As global markets transition into 2026, investors face a landscape driven by valuations, technology, and regional shifts. While volatility is likely to persist, earnings growth, emerging market tailwinds, and income-generating assets continue to offer compelling opportunities. Our base case is a moderately constructive outlook for 2026, led by artificial intelligence (AI) innovation and supported by potential interest rate cuts and targeted fiscal policies. Against this backdrop, we have identified five key investment themes for 2026, each closely aligned with macroeconomic and policy developments.

Theme One: Earnings: The Key Driver of Market Returns

The first theme is that equity valuations in most global markets are no longer inexpensive. In developed markets, robust gains in large-cap growth and technology stocks have pushed valuations to premiums above their long-term averages. By contrast, many ASEAN markets excluding Singapore continue to trade at more attractive valuations, with price-to-earnings multiples generally below their 10-year historical averages, reflecting under-positioning by investors, particularly foreign funds. Nevertheless, despite elevated global valuations, earnings growth is expected to remain supportive of equities in 2026. Moreover, in Malaysia, valuation discounts in the small- and mid-cap segments, together with improving earnings prospects, suggest that small-cap stocks may have scope to play catch-up, alongside the resilience seen in large-cap stocks.

Table 1: Valuations and Earnings Growth Across Markets

| Country | Index | 2026 P/E (x) | 10Y Avg P/E (x) | Prem/Disc | Earnings Growth (%) | |

| 2025 | 2026 | |||||

| DM | MSCI World | 20.20 | 17.31 | 17% | 10.14% | 12.43% |

| EM | MSCI EM | 13.29 | 12.10 | 10% | 11.61% | 17.97% |

| Asia Pac | MSCI Asia Pac | 15.23 | 14.00 | 9% | 5.30% | 14.66% |

| APxJ | MSCI APxJ | 14.60 | 13.48 | 8% | 8.90% | 17.40% |

| ASEAN | MSCI ASEAN | 14.56 | 14.56 | 0% | -4.88% | 9.64% |

| US | S&P 500 | 22.27 | 18.84 | 18% | 14.20% | 13.64% |

| Nasdaq | 28.32 | 26.00 | 9% | 18.31% | 29.85% | |

| Mag7 (UBXXMAG7) | 29.35 | 29.35 | 0% | 35.29% | 20.43% | |

| Europe | Stoxx 50 | 15.85 | 13.94 | 14% | -4.27% | 9.51% |

| Japan | Topix | 16.34 | 14.72 | 11% | 7.01% | 10.13% |

| China | CSI 300 | 14.45 | 12.41 | 16% | 12.51% | 14.58% |

| HK | HSI | 11.32 | 10.45 | 8% | -2.39% | 9.92% |

| HSTECH | 19.27 | 23.37 | -18% | -11.94% | 34.86% | |

| India | NIFTY 50 | 20.25 | 18.45 | 10% | 15.68% | 5.49% |

| Korea | KOSPI | 10.12 | 10.25 | -1% | 39.21% | 43.98% |

| Taiwan | TAIEX | 17.13 | 14.66 | 17% | 25.67% | 23.57% |

| Malaysia | KLCI | 14.69 | 14.98 | -2% | -3.43% | 7.13% |

| FBM EMAS | 14.39 | 15.01 | -4% | -7.87% | 9.85% | |

| FBMSC | 10.40 | 11.50 | -10% | 22.84% | 21.50% | |

| Indonesia | JCI | 13.35 | 15.00 | -11% | 24.49% | 21.34% |

| Thailand | SET | 13.10 | 15.24 | -14% | -6.04% | 7.11% |

| Singapore | STI | 14.19 | 12.57 | 13% | -1.68% | 7.94% |

| Philippines | PCOMP | 8.96 | 14.63 | -39% | 14.02% | 8.59% |

| Vietnam | VNI | 10.32 | 12.43 | -17% | 28.30% | 48.11% |

Source: PCM, Bloomberg, 30 December 2025

Theme Two: Robust Tech Growth: Volatility Warrants Caution

The second theme focuses on technology, with artificial intelligence (AI) as a major long-term growth driver. In simple terms, AI can help companies work more efficiently and boost profits, supported by ongoing investment, especially in the United States. Although spending on AI has already grown a lot, it still makes up only a small part of the overall economy compared with past big technology shifts like electricity or telecommunications. However, investors need to be aware of the risks, including the possibility of disappointing earnings from big tech companies or broader market shocks that could slow growth. Overall, technology especially AI remains a key engine for long-term growth, providing both exciting opportunities and challenges for investors in 2026.

