The global market has been rattled by geopolitical tension, Ukraine-Russian War, economic policy shifts, including the return of tariffs under Trump’s policies. These factors contribute to market volatility, making it crucial for investors to rebalance their investment portfolio.

During periods of market volatility, investors often seek strategies to preserve capital and maintain returns. One of the effective ways to mitigate volatility is through dividend investing. Historically, dividend-paying stocks have shown resilience during economic downturns by providing steady income even when stock prices decline. By focusing on stocks that pay consistent dividends, investors can enjoy regular cash flows even when share prices fluctuate.

Why Dividend Investing Matters in a Volatile Market?

- Steady Income Despite Market Fluctuations

Unlike growth stocks, which rely primarily on capital appreciation, dividend stocks provide regular income in the form of dividend payouts. This is especially valuable during volatile markets, where price swings can erode portfolio value. Even if stock prices decline, investors continue to receive dividends, helping them sustain cash flow and returns.

For example, during the COVID-19 market crash in 2020, companies like Malayan Banking Berhad (Maybank) and Tenaga Nasional Berhad (TNB) continued paying dividends, ensuring shareholders received income despite overall market weakness.

- Downside Protection

Regular dividend payments act as a financial cushion, helping to offset potential capital losses during bear markets. While share prices may fall, the dividend yield increases relative to the lower stock price, making these stocks more attractive to income-seeking investors. This increased demand can help support the stock price, reducing overall volatility.

Additionally, dividends provide an opportunity for reinvestment. Investors can use dividends to buy more shares at lower prices during a market downturn, which can accelerate wealth accumulation when the market recovers.

- Investor Confidence and Strong Financial Health

Companies that consistently pay dividends—even during economic crises—demonstrate financial strength and stability. This reassures investors that the company has robust cash flows, a healthy balance sheet, and strong profitability.

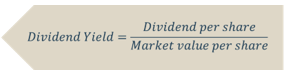

Understanding Dividend Yield

Dividend yield is a key metric in dividend investing, calculated as:

A higher dividend yield indicates a greater return on investment, but investors should also consider sustainability and growth potential.

Top Dividend Stocks in Malaysia for Stability

Several Malaysian companies have a strong track record of paying dividends, making them reliable choices when the market is under pressure.

- Malayan Banking Berhad (Maybank)

- Sector: Banking

- Average Dividend Yield: 6 – 7% p.a.

- Why It Matters: Maybank’s strong capital position and stable earnings make it a solid choice during market downturns.

- RHB Bank Berhad

- Sector: Banking

- Average Dividend Yield: 5 – 6% p.a.

- Why It Matters: Strong financials and dividend consistency make RHB Bank a defensive play in turbulent markets.

- Sunway REIT

- Sector: Property

- Average Dividend Yield: 4 – 6% p.a.

- Why It Matters: REITs are required to distribute at least 90% of their net income as dividends, offering attractive yields even in uncertain markets.

- KLCCP Stapled Group

- Sector: Property

- Dividend Yield: 2024 – 4 – 6% p.a.

- Why It Matters: REITs are required to distribute at least 90% of their net income as dividends, offering attractive yields even in uncertain markets.

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more.

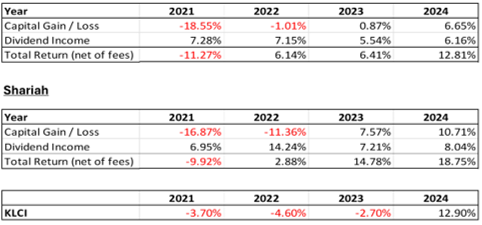

Source: PCM, Typical account, 31st Dec 2024

The table above illustrates the capital gains/losses and dividend income of our Dividend Enhanced Mandate. In strong market years, investors can benefit from both dividend payouts and potential share price appreciation. During weaker periods, dividends serve as a buffer, helping to offset market downturns and provide a more stable return.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice