Markets are playing catch-up to the new regime with the bond yields have surged to 16-year highs. The markets now believe central banks would not swiftly relax policies due to global supply challenges. They are expected to stay tightened to counter inflationary pressures. However, it is essential to consider that inflation is decreasing as pandemic-related imbalances are resolving. Approximately two-thirds of the shift in spending from services to goods has reversed. Normalisation of demand is pulling down goods prices, contributing to the decline in inflation. Additionally, the skills mismatch is also stabilising, which is helping to moderate wage growth.

The global economic outlook hinges on several critical factors, including the extent of China’s growth slowdown, the intensity of US-China tensions, and the degree to which the US economy might weaken for the Fed to unwind the rate hike. In addition to these factors, we believe there are three more areas that investors should closely watch.

- Israel-Hamas Conflict

From a market standpoint, there has so far been remarkably little fallout from events in the Middle East. Despite talk of a potential ground invasion of Gaza, it has not occurred yet, leading to speculation that behind-the-scenes pressure from Washington, Riyadh, or elsewhere is preventing Israel from taking such action. Additionally, Saudi Arabia’s ongoing silence suggests Crown Prince MBS may want to protect his economic development plans from the Gaza issue. While the conflict between Israel and Hamas has resulted in no immediate threats to oil supply yet, it has pushed oil prices up on heightened risk premium.

Nonetheless, we remain watchful if the potential escalation of the Israel-Hamas conflict would spread to broader Middle East regions and beyond, and the risk to Iran’s significant oil production (3.1 million bbl/day, constituting 3% of the global supply) due to possible U.S. sanctions. There is also concern about Iran potentially blocking the vital Straits of Hormuz, which are crucial for global oil flow (accounting for 20-30% of world consumption). While Iran denies this possibility, there remains a risk of higher oil prices impacting inflation rates and subsequently influencing trends in interest rates.

- 2024 U.S. Recession (?)

A question mark still lingers but what happens right now is that the recession fears due to rising interest rates and market uncertainty have eased, with growing investor optimism about a soft landing, but caution persists. According to data compiled by Visual Capitalist, the probability of a U.S. recession in 2024 remains uncertain, with varied economic forecasts from Wall Street, Main Street, and C-Suite sources.

Source: Visual Capitalist

What is missing here is that we observed the U.S commercial banks’ total loan growth plummeted, dropping from 12.5% YoY in Dec’22 to 3.8% in Oct’23, while commercial and industrial loans growth collapsed from 15.3% YoY in Nov’22 to just 0.01% YoY in Oct’23. Reducing bank loan growth and stricter lending standards signal growing recession risk.

Source: Jefferies

- U.S. Presidential Election 2024

The United States is slightly more than a year away from the upcoming presidential election, and numerous Republicans, including former President Donald Trump, have entered the race. As of October 18th, a popularity poll in the United States indicated that 46% of respondents support Trump, while 42% favour Biden, with the remaining portion undecided. Trump is in the lead, partly due to the scrutiny of Biden’s economic plan and his stance on the Middle East. Certainly, the situation is dynamic and subject to change.

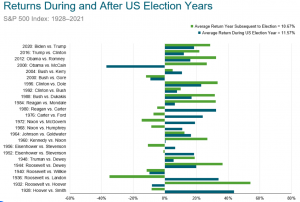

In prior election years, the S&P 500 Index has demonstrated predominantly positive performance, with only four occurrences of negative returns within past election cycles. Election years have witnessed an average return of 11.57% since 1928, which is marginally superior to post-election returns, yet they have been characterized by significant market volatility. A disclaimer to emphasise that past performance should not be regarded as an absolute predictor of future returns.

Source: Dimensional

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

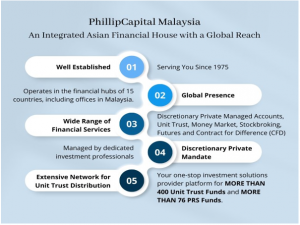

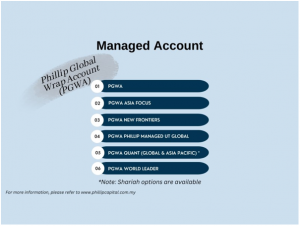

Phillip Capital Malaysia offers a comprehensive suite of financial services including managed accounts and unit trusts, that may suit your investment preferences and financial goals. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.