On the first day of his second term, President Donald Trump signed a series of executive order, revoking close to 80 Biden-era executive orders, including those on climate change, clean energy, and environmental justice. His actions aimed to prioritize fossil fuel production and shift away from clean energy initiatives. Trump began by withdrawing the U.S. from the Paris Agreement, reversing President Biden’s re-entry. He also declared a national energy emergency, directing agencies to expedite fossil fuel production, including oil and gas, and to fast-track energy infrastructure projects.

Trump’s “Unleashing American Energy” order promoted exploration and production on federal lands and waters, particularly for oil, coal, and natural gas. He also ended the pause on LNG export reviews and mandated a regulatory review to remove barriers to energy development, including electric vehicle mandates. Trump temporarily halted offshore wind leasing, initiating a review of wind energy projects. He also initiated a review of U.S. financial commitments to international climate agreements, while pushing for a regulatory freeze on new rules for 60 days. Additionally, Trump issued orders to maximize Alaska’s resource potential, prioritize water distribution in California, and lower energy prices by eliminating perceived regulatory burdens.

These actions reflect Trump’s commitment to fossil fuels and energy independence, marking a significant shift in U.S. climate policy and sparking ongoing debates about the role of the U.S. in global climate efforts. Trump’s executive orders have mixed implications. Positively, they could boost U.S. energy independence by expanding fossil fuel production, lowering energy costs, and creating jobs in traditional energy sectors. The push for more energy infrastructure and LNG exports may drive economic growth. However, the negative effects include increased environmental risks from reduced regulations, leading to higher pollution and greater climate change impacts. Internationally, the U.S. withdrawal from the Paris Agreement weakens global climate leadership and cooperation. Additionally, the focus on fossil fuels risks missing out on the economic opportunities and job creation offered by the growing clean energy sector.

Trump’s second term energy policies could have mixed effects on Malaysia. A retreat from U.S. climate leadership may reduce ESG-driven investments, but Malaysia’s green initiatives, like Green Sukuk, could still attract global capital. The focus on fossil fuels in the U.S. could benefit Malaysia’s energy sector in the short term, though an oversupply of oil might reduce oil-related revenue. Malaysia may need to fast-track its renewable energy transition to ensure long-term sustainability. Separately, Trump’s energy agenda could also support growth, especially in industrial commodities such as iron ore, coal, and bauxite, benefiting companies like SIME DARBY’s industrial segment.

Identify investment opportunities – Phillip Managed Account for Retirement (PMART) and Phillip Managed Account (PMA) ESG

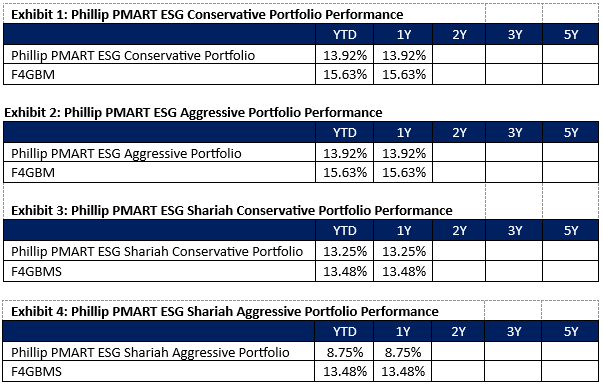

While PhillipCapital Malaysia does not currently offer green bonds, we are pleased to offer a range of investment solutions, including stock mandates, tailored to meet your financial goals and sustainability preferences. PMART and PMA ESG is a discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies. Exhibits 1-4 show the performance for PMART ESG Conventional and Shariah.

Source: PCM, 31 Dec 2024, link

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.