The abrupt swings in US policy combined with pressure on the Fed’s independence have shaken investor trust in the dollar, which was still clearly evident in positioning. Despite a stronger-than-expected US jobs report in April (177,000 jobs created vs 130,000 forecast), the greenback struggled to gain traction, revealing an undercurrent of market skepticism. Speculative short positions on the dollar have risen, indicating that investors are betting on continued weakness — a sentiment driven less by fundamentals than by concerns over political interference and policy unpredictability.

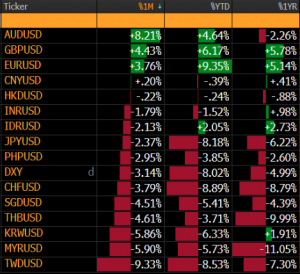

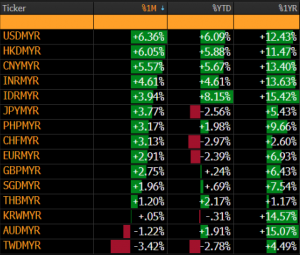

In fact, the DXY index fell 3.14% (1M), 8.02% (YTD), and 4.99% (1YR), reflecting a broadly weaker USD (see Figure 1). Investor trust in the dollar is clearly waning amid US policy uncertainty. Safe-haven currencies such as JPY and CHF are the clear winners as dollar strength abates. The Malaysian ringgit (MYR) strengthened significantly: +6.36% (1M), +6.09% (YTD), and +12.43% (1YR) vs USD (see Figure 2). It also appreciated strongly against regional currencies like KRW (+14.57%), AUD (+15.07%), and INR (+13.63%) over the past year. This signals broad market confidence in the ringgit’s resilience and improving fundamentals.

Figure 1: USD performance against other currencies

Source: Bloomberg, 5 May 2025

Figure 2: MYR performance against other currencies

Source: Bloomberg, 5 May 2025

President Donald Trump’s latest comments have done little to calm markets. While he confirmed he would not attempt to remove Federal Reserve Chair Jerome Powell, he reiterated his calls for lower interest rates and described Powell as a “stiff,” further casting doubt on the Fed’s autonomy. This persistent pressure risks undermining the credibility of US monetary policy at a time when central bank independence is crucial to managing inflation and sustaining investor confidence.

Although the Federal Open Market Committee (FOMC) is expected to hold interest rates steady at its upcoming meeting, market expectations for a June rate cut have declined sharply — from 64% a month ago to just 37% now. Expectations for a rate cut have now been pushed forward to July. Still, the dollar’s response has been tepid, and the dollar index remains below recent highs.

In normal conditions, robust labor data and fading rate-cut expectations would typically support the US currency. But in this climate of policy volatility and political pressure on the central bank, investors appear more focused on the risks than the data. We believe that until there is greater clarity around fiscal and trade policy, and until the Fed is seen as free from political influence, the dollar may remain on fragile footing — vulnerable to renewed selling on any signs of economic or institutional weakness. This could benefit regional markets like Malaysia, which offer solid fundamentals, political stability, manageable inflation, and ample liquidity, as investors look to diversify away from the US. With KLCI’s foreign shareholding at a relatively low 19.3% as of March and valuations below historical averages, Malaysia may attract flows from investors seeking both market returns and positive ringgit carry.

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.