Farewell, 2023, and Greetings to 2024!

In 2023, notable events unfolded, such as the Regional Banking Crisis in March and the subsequent suspension of the US Debt Ceiling in late May/early June. In China, substantial growth challenges, particularly in the property sector, emerged, marked by Country Garden’s missed coupon payment. This prompted significant government stimulus in Q3 and Q4, including an additional RMB 1 trillion bond issuance. Toward the year’s end, the US 10-year Treasury reached a 16-year high, and the Israel-Hamas Conflict contributed to global market weakness. However, the Federal Reserve’s less hawkish tone in November/December resulted in a shift toward positive market sentiment.

We all know markets hate uncertainty and thrive on clarity. A clearer understanding of the future direction may provide additional room for a rally. However, five notable factors are believed to shape the outlook for 2024.

First and foremost, are we in a new regime of higher global real rates?

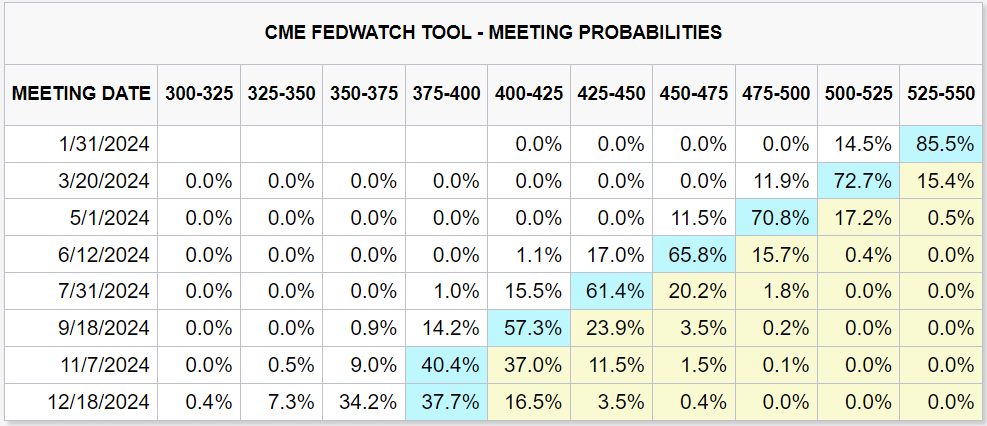

We think fears of dramatically higher real rates are overdone and we are near the end of the tightening cycle. The interest rate futures market is currently anticipating a potential rate cut as early as March 2024.

Source: CME Fedwatch Tool, 27 December 2023

Nevertheless, if developed markets (DM) continue to adopt a “higher for longer” interest rate regime, It could present a variety of challenges to emerging market (EM) assets, including reduced capital inflows, currency depreciation, and higher debt-servicing burdens for EM nations.

Secondly, are there still geopolitical threats?

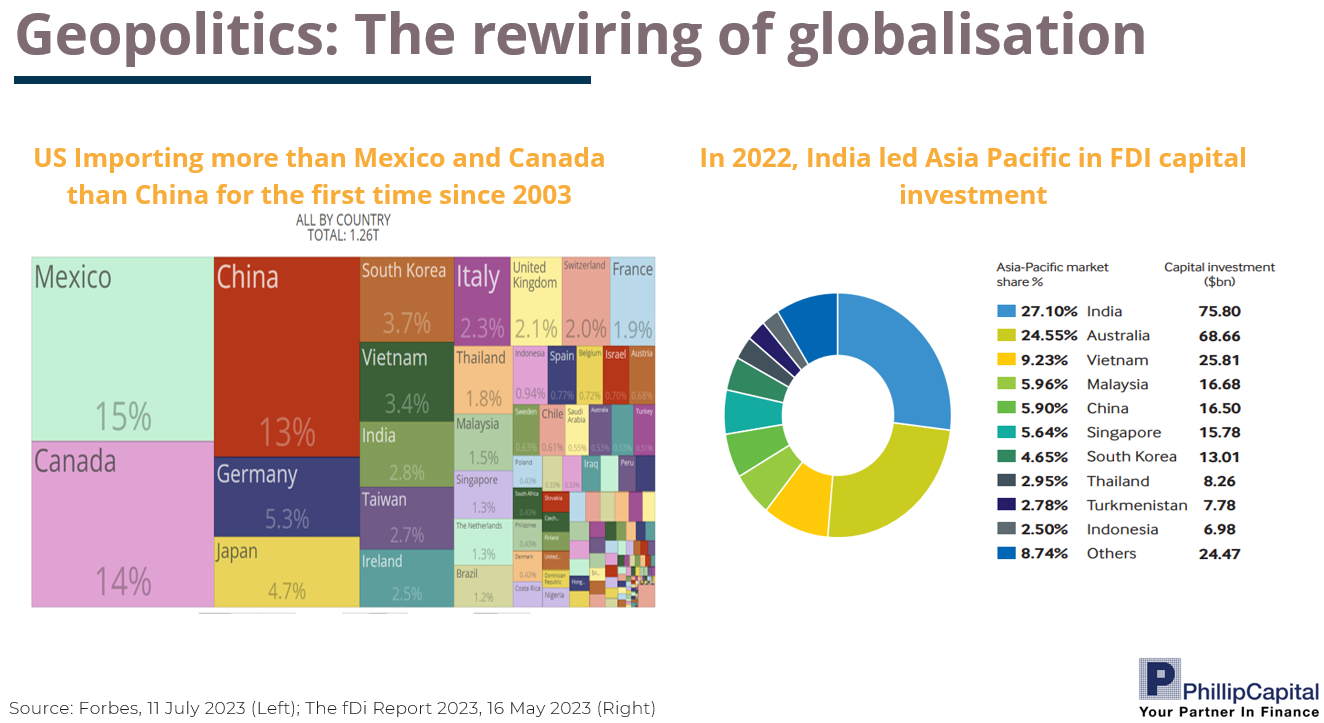

Since the onset of US-China trade war, China is losing US import share, with Vietnam and Mexico emerging as key manufacturing hubs through “friend-shoring” and “near-shoring. Deglobalisation and onshoring are reshaping the global manufacturing landscape while India had also received influx of FDI in the recent years.

Separately, geopolitical risks, including the Middle East conflict and Taiwan’s election, introduce uncertainties in 2024. Finally, the potential return of President Trump post-2024 could heighten international tensions, trade tariffs, and fiscal concerns, complicating global markets.

Thirdly, what to do with Global Tech and Artificial Intelligence (AI)?

If it weren’t for the outstanding performance of the tech sector this year, the S&P would be showing little to no growth. Some analysts argue margins could face additional downward pressure next year as inflation falls, wages remain high, and interest expense resurges. However, a steep acceleration in TECH+ profits should offset this broader weakness. AI is playing an important role in innovation and efficiency, as it matures into a general-purpose technology, AI’s impact on productivity could be relatively swift from here given its broad business applicability and low complementary investments needs. Yet, the true scale of economic payoffs will be shaped by its interplay with labour markets dynamics and demographic challenges.

Fourthly, can we escape a global slowdown?

The answer remains uncertain, as the market is acknowledging certain potential risks, including declining corporate profits, low savings rates, sluggish industrial loan growth, high valuations, and lingering concerns about a recession. Valuations and risk premiums are notably high, with persistent worries about an economic downturn. On a separate note, global trade, responsible for nearly half of the growth slowdown since spring, continues to contract. About 30% of this decline is attributed to the tech sector, but there are indications of improvement, particularly in memory prices.

Finally, where is China landing?

China’s GDP has now recovered back to its pre-Covid trend. According to IMF, China was projected to grow 4.2% in 2024 in the Oct projections, but was revised to 4.6% in 2024 in Nov. The revision is attributed to China’s stronger-than-expected growth in the third quarter and a series of recently released policies. Separately, we observe a mix of economic signals, with improved retail sales and lending activities, contrasted by a slowdown in manufacturing and property sales. In the longer run, some market participants express concerns about challenges related to high debt, an aging population, and the erosion of labour cost advantages (leading to the relocation of production to lower-cost regions such as ASEAN).

All of these pose risks for 2024. At the same time, risks may also imply opportunities. We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

Phillip Capital Malaysia offers a comprehensive suite of financial services including managed accounts and unit trusts, that may suit your investment preferences and financial goals. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors.

Click here to learn more

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies.

To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link. We like these companies because they have received high ESG ratings, which we believe can contribute to their long-term sustainability, responsibility, and profitability.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Separately, for investors who would like to have regional exposure, PMART UT, is a portfolio of EPF approved unit trust funds managed by award-winning fund managers. It allows investors to invest in multiple unit trust funds through a single investment and is reviewed and adjusted regularly or as needed in response to major events. Separately, PMA UT is ideal for cash investors seeking a tailored investment solution via investment in multiple unit trust funds through a single investment. We offer both conventional and Shariah-compliant options to accommodate the preferences of all investors. We also offer both Moderate and Aggressive mandates that cater to different investors’ level of risk appetite. Separately, we also like US market where we are of the view that quality of earnings is much better, as such we have also introduced PMART Quant US for those who can take foreign currency/market volatility and single market exposure.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.