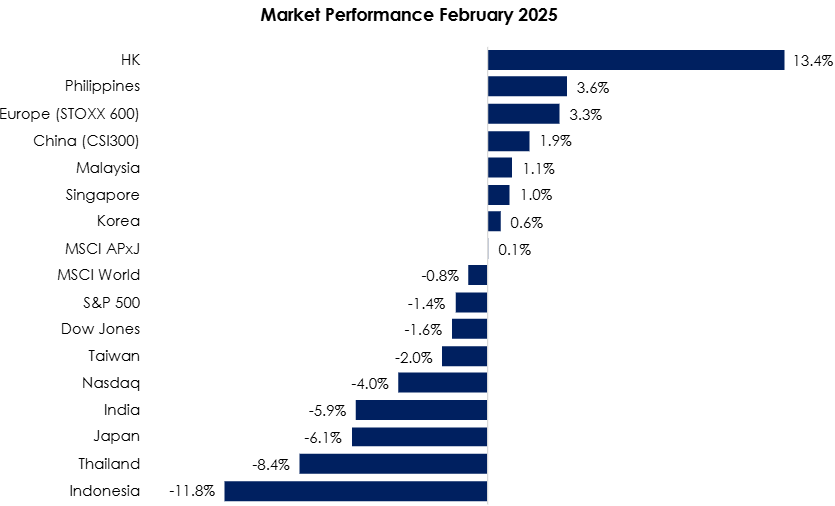

Both the MSCI Asia Pacific Ex-Japan Index (0.1%) and MSCI World Index (-0.8%) remained flat mom as global markets were largely mixed in February. Hong Kong (+13.4%) and China (+1.9%) enjoyed a huge rally on the back of DeepSeek, a Chinese AI language model, reigniting massive interest towards China Tech. Philippines (+3.6%) finally broke out of its 4-month back-to-back decline thanks to strong earnings results for its local banks as well as an MSCI rebalancing boost. On the other hand, Indonesia (-11.8%) suffered a massive market selloff as President Prabowo’s radical austerity measures rattled investors’ nerves. In the same vein, Thailand (-8.4%) faced eroding investor sentiment as increase competition and structural issues threaten its once vibrant industrial scene, prompting the Bank of Thailand to cut its policy rate to 2%. In contrast, Japan (-6.1%) equities saw a significant decline despite better-than-expected economic growth at 2.8% for 4Q24 and stable inflation around the target level of 2% (see Exhibit 1).

Exhibit 1: Market Performance February 2025

Source: Bloomberg, PCM, 28 February 2025

On the monetary policy front, the Bank of England (BOE) reduced its rate from 4.75% to 4.50%. Meanwhile, in Asia, the Bank of Korea (BOK) decreased its interest rates from 3.00% to 2.75%. The Reserve Bank of India (RBI) cut its key interest rate from 6.50% to 6.25%, for the first time in nearly five years. Finally, the People’s Bank of China held the medium-term lending facility rate at 2.0% and left the 1-year and 5-year loan prime rates unchanged at 3.1% and 3.6%, respectively.

Back home, the FBMKLCI gained 1.1% mom after a weak start this year, closing at 1,574.70. In contrast, the Small Cap Index fell by 6.6%, while the Mid 70 Index decreased by 5.4%. Sector-wise in February, the top performing sectors were Plantation, Finance, and Construction, up 3.6%, 2.5%, and 1.5%, respectively. The worst performing sectors were Technology, Healthcare, and Energy, which saw sharp declines of 13.1%, 10.5% and 8.4%, respectively. Foreign investors continued to be net sellers for the fifth consecutive month in February, recording net sell flows of RM2.2bn, with outflows totaling RM13.1bn over the past five months. Separately, in February, there were five listings on the ACE Market (Northern Solar Holdings Bhd, Colform Group Bhd, Richtech Digital Bhd, Techstore Bhd, and ES Sunlogy Bhd).

Equity Market Outlook & Investment Strategy

Malaysia

The Malaysian market remained weak throughout the month, with mid and small-cap stocks lagging behind large-cap stocks. The results season was mixed, with sectors like oil & gas, technology, healthcare, rubber products, consumer, and auto underperforming, while plantations, transport, property, and basic materials exceeded expectations. Positive earnings revisions were seen in REITs, plantation, banking, and property. Valuation remains attractive with the KLCI trading at 13.8x P/E, 1 standard deviation below its 10-year mean. FBM Emas which comprises the big, medium and small cap companies in Malaysia now trades at 13.4x P/E, 1.3 standard deviation below its 10-year mean. We remain vigilant in our stock and sector selection against increasing macro risks from trade tensions and geopolitical uncertainties.

Regional

Amid growing concerns about potential overcapacity in AI infrastructure and its effect on overall market sentiment, investors are likely to remain on the sidelines. Additionally, ongoing worries about President Trump’s tariff plans and measures to limit investments between the US and China will continue to weigh on global trade and economic growth, dampening risk appetite. As global markets grapple with heightened uncertainty, we emphasize the importance of diversification and a focus on quality amid volatility.

