The “Swiftonomics” effect refers to the economic impact generated by Taylor Swift, highlighting her ability to catalyze economic benefits for local communities through specific actions such as her world tour “The Eras Tour”.

Taylor Swift is currently in her six concerts for “The Eras Tour” in Singapore, all of which have sold out. It has has been revealed that the Singapore Tourism Board (STB) awarded a grant to Taylor Swift in exchange for the exclusive rights to her concert series in Southeast Asia. While the exact amount and terms are undisclosed, Thai Prime Minister Srettha Thavisin has sparked attention by suggesting that an offer ranging from US$2 million to US$3 million was made for each show.

So, what are the ripple effects that a global tour by a megastar like Taylor Swift would trigger?

According to economists, it is estimated that Taylor Swift’s series of six concerts could generate as much as S$500 million (US$371 million) in tourism revenue for Singapore. According to the data from travel platform Trip.com, Singapore-related bookings from March 1 to 9, coinciding with the concert dates, have surged by 275% compared to the figures for March 15 to 23, a comparable nine-day span two weeks afterward. During the concert period of March 1 to 9, bookings for inbound flights to Singapore saw an increase of 186%, while hotel reservations experienced a remarkable jump of 462% compared to the March 15 to 23 period.

As for Taylor Swift’s four-day tour in Japan that concluded in early Feb, it is estimated that the economic impact will generate tourism revenue surpassing ¥34.1 billion (US$230 million), encompassing ticket sales, merchandise revenue, and tourist expenditures.

How does tourism contribute to the economic growth of a country?

- Job Creation

Tourism significantly boosts job creation across various sectors, directly employing individuals in hospitality, travel services, transportation, and entertainment. Indirectly, it supports jobs in the supply chain, retail, as well as food and beverage industries due to increased demand from tourists. Tourism also encourages entrepreneurship and innovation, leading to new business ventures. Additionally, it fosters skill development and offers diverse employment opportunities, from customer service to management roles. Overall, the tourism industry not only provides direct employment opportunities but also stimulates broader economic activity, making it a key driver of job creation and economic development.

- Catalyst for Local Economy

Tourism acts as a catalyst for the local economy by injecting foreign spending directly into various sectors, thereby stimulating economic activity. When tourists visit a destination, they spend on accommodation, dining, attractions, and shopping, which directly benefits hotels, restaurants, and local businesses. This influx of spending leads to the multiplier effect, where increased demand generates more jobs and further economic activity beyond the tourism sector, such as in construction, agriculture, and transportation. Additionally, successful tourism can attract investment in infrastructure and services, enhancing the quality of life for residents and making the destination more attractive for future visitors.

- Infrastructure Development

Tourism drives infrastructure development in a country by necessitating improved transportation systems, including airports, roads, and public transit, to accommodate visitors. It also spurs the construction of hotels, resorts, and recreational facilities, enhancing the area’s attractiveness. Moreover, the demand for better water, sanitation, and telecommunications services increases, leading to advancements in these essential utilities. This development not only serves tourists but also significantly improves the quality of life for local residents, ensuring that the benefits of tourism extend beyond the sector, contributing to the overall socio-economic development of the country.

- Increased Tax Revenue

Tourism boosts tax revenues by increasing consumption and business income within the host country. Tourists spending on hotels, restaurants, and attractions contribute to sales tax collections. Moreover, tourism-related businesses pay taxes on their profits. Additionally, some destinations impose specific tourist taxes, for example, Malaysia has imposed tourism tax of RM10 per room per night on hotel accommodation for the foreign passport holder. This expanded tax base results in higher government revenues, which can be reinvested in public services and infrastructure, enhancing the destination’s appeal and benefiting the local economy and residents alike.

Considering the significance of tourism revenue to a country’s economy, how is Malaysia’s tourism sector performing so far?

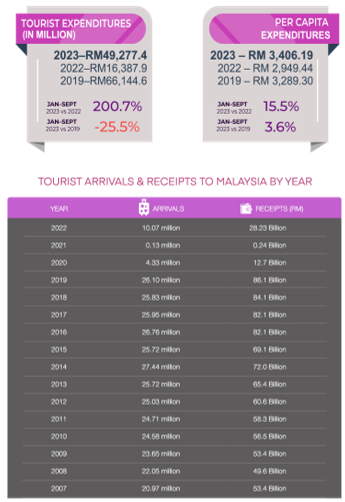

The Ministry of Tourism’s data indicates that Malaysia welcomed 14.4 million tourists between January and September 2023, marking a 160.40% increase year-over-year compared to the same period in 2022. This number is just shy of the tourist arrivals seen in the pre-pandemic year of 2019 (see Exhibit 1). Given the surge in tourist arrivals, the government has revised tourism target to 19.1 million by year-end 2023, up from the initially set target of 16.1 million. Considering Malaysian government’s decision to relax visa entry requirements for several countries including China and India, achieving the revised target appears to be highly probable.

Exhibit 1. Malaysia Tourism highlights January – September 2023

Source: Ministry of Tourism

We have also seen healthy improvement in tourist expenditures that amounted to RM49.2Billion as of September 2023. This represents a 200% year-over-year increase compared to 2022, though it is still 25.5% below the figures from 2019. On a positive note, per capita expenditures among tourists rose by 15.5% compared to 2022 and by 3.6% in relation to 2019, indicating an increase in tourist-generated revenue (see Exhibit 2).

Exhibit 2. Tourist expenditures data January – September 2023

Source: Ministry of Tourism

We are cautiously optimistic that Malaysia’s tourist arrivals would be back to the pre-pandemic level and achieve the target set for 2024 (27.3 million tourist arrival and RM102.7 billion receipts). This is bolstered by the easing of visa requirements for visitors from India and China. Furthermore, the weak Ringgit may also be a potential driver for international tourists to select Malaysia as their travel destination.

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

PMART/PMA Dividend Enhanced

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors.

Click here to learn more

PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.