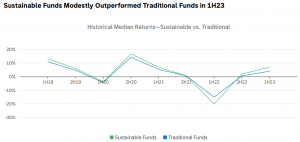

In Morgan Stanley’s most recent report “Sustainable Reality“, it is highlighted that during the first half of 2023, sustainable funds returned to their historical trend of surpassing traditional funds in performance after some underperformance in 2022 (see Figure 1). Specifically, sustainable funds recorded a robust growth of 6.9%, while traditional funds lagged behind at 3.8%. The relatively stable market conditions this year, when compared to 2022, worked in favour of sustainable funds, and it appears that sustainable funds are maintaining their stability and serving as a reliable source of patient capital for investors who have their sights set on longer-term investment horizons.

Figure 1: Sustainable Funds Return to Outperforming Traditional Funds

Source: Morgan Stanley Institute for Sustainable Investing analysis of Morningstar data

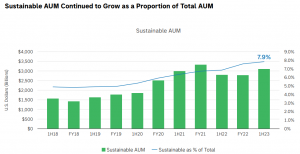

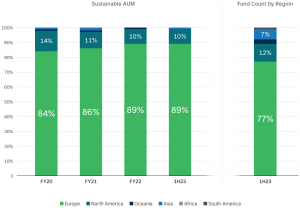

Another noteworthy takeaway is that the assets under management (AUM) of sustainable funds continued to expand, reaching over $3.1 trillion globally as of June 2023, compared to $2.8 trillion at the end of 2022 and represents approximately 8% of the total AUM (see Figure 2). However, Asia is still in the early stages of its sustainability journey. Europe remains the leading region in terms of sustainable assets under management (AUM) and the number of sustainable funds, outperforming other global regions. Europe accounts for a substantial 89% of the total sustainable AUM, whereas North America contributes 10%, and all other regions combined make up less than 2%. In terms of fund count, Europe houses more than three-quarters of the world’s sustainable funds, followed by North America at 12%, and Asia at 7% (see Figure 3).

Figure 2: Investor Demand for Sustainable Funds Remains Strong

Source: Morgan Stanley Institute for Sustainable Investing analysis of Morningstar data

Figure 3: Europe Far Outpaces Other Regions in Number of Sustainable Funds

Source: Morgan Stanley Institute for Sustainable Investing analysis of Morningstar data

Back home, as of August 1, 2023, there are a total of 38 Unit Trust Sustainable and Responsible Investment (SRI) Funds and 31 Wholesale SRI Funds. Following a substantial wave of new fund launches in 2022, the pace of activity has eased, with only 5 Unit Trust SRI Funds introduced in the current year. Nevertheless, we hold the view that investors (individuals, corporates and institutions) are increasingly expressing interest in sustainable investment which will continue to support the demand for investments with strong credentials and products. To accomplish these objectives, collaboration and support are required from a diverse range of stakeholders, such as government-linked investment firms, asset management entities, corporations, small and medium-sized enterprises (SMEs), as well as regulatory bodies.

Phillip Capital Management Sdn Bhd (PCM)’s role in ESG

In line with the nation’s goal towards sustainability, PCM has integrated ESG factors that we attest as material and relevant for a company’s financial performance and long-term sustainability into our investment decision-making process. These include but not limited to ESG ratings by established index, environmental considerations (climate change, natural resources preservation, pollution & waste), social considerations (health & safety, community engagement, employee relations) and governance considerations (board independence, transparency & disclosure, shareholder rights).

Separately, PCM offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies.

To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link. We like these companies because they have received high ESG ratings, which we believe can contribute to their long-term sustainability, responsibility, and profitability.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.