Fixed Income Outlook & Strategy

Malaysia

Looking ahead, we forecast a moderation in GDP growth to 4.9% in 2025. Risks to the outlook remain skewed to the downside, primarily due to heightened global uncertainties, including the potential for a renewed trade war that could disrupt global supply chains and reduce external demand. Nonetheless, we remain optimistic that Malaysia’s robust domestic demand will continue to provide a solid foundation for economic growth in 2025. We maintain our view that BNM will keep OPR rate at 3.0% in 2025. We overweight corporate bonds over MGS/GII due to higher yield.

Regional

In February 2025, the 10-year UST yield tumbled to 4.25%, shedding 42bps from its mid-month peak, as markets reacted to a mix of tariff escalations, fiscal tightening risks, and weaker economic data. US personal spending unexpectedly declined, despite rising incomes, while PCE inflation eased (headline: 2.5% yoy, core: 2.6% yoy), reinforcing expectations of two Fed rate cuts in 2025. Adding to market jitters, President Trump imposed 25% tariffs on Europe, Mexico, and Canada, stoking fears of slowed economic activity, while his commitment to balancing the budget amid a 7% fiscal deficit to GDP raised concerns over aggressive government spending cuts, accelerating the downward pressure on Treasury yields.

Bank of Japan (BOJ) Deputy Governor Shinichi Uchida reaffirmed the central bank’s commitment to tapering bond purchases, undeterred by rising yields, while emphasizing that underlying inflation is steadily approaching the 2% target, strengthening expectations for further rate hikes in 2025. Meanwhile, fresh data showed that Tokyo core inflation, a key leading indicator of national price trends, eased to 2.2% in February (Jan: 2.5%) but remained above the BOJ target for the fourth consecutive month, signaling persistent inflationary pressures that could justify a continued shift away from Japan’s ultra-loose monetary policy.

The People’s Bank of China (PBoC) held its key lending rates steady for the fourth consecutive month in February, in line with market expectations, as policymakers navigated yuan volatility and mounting trade tensions spurred by US President Donald Trump’s tariff policies. The one-year loan prime rate (LPR) remained at 3.1%, while the five-year LPR, a key benchmark for mortgages, stayed at 3.6%, both at record lows following cuts in July and October 2024. Despite maintaining current rates, the PBoC signaled flexibility, stating it would adjust interest rates and the reserve requirement ratio as needed to support China’s sluggish economy. Meanwhile, Beijing reaffirmed its commitment to a proactive fiscal policy, building on its September 2024 stimulus package to bolster growth amid ongoing economic headwinds.

Strategy for the month

We are neutral on global equities as geopolitical risks and weak economic data continue to influence market sentiment. Many sell-side brokers now believe that tariffs have increased the likelihood of a U.S. recession. As a result, the MSCI World Index has experienced a correction and is now trading close to its historical average with a P/E ratio of 18.4x, while the S&P 500 stands at 20.1x, also near its historical mean. On a separate note, we are becoming more optimistic about China. During the first week of March, officials set a 5% GDP growth target, 2% CPI, and 5.5% unemployment rate for 2025. Policies include increased government bond issuance, credit expansion, fiscal deficit rise to 4%, and support for innovation, households, and the property market.

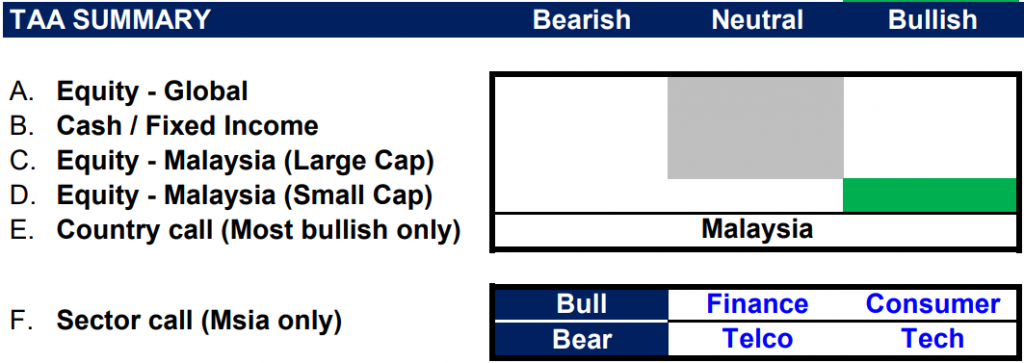

Our Tactical Asset Allocation for the month indicates a preference for the Malaysian market, which has experienced a larger decline compared to others in the recent market correction, presenting a value opportunity. We maintain a neutral stance on large-cap stocks while continuing to favour selected small-cap stocks which have declined more than the large caps. Sector-wise, we prefer defensive sectors such as Financials and Consumer. The Financials sector, especially, is a liquid proxy to market performance, benefiting if investor sentiment improves. On the other hand, we turned negative on Technology due to the growing uncertainty around trade and industry policy changes under the new US administration, as well as the muted demand recovery for consumer electronics and automotive, both of which could lead to downside risks for sector earnings. Lastly, we maintain an underweight stance on the Telco sector.

Exhibit 2: PCM’s monthly strategy snapshot

Source: PCM, 28 February 2025

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

TAA_Presentation_Deck_March_13.3.2025.pdf

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.