Global markets have remained weak throughout October, dented by concerns about higher interest rate, with the 10-year U.S. Treasury yield briefly exceeding 5% after 16 years. Investors remain cautious due to concerns about the global economy and geopolitical tensions, particularly the possibility of the Israel-Hamas conflict escalating and causing supply disruptions in the broader Middle East and beyond.

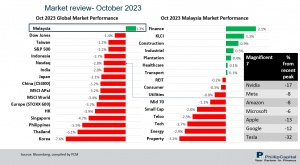

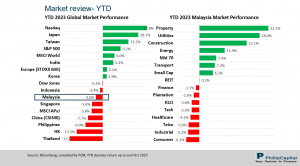

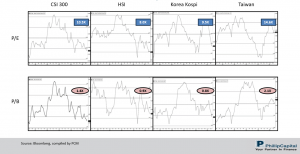

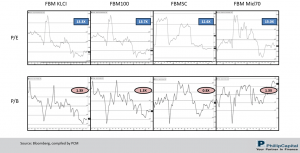

The MSCI Asia Pacific Ex-Japan Index lost -3.2% in October, mirroring the MSCI World Index which declined -3.4%. Malaysia (+1.3%) led the index, being the only gainer as investors digest the recent Budget 2024 speech. South Korea was the worst performer (-7.6%) despite economic growth beating estimates and exports rising for the first time since a year ago. Thailand (-6.1%) also fared poorly as the Finance Ministry cut its 2023 economic growth forecast to 2.7% from 3.5% earlier. Philippines (-5.5%) mired by persistent inflation, resumed monetary policy tightening as the policy rate was raised by 25bps to 6.5% (see Exhibit 1).

Exhibit 1: Oct 2023 & YTD 2023 Market Performance

The US economy’s strength (strong Q3 GDP) and continued tight labour markets would mean rates will stay higher for longer, while the slowdown in China’s economic indicators could create a ripple effect that impacts other parts of the world. China’s economy showed some signs of recovery in August, September and October as China rolled out stimulus measures to counter a slowdown, though factory activity unexpectedly shrunk in October. Our base case is a soft landing for the US and moderate growth recovery for China towards end-2023 supported by policy stimulus. Separately, we expect the monetary policies are likely to stay accommodative while more expansionary policies to be in place in order to bolster the Chinese economy.

Back home, The Budget 2024 aligns allocations and incentives with Malaysia Madani, 12MP-MTR, NIMP 2030, and NETR, benefiting sectors like Construction, Utilities, Renewables (Solar & EV), Tech, E&E, Chemical, and Tourism. Fiscal outlook could also improve with the passing the of the Fiscal Responsibility Act which could enhance investor’s confidence, ending years of uncertain policies. A noteworthy initiative is the fuel subsidy rationalisation, underscoring the government’s dedication to sustainable growth. These bold, albeit non-populist, measures enhance the government credibility, signalling a steadfast commitment to its long-term economic plans.

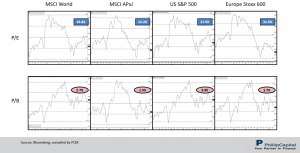

Despite declining global valuations in October (see Exhibit 2), we remain cautiously optimistic about stocks, especially in China, where robust stimulus measures support attractive valuations. In Malaysia, large-cap stocks present opportunities, while small-cap stocks are gaining appeal. All in, we favour the Construction sector due to Budget 2024, rollout of infrastructure projects, and the National Energy Transition Roadmap. We hold a selective optimistic view on specific companies within the Industrial sector that will benefit from trade diversion and the ongoing recovery narrative. Conversely, the Telco sector faces challenges due to intense competition, and the Consumer sector’s outlook dims due to an increase in the Sales and Services Tax (SST) to 8% and the introduction of a 5–10% luxury goods tax in Budget 2024.

Exhibit 2: Global market valuations have experienced a correction (selected markets)

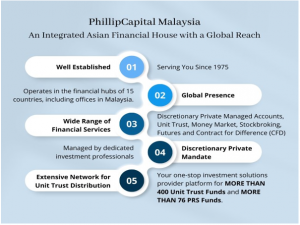

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

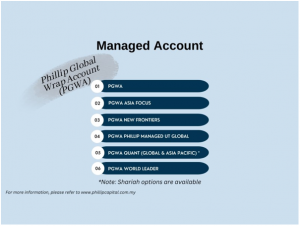

Phillip Capital Malaysia offers a comprehensive suite of financial services including managed accounts and unit trusts, that may suit your investment preferences and financial goals. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.