Market Review (July 2025)

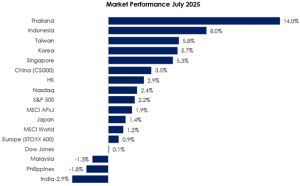

The MSCI Asia Pacific Ex-Japan Index (+1.9%) continued its lead over the MSCI World Index (+1.2%) for the second consecutive month as US tariff negotiations gained positive momentum. Thailand (+14.0%) recovered dramatically after forming a double bottom in June, thanks to a ceasefire over border disputes with Cambodia as well as a reduction in the US tariff rate from 36% to 19%. Indonesia (+8.0%) market was also bolstered by new deals with US, lowering their tariff rate from 32% to 19%. Taiwan (+5.8%) rallied strongly after positive earnings results from TSMC as well as loosened export restriction to China for Nvidia chips. On the losing end, India (-2.9%) was a surprising underperformer as US slapped it with 25% tariff plus penalties due to its ongoing trade arrangements with Russia. Philippines (-1.8%) market stumbled despite negotiating a 19% tariff, an outcome some pundits called unfair due to the tariff-free access imports from US received from the deal. Malaysia (-1.3%) also declined earlier in the month on news of a 25% US tariff, but later rebounded after the rate was reduced to 19% as part of a broader agreement. The deal also included a commitment to purchase 30 additional Boeing aircraft and an easing of the halal certification process for US meat exports, provided producers meet Malaysia’s existing standards (see Exhibit 1).

Exhibit 1: Market Performance July 2025

Source: Bloomberg, PCM, 31 July 2025

On the monetary policy front, in July, the Federal Reserve (Fed) held interest rates steady at the 4.25% to 4.50% range during its meeting, as widely expected. Separately, the European Central Bank (ECB) left interest rates unchanged at 2.00%. In Asia, the People’s Bank of China (PBoC) maintained the one-year LPR at 3.0% and the five-year LPR at 3.5%. The Bank of Japan left its key short-term interest rate unchanged at 0.5% during its July meeting. Finally, Bank Negara Malaysia (BNM) cut the Overnight Policy Rate (OPR) by 25 basis points to 2.75%, the first time in nearly two years.

The FBMKLCI Index lost 1.3% month-on-month (m-o-m) in July, closing at 1,513.25 points. Meanwhile, the Small Cap Index increased by 1.3%, while the Mid 70 Index increased by 2.8%.

Sector-wise in July, the top-performing sectors were Construction, REITs, Industrial, up 5.2%, 4.5%, and 3.8%, m-o-m, respectively. The worst-performing sectors were Healthcare, Financials, and Transport which saw declines of 2.8%, 2.1% and 0.7%, respectively. Foreign investors continued to be net sellers in July, recording RM0.9 billion in outflows. Separately, in July, there were six listings on the ACE Market (ASM Automation Grp Bhd, PMCK Bhd, A1 A.K. Koh Grp Bhd, iCents Grp Holdings Bhd, Enproserve Grp Bhd, and Oxford Innotech Bhd).

Equity Market Outlook & Investment Strategy

Malaysia

Malaysia has secured a 19% US tariff rate, bringing it in line with several regional peers. This reduces a key overhang and reinforces the country’s appeal for foreign direct investment (FDI), while helping avoid trade disadvantages within ASEAN. In addition, the launch of the 13th Malaysia Plan outlines the country’s development direction for the next five years, with targeted support for key sectors such as Construction, Renewables, Technology, and Property. Separately, the plan also reflects the government’s commitment to restoring fiscal discipline and strengthening its financial position. The KLCI remains a relative laggard year-to-date, trading at 13.4x P/E—1.1 standard deviation below its 10-year mean—offering attractive valuations. While near-term headwinds persist from rising cost pressures (including SST, electricity tariffs, and EPF contributions for foreign workers), we believe strong domestic liquidity, compelling valuations, and proactive policy support could help mitigate downside risks and support selective buying opportunities ahead.

Regional

The U.S. has reached tariff agreements with several key partners, including Japan, Korea, most ASEAN countries, the EU, and the UK. However, the tariff discussion deadline with China and Mexico has been extended, while Canada and India face higher tariffs. We view the overall trade environment as still uncertain, especially since major trading partners like China have yet to reach a resolution—making the eventual outcomes particularly important. On the monetary front, the Fed remains cautious about rate cuts, citing the need to assess the inflationary impact of tariffs. Our outlook for global equities remains cautious, as sentiment is expected to remain sensitive to policy signals from major economies. While there are selective opportunities—particularly in sectors supported by long-term structural trends—a disciplined and selective investment approach is essential amid ongoing uncertainty. Maintaining flexibility and staying responsive to potential market dislocations will be critical to navigating the rest of 2025 effectively.

Fixed Income Outlook & Strategy

Malaysia

The near-term outlook for U.S. Treasury (UST) yields is tilted upward, driven by fading expectations of near-term Fed rate cuts, persistent strength in the labor market, and elevated geopolitical and fiscal uncertainty. Although two FOMC members dissented in favor of a rate cut, Chair Powell’s firm messaging reinforced a data-dependent approach and pushed back on politically driven expectations of policy easing. This has led markets to reprice the timing and magnitude of future cuts, placing upward pressure on yields, particularly at the long end of the curve.

