Climate change is no longer just an environmental issue—it is a financial one. Increasingly, investors and asset managers recognize that climate risks pose significant threats to global markets, industries, and portfolio performance. From extreme weather events to shifting regulations and the transition to a low-carbon economy, climate-related risks are reshaping the investment landscape. This is where Environmental, Social, and Governance (ESG) factors become critical in portfolio management, particularly in Malaysia, where climate policies and sustainability initiatives are gaining momentum.

The Growing Financial Impact of Climate Change in Malaysia

Climate change presents two key financial risks: physical risk and transition risk.

- Physical risk refers to the direct impact of climate change, such as floods, rising temperatures, and unpredictable weather patterns. Malaysia has experienced severe floods, like the December 2021 disaster that caused RM6.1 billion in economic losses, affecting infrastructure, businesses, and livelihoods. Investors with holdings in vulnerable sectors—such as real estate, agriculture, and insurance—must consider the financial consequences of these climate events.

- Transition risk arises from policies and market shifts toward a low-carbon economy. Malaysia has committed to achieving net-zero greenhouse gas emissions by 2050, as outlined in the National Energy Transition Roadmap (NETR) and the Twelfth Malaysia Plan. These policies push companies to adopt sustainable practices or risk regulatory penalties, stranded assets, and declining investor confidence.

How ESG Integration Helps Mitigate Climate Risk

To address climate-related financial risks, investors are incorporating ESG factors into their portfolio management strategies. In Malaysia, this involves:

- Investing in Low-Carbon and Renewable Energy Projects

The Malaysian government has introduced initiatives such as the Green Technology Financing Scheme (GTFS) to encourage investment in clean energy. Companies in the renewable energy sector, such as solar power and waste-to-energy businesses, are well-positioned to benefit from these policies, making them attractive options for ESG-focused investors.

- Adapting to ESG Regulatory Changes

The Sustainable and Responsible Investment (SRI) Sukuk Framework, introduced by the Securities Commission Malaysia (SC), promotes green financing through Shariah-compliant bonds. Investors looking for sustainable fixed-income assets can explore these SRI sukuk, which fund projects like renewable energy and green buildings.

- Assessing Corporate ESG Commitments

Bursa Malaysia has mandated ESG disclosures for public-listed companies under the Bursa Malaysia Sustainability Reporting Framework. Investors should scrutinize these reports to assess corporate sustainability performance. Companies in sectors like energy, finance, and consumer goods that integrate ESG principles into their strategies are more likely to remain resilient in the face of climate-related risks.

- Divesting from High-Carbon Industries

Institutional investors and government-linked funds in Malaysia are increasingly adopting sustainable investment frameworks, shifting capital away from fossil fuel-heavy sectors in favor of ESG-compliant investments. Individual investors can follow similar strategies to minimize exposure to transition risks and align their portfolios with long-term sustainability trends.

Identify investment opportunities – Phillip Managed Account for Retirement (PMART) and Phillip Managed Account (PMA) ESG

In line with the nation’s goal towards sustainability, Phillip Capital Management has integrated ESG factors that we attest as material and relevant for a company’s financial performance and long-term sustainability into our investment decision-making process. These include but not limited to ESG ratings by established index, environmental considerations (climate change, natural resources preservation, pollution & waste), social considerations (health & safety, community engagement, employee relations) and governance considerations (board independence, transparency & disclosure, shareholder rights).

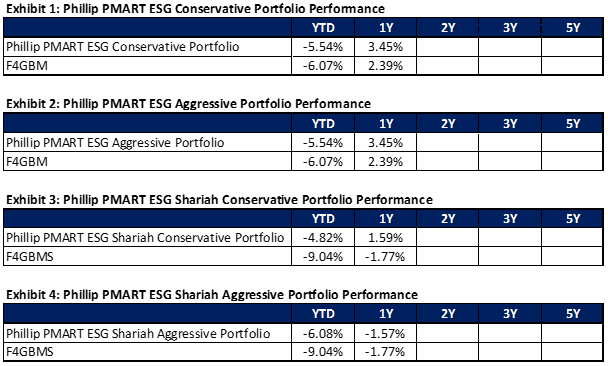

Separately, PCM offers PMART and PMA ESG, a discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies. Exhibits 1-4 show the performance for PMART ESG Conventional and Shariah.

Source: PCM, 28 Feb 2025, link

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.