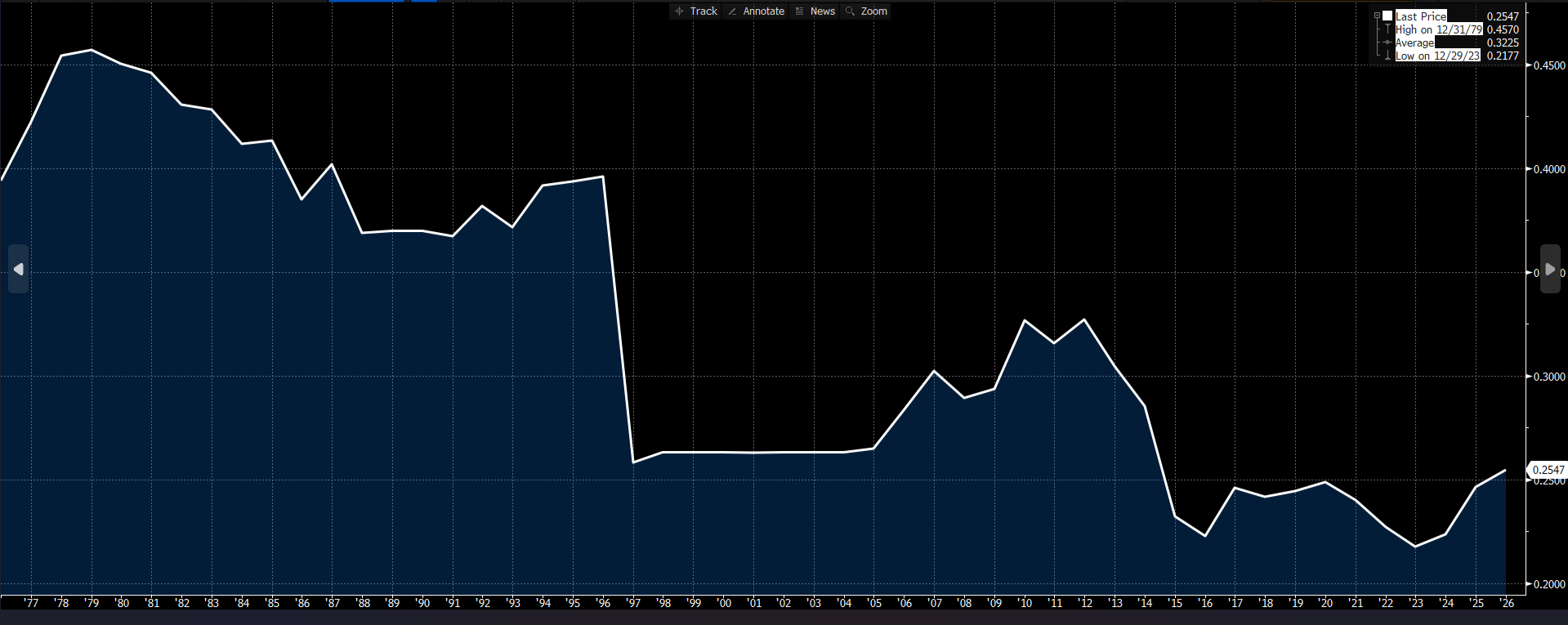

The Malaysian ringgit is finally showing signs of a meaningful turnaround. For much of the past five decades, the currency trended weaker, reflecting slower industrial growth and widening economic gaps with more advanced economies. However, since 2024, this trend has begun to reverse. Recent gains appear to be more than just a short-term rebound; they reflect deeper structural improvements in Malaysia’s economy alongside more supportive global financial conditions. As shown in Exhibit 1, the MYRUSD index been trending downward, indicating a strengthening ringgit. Looking ahead to 2026, several powerful forces ranging from global supply chain realignments and stronger fiscal management to rising foreign direct investment suggest that the ringgit has further room to appreciate. Below, we outline the key factors that could support continued strength in the currency through 2026.

Exhibit 1: MYRUSD Index for 50 Years

Source: Blomberg, PCM, 11 February 2026

First, the “China Plus One” tech boom.

As global companies seek to reduce their dependence on China, many are actively searching for alternative production bases across Asia. Malaysia has emerged as a leading choice due to its political stability, skilled workforce, and well-developed infrastructure. Amid rising U.S.–China tensions, companies have been relocating critical supply chains out of China, with Penang increasingly recognised as “ASEAN’s Silicon Valley.” Major players such as AMD and Intel are driving growth in Penang, supported by substantial foreign investments in AI data centers, semiconductor manufacturing facilities, and high-tech industrial parks. As these multinational corporations invest in Malaysia, they must convert foreign currencies into ringgit, generating sustained and long-term demand for the MYR and further supporting the currency.

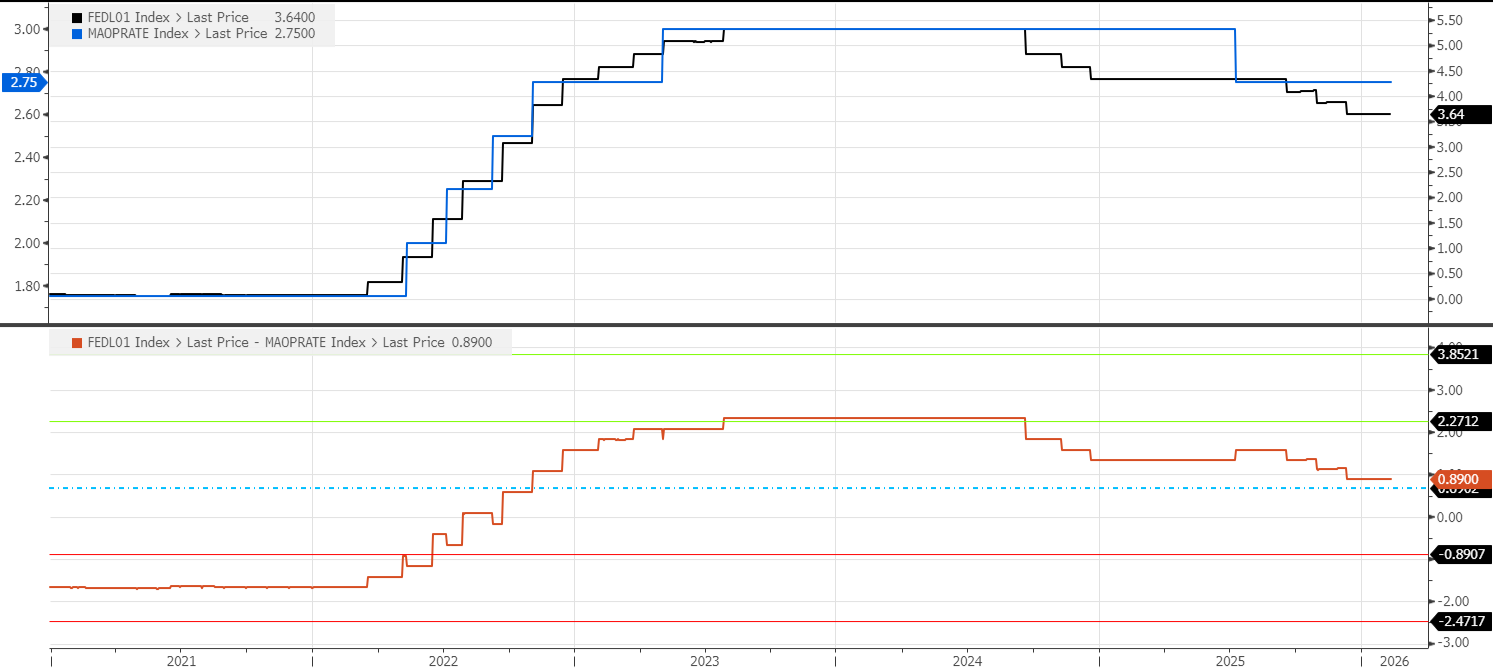

Second, a smaller interest rate gap.

In late 2025, the U.S. Federal Reserve and several other major central banks began cutting interest rates to support their economies. In contrast, Bank Negara Malaysia maintained its policy rate at 2.75%. As a result, the interest rate differential between Malaysia and the United States narrowed throughout 2025 and into early 2026 (Exhibit 2), becoming a key driver of the Malaysian ringgit’s appreciation. With Malaysia offering relatively stable and competitive yields, Malaysian bonds and deposits became increasingly attractive to global investors seeking stronger returns. This boosted foreign capital inflows and supported the ringgit. For foreign investors, this environment offered higher potential returns at a more favorable entry cost. As capital flowed into Malaysia, investors converted foreign currencies into ringgit, increasing demand for the MYR and further strengthening the currency.

Exhibit 2: Fed Funds Rate vs Malaysia OPR Rate

Source: Blomberg, PCM, 11 February 2026

Third, stronger fiscal discipline.

The Malaysian government has taken concrete steps to strengthen its finances by reducing blanket petrol subsidies and replacing them with targeted subsidies. The savings from these reforms are redistributed through programmes such as Sumbangan Asas Rahmah (SARA), which provide direct aid to lower-income households. These measures have helped restore confidence in Malaysia’s fiscal management and is already reflecting in the markets. After an outflow of RM22.3 billion in 2025, foreign investors returned as net buyers, with net inflows reaching approximately RM1.0 billion in January 2026. Such strong inflows point to growing trust among both local and international investors in Malaysia’s economic direction.

Together, these measures have made government spending more controlled, efficient, and sustainable. As a result, the budget deficit has narrowed, and Malaysia’s overall fiscal position has improved. International credit rating agencies and bond investors see this as a sign of stronger policy discipline and better long-term planning. With greater confidence in Malaysia’s public finances, demand for the Ringgit has increased, helping to support and strengthen its value.

Finally, resilient tourism and trade.

Finally, Malaysia recorded a historic tourism rebound in 2025, welcoming 42 million international visitors this momentum to continue with Visit Malaysia 2026 campaign to attract higher tourist arrivals and spending with Malaysia’s target of attracting 47 million this year. Tourists bring in foreign currency, which is then exchanged for Ringgit. At the same time, new trade agreements and diversified export markets have helped stabilize Malaysia’s exports. Together, tourism and trade ensure a steady inflow of foreign currency, reinforcing the Ringgit’s recovery.

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.