The circular economy is an innovative model designed to minimize waste, maximize resource efficiency, and create sustainable value. Unlike the traditional linear economy, which follows a “take, make, use, dispose” model, the circular economy emphasizes reducing, reusing, repairing, and recycling materials and products to close the loop of production and consumption.

How Malaysia is Adopting the Circular Economy

Malaysia is transitioning to a circular economy to address environmental challenges and improve economic resilience. Several initiatives highlight this commitment:

- Plastic Waste Management

The Malaysia Plastics Sustainability Roadmap 2021-2030, introduced by the Ministry of Natural Resources and Environment, aims to reduce single-use plastics and enhance recycling rates through strategies like fostering innovation in biodegradable plastics and creating incentives for recycling businesses.

- Sustainable Manufacturing

Industries are adopting circular principles through energy-efficient technologies and sustainable practices. Companies like Top Glove Corporation recycle production byproducts and reduce water consumption using advanced treatment technologies. Top Glove Corp Bhd plans to increase its water recycling capacity by 50% to six million cubic meters annually by 2025, up from the current four million, aligning with Selangor’s Zero Discharge Policy (ZDP). The company has already become the first industrial premises to complete the ZDP licensing process, as recognized by Selangor authorities.

- Circular Economy in Construction

The Construction Industry Development Board (CIDB) promotes green building practices such as using recycled materials and modular construction methods. Additionally, the Green Building Index (GBI), Malaysia’s green rating system for buildings, assesses projects based on energy efficiency, water efficiency, sustainable site planning, and use of recycled or eco-friendly materials. Projects like Putrajaya Green City exemplify how integrating GBI standards can reduce environmental impact and enhance resource efficiency.

- Implementation by Listed Companies

Listed companies in Malaysia are integrating circular practices into their operations. For example:

- Petronas: Investing in chemical recycling technologies to convert plastic waste into valuable feedstock.

- Sime Darby Property: Utilizing sustainable building materials and incorporating green certifications in developments.

- Sunway Group: Implementing comprehensive waste management systems in their townships and promoting renewable energy solutions.

Benefits and Values Created by the Circular Economy

Adopting a circular economy creates numerous benefits:

- Environmental Benefits

- Waste Reduction: Less waste in landfills and incinerators.

- Resource Conservation: Minimizing the need for virgin materials.

- Lower Carbon Emissions: Recycling and energy-efficient manufacturing mitigate climate change.

- Economic Advantages

- Cost Savings: Businesses save costs by optimizing resource use and reducing waste.

- New Opportunities: Innovation and markets for recycling and repair services.

- Resilience: Reduces dependency on finite resources.

- Social Impact

- Job Creation: Circular innovations generate jobs.

- Improved Public Health: Reducing pollution benefits communities.

- Education and Awareness: Promotes sustainable living and responsible consumption.

Conclusion

The circular economy offers Malaysia an opportunity for sustainable growth while addressing environmental concerns. By integrating circular practices into industries, listed companies, and communities, Malaysia can create long-term value for its citizens and the planet. With continued innovation and commitment, the circular economy can become a cornerstone of the nation’s development strategy, ensuring a resilient future for generations to come.

Identify investment opportunities – Phillip Managed Account for Retirement (PMART) and Phillip Managed Account (PMA) ESG

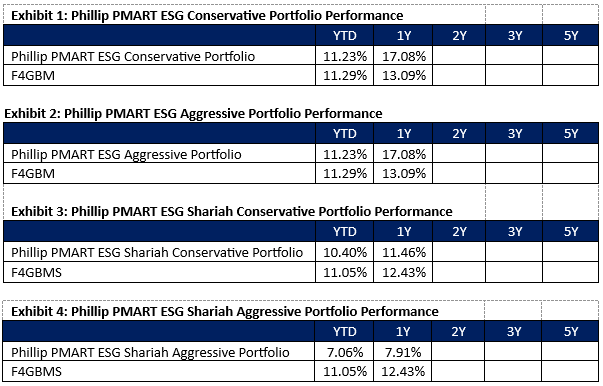

While PhillipCapital Malaysia does not currently offer green bonds, we are pleased to offer a range of investment solutions, including stock mandates, tailored to meet your financial goals and sustainability preferences. PMART and PMA ESG is a discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies. Exhibits 1-4 show the performance for PMART ESG Conventional and Shariah.

Source: PCM, 31 Oct 2024, link

Exhibits 5 & 6 provide a list of the stocks in our portfolio. The percentage composition of each stock may vary depending on whether the mandate is Conservative or Aggressive.

