity tariffs in 2H25. Despite these headwinds, strong domestic liquidity, a gradually strengthening ringgit (+4.8% YTD vs USD), and government initiatives such as NETR, JS-SEZ, and NIMP 2030 could help cushion downside risks and support selective buying opportunities in the near term.

Regional

As we enter June, global market conditions remain uncertain, with the potential for renewed volatility remaining high. Equities may face headwinds in the near term due to rising geopolitical tensions, persistent inflationary pressures, and a slowdown in global economic growth. Trade negotiations are ongoing; however, a meaningful breakthrough appears unlikely before the 90-day tariff suspension expires on July 8 – a key milestone that could trigger new policy shifts. In the interim, markets may experience economic distortions stemming from pre-tariff stockpiling, supply chain disruptions, and decelerating growth, all of which could amplify earnings volatility. While several central banks have begun easing monetary policy, the US Federal Reserve has yet to follow suit. Investors are anticipating a potential Fed rate cut later this year, particularly in light of the US economy contracting by 0.3% in the first quarter of 2025 – its first decline since early 2022, and a high US debt ($36tn). Although rate cuts could help underpin equity valuations, lingering trade uncertainties and uneven regional growth may continue to dampen investor sentiment. Against this backdrop, we emphasize the importance of diversification and a focus on quality amid volatility.

Fixed Income Outlook & Strategy

Malaysia

UST yields are expected to remain elevated in the near term, driven by ongoing fiscal concerns, rising debt levels, and uncertainty surrounding US federal spending and trade negotiations. While a breakthrough in trade talks may offer temporary relief, the broader trend for yields remains upward. Markets will closely watch Fed Chair Powell’s speech and the FOMC minutes for further clues on policy direction.

Domestically, Malaysian Government Securities (MGS) and Government Investment Issues (GII) yields are expected to stay stable, supported by resilient demand, a favourable supply-demand backdrop, and potential capital reallocation from developed to emerging markets.

Regional

The Federal Open Market Committee (FOMC) has decided to keep the Fed funds rate unchanged for the third consecutive meeting, signaling a cautious approach as it balances the need to combat inflation with the risk of weakening employment. The US had its official rating downgrade by Moody’s in May, the final credit rating agency to join S&P and Fitch at AA+. This led to UST yields spiking as debt concerns and widening deficits rose. The 30-year UST yield briefly exceeded 5% amid market anxiety over Trump’s tax-cut approval by the House and weak demand at a 20-year bond auction. Risk sentiment worsened by Trump’s proposed 50% EU tariffs just before the US market early close for Memorial Day. The market was given a breather following Trump’s decision to extend EU trade negotiations to July 9 and agreed to postpone the 50% tariff.

The Bank of Japan (BoJ) kept its key short-term interest rate unchanged at 0.5% during its May meeting, maintaining the highest level since 2008 and in line with market expectations. In its quarterly outlook, the BoJ lowered its FY 2025 GDP growth forecast to 0.5% from 1.0% projected in January, citing trade risks and policy uncertainty. The 2026 growth outlook was also reduced to 0.7% from 1.0%. The BoJ also trimmed its core inflation forecast for FY 2025 to 2.2% from 2.7% and expects it to ease further to 1.7% in FY 2026 before ticking up to 1.9% in FY 2027. Meanwhile, headline inflation is projected to hover around 2% through the FY ending March 2028.

The People’s Bank of China (PBoC) cut key lending rates to record lows at the May fixing, in line with market expectations and marking the first reduction since October. The move follows Beijing’s sweeping monetary easing measures announced earlier this month to bolster a sluggish economy and cushion potential fallout from the ongoing trade tensions with the U.S. The one-year loan prime rate (LPR), the benchmark for most corporate and household loans, was lowered by 10 basis points to 3.0%, while the five-year LPR, which guides mortgage rates, was cut by the same margin to 3.5%.

Strategy for the month

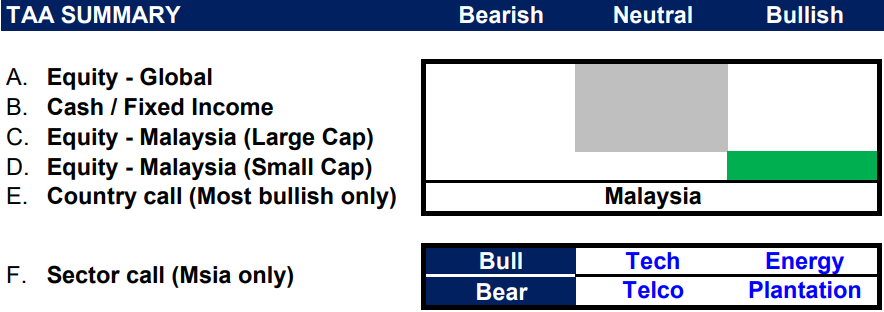

We remain neutral on global equities as geopolitical risks and soft economic data continue to weigh on market sentiment in the near to medium term, though we note positive signs of easing US–China trade tensions. We remain constructive on Asia Pacific ex-Japan equities, as export-driven economies could see short-term gains from easing tariff tensions, with North Asia likely to build momentum. That said, elevated volatility in the near term would not be surprising as these dynamics unfold. Geopolitical risks also remain unresolved and could introduce additional uncertainty.

We continue to prefer Malaysia, as it remains a laggard this year compared to other markets. While the MSCI Asia Pacific ex-Japan Index is now trading at 52-week highs amid renewed optimism, and both the U.S. and European markets are performing well, we see value in positioning in laggards like Malaysia that have yet to catch up. We maintain a neutral view on large-cap stocks due to balanced risk-reward and have shifted to bullish on small-caps amid recent positive developments in US-China tariff policies that support a risk-on sentiment.

Sector-wise, we remain bullish on the Technology sector, as its underperformance offers room for a potential rebound. We remain selective in the Energy sector, favouring LNG-related plays due to the increasing allocation of global energy capex toward LNG. This structural shift supports the long-term outlook for gas, which is set to benefit from rising energy demand. On the other hand, we maintain an underweight stance on the Telco and Plantation sectors given the lack of catalysts. We are also turning cautious on the Consumer sector, as the recently announced SST broadening may pressure profit margins and dampen consumer spending.

Exhibit 2: PCM’s monthly strategy snapshot

Source: PCM, 31 May 2025

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

TAA_Presentation_Deck_June-12.6.2025.pdf

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.