In Malaysia, the medium-term outlook for MGS and GII yields is also biased higher. The IMF’s upgraded 2025 GDP growth forecast and the launch of the 13th Malaysia Plan point to stronger domestic demand and increased public sector spending, which may lead to higher government bond issuance. Coupled with potential inflationary pressures and a normalization in policy stance, these factors are expected to drive a gradual upward shift in the domestic yield curve. Both global and local fixed income markets appear poised for a structural adjustment toward higher yields amid improving macroeconomic conditions.

Regional

The Federal Reserve maintained the federal funds rate at 4.25%–4.50% in its latest meeting, with two dissenting votes calling for a rate cut, highlighting rising internal divergence on the policy path. Markets initially priced in a more dovish stance, but U.S. Treasury yields climbed following Chair Powell’s press conference, where he emphasized that no decision had been made on future cuts. He underscored that the labor market remained resilient and showed no clear signs of deterioration, thereby reducing the urgency for immediate easing. Chair Powell also pushed back on expectations following President Trump’s remarks, suggesting a likely rate cut in September. He noted that fiscal policy was broadly neutral and not providing significant stimulus, while tariffs imposed by the administration were contributing to upward price pressures. Overall, the Fed reaffirmed its data-dependent stance, with monetary policy decisions likely to be shaped by upcoming economic data rather than political influence.

The People’s Bank of China (PBOC) maintained its key lending rates at historic lows during the July fixing, holding the one-year loan prime rate (LPR) at 3.0% and the five-year LPR at 3.5%, in line with market expectations. The decision reflects the central bank’s cautious approach amid growing signs of a slowdown in economic momentum, pressured by a confluence of external and domestic headwinds, including sweeping U.S. tariffs, tepid domestic demand, and an ongoing downturn in the property sector.

China’s economic momentum showed signs of strain at the start of 3Q 2025, as the S&P Global China General Manufacturing PMI slipped to 49.5 in July from 50.4 in June, falling below market expectations of 50.4. The contraction was driven by a slowdown in new business growth, prompting manufacturers to scale back production, indicating weakening industrial demand following a relatively strong first half of the year. On the inflation front, consumer prices rose marginally by 0.1% y/y in June (May: -0.1%), marking an end to four consecutive months of deflation. This modest rebound in CPI reflects early signs of effectiveness from Beijing’s fiscal and monetary stimulus aimed at reviving domestic consumption. Meanwhile, China’s external sector remained resilient, with exports accelerating by 5.8% y/y in June (May: +4.8%), supported by front-loaded demand from global buyers ahead of an anticipated round of U.S. tariff hikes in August. While short-term trade dynamics remain favorable, softening factory activity and muted domestic demand signal persistent structural challenges in sustaining growth in the second half of the year.

Strategy for the month

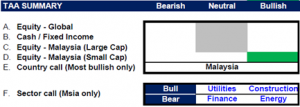

We remain neutral on global equities, as policy-driven uncertainty under US President Donald Trump continues to weigh on investors sentiments. However, we remain constructive on Asia Pacific ex-Japan equities, particularly in North Asia, supported by a weaker US dollar and a more dovish Federal Reserve. Potential easing by the Fed would give Asian central banks greater flexibility to lower interest rates, which in turn could provide further support to regional market sentiment.

We continue to prefer Malaysia, as it remains a laggard this year compared to other markets. While the MSCI Asia Pacific ex-Japan Index is now trading at 52-week highs amid renewed optimism, and both the U.S. and European markets are performing well, we see value in positioning in laggards like Malaysia that have yet to catch up. We maintain a neutral view on large-cap stocks due to balanced risk-reward and have shifted to bullish on small-caps as the recent market correction has created selective buying opportunities.

Sector-wise for the next six months, we are bullish on the Utilities and Construction sectors, supported by strong policy tailwinds and rising investment momentum. Key initiatives such as the New Industrial Master Plan 2030, the National Semiconductor Strategy, and the Johor-Singapore Special Economic Zone are expected to spur infrastructure development and energy demand. In addition, the upcoming National Investment Incentives Framework and the next phase of multi-pronged reforms under the 13th Malaysia Plan will further reinforce investment flows. For Construction, we see positive spillovers from rising capex in infrastructure, industrial parks, and data centre developments. Meanwhile, the Utilities sector is well-positioned to benefit from structural demand growth driven by the National Energy Transition Roadmap (NETR) and the accelerating shift towards clean and sustainable energy.

For Financials, the recent OPR cut may result in a 1–2% impact on overall earnings, as net interest margins (NIMs) are expected to temporarily compress. However, NIMs should begin to normalise in the coming quarter as the downward repricing of deposit rates takes effect. That said, the sector remains supported by attractive dividend yields and continued interest from institutional investors. We maintain an underweight view on the Energy sector due to its cyclical nature, which makes earnings more volatile. Nonetheless, energy companies with diversified business models are likely to be more resilient and less affected by these cyclical pressures.

Exhibit 2: PCM’s monthly strategy snapshot

Source: PCM, 31 July 2025

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.