Exhibit 5: Stock List – ESG Conventional

| Company Name | ESG Rating |

| CTOS DIGITAL BERHAD | **** |

| DELEUM BHD | **** |

| DIALOG GROUP BHD | *** |

| GAMUDA BHD | *** |

| HARTALEGA HOLDINGS BHD | **** |

| HIBISCUS PETROLUEM BHD | *** |

| INARI AMERTRON BHD | **** |

| KELINGTON GRP BHD | **** |

| KOSSAN RUBBER INDUSTRIES BHD | *** |

| LAGENDA PROPERTIES BERHAD | *** |

| MATRIX CONCEPTS HLDGS BHD | *** |

| RCE CAPITAL BERHAD | **** |

| SHANGRILA HOTELS (M) BHD | *** |

| TELEKOM MALAYSIA BHD | *** |

Source: PCM, 30 Nov 2024, listed in alphabetical order

Exhibit 6: Stock List – ESG Shariah

| Company Name | ESG Rating |

| BANK ISLAM MALAYSIA BERHAD | *** |

| CTOS DIGITAL BERHAD | **** |

| D & O GREEN TECHNOLOGIES BHD | *** |

| DELEUM BHD | **** |

| DIALOG GROUP BHD | *** |

| GAMUDA BHD | *** |

| HARTALEGA HOLDINGS BHD | **** |

| HIBISCUS PETROLUEM BHD | *** |

| INARI AMERTRON BHD | **** |

| KELINGTON GRP BHD | **** |

| KOSSAN RUBBER INDUSTRIES BHD | *** |

| LAGENDA PROPERTIES BERHAD | *** |

| MATRIX CONCEPTS HLDGS BHD | *** |

| RCE CAPITAL BERHAD | **** |

| SHANGRILA HOTELS (M) BHD | *** |

| TELEKOM MALAYSIA BHD | *** |

Source: PCM, 30 Nov 2024, listed in alphabetical order

Recognising the increasing significance of ESG factors in investment decisions, we have introduced the Dividend Enhanced ESG Mandate in April 2024, which integrates quantitative investment methods inspired by our Dividend Enhanced strategy. This methodology involves Universe selection, Filtering, Construction, and Rebalancing. Building upon our investment strategy, we have integrated an ESG filter mandating that selected stocks meet a minimum ESG Rating of 3 Stars from the FTSE4Good Bursa Malaysia (F4GBM) Index. Exhibits 7 & 8 show the list of stocks in our Dividend Enhanced ESG mandates.

Exhibit 7: Stock List – Dividend Enhanced ESG Conventional

| Company Name | 12M Forward Dividend Yield | ESG Rating |

| GENTING MALAYSIA BHD | 7.46 | *** |

| SIME DARBY BERHAD | 6.45 | *** |

| MALAYAN BANKING BHD | 6.37 | **** |

| RHB BANK BHD | 6.21 | **** |

| BANK ISLAM MALAYSIA BHD | 6.08 | *** |

| HEINEKEN MALAYSIA BHD | 6.02 | *** |

| AXIS REAL ESTATE INVESTMENT | 5.73 | *** |

| MISC BHD | 5.04 | **** |

| PETRONAS DAGANGAN BHD | 4.62 | *** |

| AXIATA GROUP BERHAD | 4.47 | *** |

| PETRONAS GAS BHD | 4.34 | **** |

| WESTPORTS HOLDINGS BHD | 4.30 | **** |

| CELCOMDIGI BHD | 4.22 | **** |

| TELEKOM MALAYSIA BHD | 3.75 | *** |

| TENAGA NASIONAL BHD | 3.74 | *** |

| AVERAGE YIELD | 5.25 |

Source: PCM, 30 Nov 2024, sorted by 12M Forward Dividend Yield

Exhibit 8: Stock List – Dividend Enhanced ESG Shariah

| Company Name | 12M Forward Dividend Yield | ESG Rating |

| BERMAZ AUTO BHD | 10.02 | **** |

| SIME DARBY BERHAD | 6.45 | *** |

| BANK ISLAM MALAYSIA BHD | 6.08 | *** |

| AXIS REAL ESTATE INVESTMENT | 5.73 | *** |

| MISC BHD | 5.04 | **** |

| PETRONAS DAGANGAN BHD | 4.62 | *** |

| SYARIKAT TAKAFUL MALAYSIA KE | 4.50 | *** |

| RCE CAPITAL BHD | 4.48 | **** |

| AXIATA GROUP BERHAD | 4.47 | *** |

| MATRIX CONCEPTS HOLDINGS BHD | 4.34 | *** |

| PETRONAS GAS BHD | 4.34 | **** |

| WESTPORTS HOLDINGS BHD | 4.30 | **** |

| CELCOMDIGI BHD | 4.22 | **** |

| TELEKOM MALAYSIA BHD | 3.75 | *** |

| TENAGA NASIONAL BHD | 3.74 | *** |

| AVERAGE YIELD | 5.07 |

Source: PCM, 30 Nov 2024, sorted by 12M Forward Dividend Yield

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.