Theme Three: Emerging Markets (EM): Structural Tailwinds

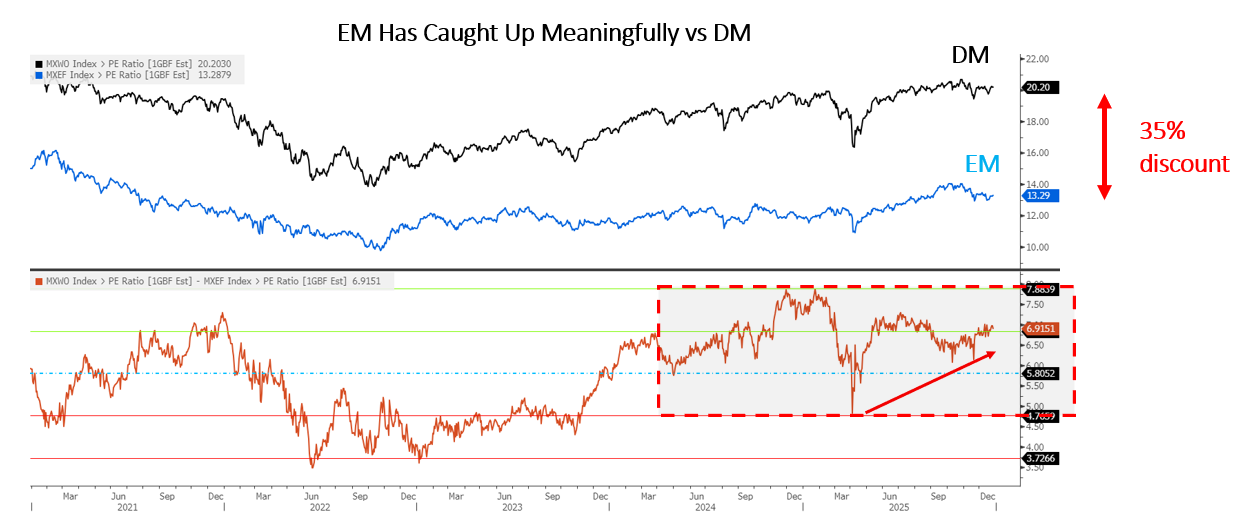

The third theme highlights the valuation gap between Developed Markets (DM) and Emerging Markets (EM), which remains appealing for investors. In simple terms, EM stocks are still trading at a significant discount to DM about 35% cheaper based on price-to-earnings ratios even though they have risen somewhat in recent years. Despite the gap narrowing, EM markets continue to benefit from strong tailwinds. These include AI-driven growth in technology-heavy economies like China, Taiwan, and Korea, ongoing government spending in large EM countries such as China and India, and easier financial conditions thanks to a weaker U.S. dollar and potential interest rate cuts. Additionally, changes in domestic markets, especially in electronics, automotive, and semiconductor sectors, are helping EM economies grow. Overall, these factors make EM equities attractive, offering reasonable valuations, recovery potential, and strong growth themes heading into 2026, making them a key part of a diversified portfolio.

Figure 1: EM is trading at a huge discount vs DM

Source: PCM, Bloomberg, 30 December 2025

Theme Four: Malaysia: A Forgotten Dividend Haven

The fourth theme highlights Malaysia as a high-yield market in a low-yield global environment. With a dividend yield of around 4%, the KLCI outperforms both developed and emerging markets, which average about 2%. Coupled with a higher dividend payout ratio of roughly 60%, this positions Malaysia as a dividend haven. Looking ahead to 2026, Malaysia’s economy is expected to grow moderately, supported by private consumption, government spending, moderate inflation, and a stable job market. Corporate earnings are also projected to recover after a slow 2025, with analysts expecting mid-single-digit growth and the KLCI trading in a higher range as confidence improves. In addition, thematic opportunities like the renewable energy transition, expansion of data centres, digital and industrial transformation, and strong domestic demand from initiatives such as Visit Malaysia 2026 could drive further growth. Institutional support, through programs like GEAR-uP, which aims for large domestic investments and long-term value creation, adds another layer of strength. Overall, Malaysia offers a compelling mix of stability, policy support, and earnings recovery, making it a core market to consider in 2026.

Theme Five: Diversification Through Alternatives

The fifth theme focuses on diversifying through alternative assets. In simple terms, when markets are expensive and volatility remains high, spreading investments beyond traditional stocks and bonds becomes even more important. Gold is a well-known hedge, helping protect portfolios against economic uncertainty, inflation, and geopolitical risks. Private credit offers steady income, attractive risk-adjusted returns, and low correlation with public markets, making it a useful complement to traditional investments. By including both gold and private credit, investors can make their portfolios more resilient, reduce overall volatility, and improve returns adjusted for risk in 2026. However, private credit is typically accessible only to accredited investors, due to higher risk, complexity, illiquidity, and regulatory restrictions.

Final Thoughts

The investment landscape in 2026 will be defined by durable earnings, technological innovation, emerging market tailwinds, income opportunities, and disciplined diversification. Investors who stay selective, focus on valuations, and maintain a diversified approach will be best positioned to navigate the year ahead successfully.

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer

The information contained herein does not constitute an offer, invitation, or solicitation to invest in any product or service offered by Phillip Capital Management Sdn Bhd (“PCM”). No part of this document may be reproduced or circulated without prior written consent from PCM. This is not a unit trust or collective investment scheme and is not an obligation of, deposit in, or guaranteed by PCM. All investments carry risks, including the potential loss of principal.

Performance figures presented may reflect model portfolios and may differ from actual client accounts’ performance. Variations in individual clients’ portfolios against model portfolios and between one client’s portfolio to another can arise due to multiple factors, including (but not limited to) higher relative brokerage costs for smaller portfolios, timing of capital injections or withdrawals, timing of purchases and sales, and mandate change (e.g., Shariah vs. conventional). These differences may impact overall performance.

Past performance is not necessarily indicative of future returns. The value of investments may rise or fall, and returns are not guaranteed. PCM has not considered your investment objectives, financial situation, or particular needs. You are advised to consult a licensed financial adviser before making any investment decisions.

While all reasonable care has been taken to ensure the accuracy and completeness of the information contained herein, no representation or warranty is made, and no liability is accepted for any loss arising directly or indirectly from reliance on this material. This publication has not been reviewed by the Securities Commission Malaysia.