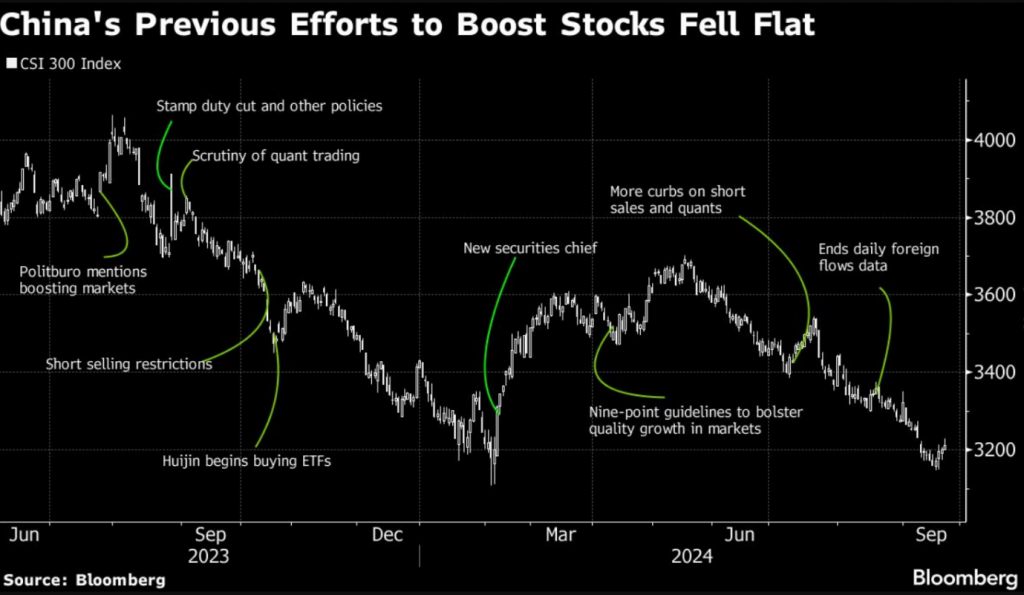

Chinese equities performed well until May this year, but then experienced a sharp correction due to weaker-than-expected economic growth, low consumption, challenges in the property market, disappointing PMI figures, and high youth unemployment, all of which have dampened market sentiment. Since the beginning of the year, Chinese policymakers have been actively implementing various measures, including state-owned funds buying and initiatives to encourage spending, particularly in real estate. While these efforts have provided some support, they have not been sufficient to fully stabilise the market (see Exhibit 1).

Figure 1: China’s Previous Efforts to Boost Stocks Fell Flat

Source: Bloomberg, Sep 2024

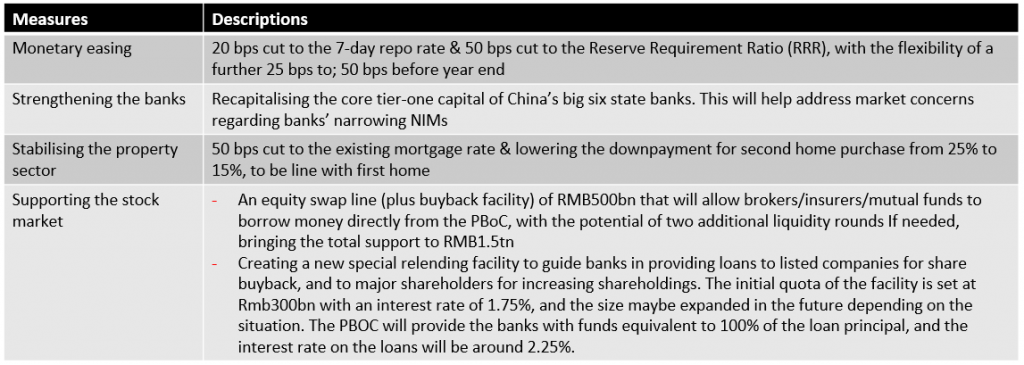

The situation changed rapidly with the announcement of a policy package aimed at boosting growth. On September 24, 2024, the State Council held a press conference attended by key officials, including Pan Gongsheng, Governor of the People’s Bank of China (PBOC); Li Yunze, Director of the National Financial Regulatory Administration (NFRA); and Wu Qing, Chairman of the China Securities Regulatory Commission (CSRC) (see Exhibit 2).

Figure 2: Policy Package announced on September 24, 2024

Source: Press, compiled by PCM, Sep 2024

Then, on September 26, 2024, China conducted an unscheduled Politburo meeting to discuss economic policies, chaired by President Xi Jinping. Historically, such meetings are typically held only in April, July, and December. This meeting took place just two days after the government announced a significant policy package that included a cut in policy rates, a reduction in the reserve requirement ratio (RRR), a decrease in the down payment ratio for second homes, adjustments to existing mortgage interest rates, and the introduction of two new tools aimed at directly supporting the stock market. The meeting focused on implementing existing and new policies to enhance economic effectiveness. Key strategies include adjusting monetary and fiscal measures, stabilizing the property market, boosting capital markets, promoting consumption, and prioritizing employment for vulnerable groups.

With that, China and Hong Kong equities saw a substantial rally last week, with the Hang Seng Index and Shanghai Composite Index both rising 17% in September. As a result, the Hang Seng Index has become the top-performing market year-to-date in September 2024, up 24%, while the Shanghai Composite Index has also turned positive for the year with a 12% gain. China’s policy announcements on September 24 and 26, 2024, represent a significant shift in the country’s approach to policymaking. First, the wealth effect from stocks and property has now gained the attention of policymakers. Second, there is a clear intention to stimulate consumption through direct subsidies, aimed at addressing insufficient domestic demand and the structural imbalances between supply and demand that have contributed to disinflationary pressures.

While the policy shift will enhance China’s growth outlook, the country must still tackle structural issues through both substantial fiscal measures and reforms. For a more sustained recovery, we believe policymakers need to actively leverage fiscal policies and implement strategies to purchase excess housing inventory more decisively. We anticipate the next policy window will occur during the National People’s Congress in late October 2024. Looking ahead to 2025, the most significant downside risk would come from a major increase in US tariffs on Chinese exports. Additionally, the possibility of a US recession poses a threat, as it would reduce global demand and negatively impact China’s exports. Despite the recent market rally, valuations remain at the lower end of historical averages. The CSI 300 Index is currently trading at a 2024 P/E of 12.32x, roughly in line with its 5-year average, but the price-to-book ratio stands at 1.49x, which is one standard deviation below the 5-year mean. Similarly, the HSI Index appears appealing, trading at a 2024 P/E of 9.38x, half a standard deviation below its 5-year average, while its price-to-book ratio is close to the average level (see attached chart).

Clients interested in gaining exposure to China may want to consider PMART UT and Managed UT. We also offer Phillip Focus China Fund, Phillip Asiapac Income Fund and Phillip Global Stars Fund that offer investors exposure to HK/China market. Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.