In the rapidly evolving landscape of corporate sustainability, Diversity, Equity, and Inclusion (DEI) has emerged as a crucial element of the Environmental, Social, and Governance (ESG) framework. DEI primarily falls under the “Social” pillar of ESG, which evaluates a company’s relationships with its employees, customers, and the wider community. While environmental issues often dominate ESG discussions, the social aspects—particularly DEI—have proven to be equally significant in assessing a company’s long-term resilience and societal impact.

What is Diversity, Equity and Inclusion (DEI)?

Diversity refers to the presence of a wide range of differences within a company, particularly in relation to race, gender, age, ethnicity, sexual orientation, and ability. A diverse workforce is reflective of the society in which a company operates and demonstrates a commitment to equal representation.

Equity focuses on ensuring fairness within the company, recognizing that different groups have different needs and may require varying levels of support to achieve similar outcomes. Equity aims to level the playing field, ensuring that all employees have equal access to opportunities, growth, and resources, irrespective of their background.

Inclusion involves creating a work environment where all individuals feel valued, respected, and able to fully contribute to the company. It goes beyond merely having a diverse workforce, emphasizing the importance of integrating diverse perspectives into company operations and decision-making.

The Role of DEI in ESG Strategy

In recent years, the role of DEI in corporate ESG strategy has gained considerable attention. Investors, regulators, and other stakeholders increasingly view DEI as a reflection of strong corporate governance and risk management. Companies with a diverse and inclusive workforce tend to be more innovative, resilient, and capable of achieving sustainable growth. On the other hand, a failure to address DEI risks can lead to reputational damage, regulatory scrutiny, and financial penalties.

Why DEI Matters for Businesses and Investors

Numerous studies have shown that diversity enhances creativity, innovation, and problem-solving within teams, hence improve the workforce productivity. Diverse teams bring together different perspectives, experiences, and ideas, which can lead to more robust and innovative solutions. Companies that prioritize DEI are often more agile in adapting to changes in the market, as they draw on a broader range of insights. A LinkedIn study found that companies with dedicated DEI teams are 22% more likely to be recognized as “industry leaders” with “high-caliber” talent. These organizations are also 12% more likely to be viewed as inclusive workplaces for individuals from diverse backgrounds. Similarly, a 2020 study by global consulting firm McKinsey & Company highlighted that the most diverse companies are now more likely than ever to outperform their less diverse counterparts in terms of profitability.

In addition, companies that demonstrate a genuine commitment to DEI often enjoy stronger relationships with stakeholders like employees, customers, and the communities they serve. A focus on DEI can enhance employee engagement and retention, as workers are more likely to stay with a company that promotes fair treatment and equal opportunity. Similarly, customers are increasingly favoring brands that reflect their own values, including diversity and inclusion. In contrast, companies that fail to prioritize DEI may face reputational damage, negative media coverage, or even consumer boycotts. Social media amplifies the visibility of corporate actions, making it easier for consumers to hold companies accountable for their DEI policies—or lack thereof.

Companies that neglect DEI expose themselves to a variety of risks, including legal and regulatory challenges. Discrimination lawsuits, allegations of unfair labor practices, and non-compliance with diversity regulations can result in substantial financial losses and reputational harm. Moreover, companies with homogeneous leadership teams may be more vulnerable to groupthink, which can limit their ability to identify and respond to emerging risks and opportunities.

Conversely, companies that invest in DEI initiatives create a more resilient and adaptable workforce. A diverse range of perspectives enhances a company’s ability to anticipate and mitigate risks, making DEI a critical aspect of long-term risk management.

DEI in Malaysia

DEI is becoming increasingly vital on a global scale, but frameworks that work in one country may not be directly applicable in another. For instance, Malaysia’s unique ethnic and cultural diversity requires tailored DEI strategies that reflect its specific social and historical context.

The CEO Action Network (CAN) launched Malaysia’s first diversity, equity, and inclusion (DEI) implementation guide on 15th May 2024, addressing the country’s unique ethnic, cultural, and social diversity. Unlike Western-centric DEI frameworks, this guide is tailored to Malaysia’s specific challenges, including Bumiputera considerations, racial discrimination, disability inclusion, and an aging population. It aims to help businesses integrate DEI principles effectively, improve performance, and attract talent. CAN emphasizes that corporate leaders must go beyond internal policies to make a broader societal impact. The guide marks the beginning of deeper DEI integration into Malaysian corporate strategies.

Conclusion

Diversity, Equity, and Inclusion are essential components of a robust ESG strategy. Companies that prioritize DEI are better positioned to attract and retain top talent, foster innovation, and build stronger relationships with stakeholders. As investors and regulators place increasing emphasis on social sustainability, companies that fail to address DEI risk falling behind in the race toward long-term success.

Identify investment opportunities – Phillip Managed Account for Retirement (PMART) and Phillip Managed Account (PMA) ESG

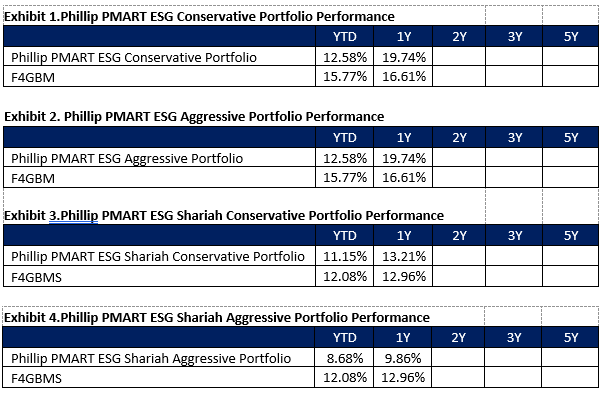

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies. Exhibit 1 & 2 shows the performance for PMART ESG Conventional and Shariah respectively.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.