Building upon the article released last week, we are zooming into five themes that investors should closely monitor in 2024.

Theme 1: Peaking interest rates bode well with equities; Emerging markets (EM) stand to benefit the most

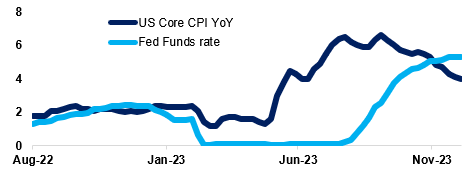

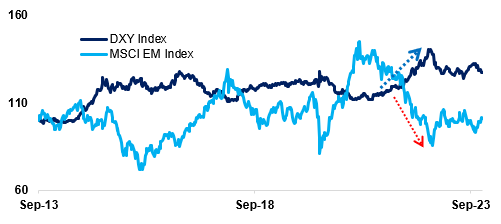

Following an extended period of aggressive tightening, we anticipate the Fed’s interest rate policy normalizing in 2024, shifting to moderation before potential rate cuts. Faster-than-expected US inflation decline (Figure 1) empowers Fed to recalibrate, averting a hard landing and creating room for easing amid a potentially challenging global growth outlook. It appears that the Fed adopts a proactive approach to encourage growth while mitigating some of the macroeconomic and geopolitical risks. The fall of interest rates expected in 2024 bode well for growth-oriented sectors and those that rely heavily on imports for production inputs. Separately, a weaker dollar eases the burden on deficit-laden governments and could potentially attract foreign inflows returning to emerging markets (Figure 2).

Figure 1: US Inflation rate and Fed Funds Rate

Source: Bloomberg, PCM

Figure 2: MSCI EM Index performance against DXY

Source: Bloomberg, PCM

Theme 2: The Dual Forces (US & China) are shaping our world

Since the creation of the People’s Republic of China in 1949, several efforts have been made to limit China’s access to or stop its development in various critical technologies, including nuclear weapons, space, satellite communication, GPS, semiconductors, supercomputers, and artificial intelligence. The US has also tried to curb China’s market dominance in 5G, commercial drones, and electric vehicles (EVs). Throughout history, unilateral or extraterritorial enforcement efforts to curtail China’s technological rise have failed. For example, since the onset of US-China tensions where US limited/banned the export of advanced artificial intelligence (AI) chips to China, Nvidia which has traditionally held a dominant position as the leading provider of AI chips in China with a market share surpassing 90%, is facing challenges. In response to these limitations, Chinese companies, including Huawei, have embarked on the development of their versions of Nvidia’s best-selling chips, such as the A100 and the H100 graphics processing units (GPU).

Another example is US car maker Tesla has lost its crown as the top maker of all-electric vehicles to Chinese firm BYD, according to sales figures released on 2nd Jan 2024. Notably, Tesla delivered 484,507 vehicles in Q4 2023, a 11% increase from the previous quarter. Despite the growth, Tesla lost its title as the world’s leading electric vehicle producer and seller to Chinese competitor BYD, which reported 9% higher sales for the same period. These numbers highlight the challenges Tesla may encounter in 2024 from competitors aiming to leverage the rising demand for electric vehicles and suggest that BYD’s strategy of price cuts is effectively capturing market share and recognition.

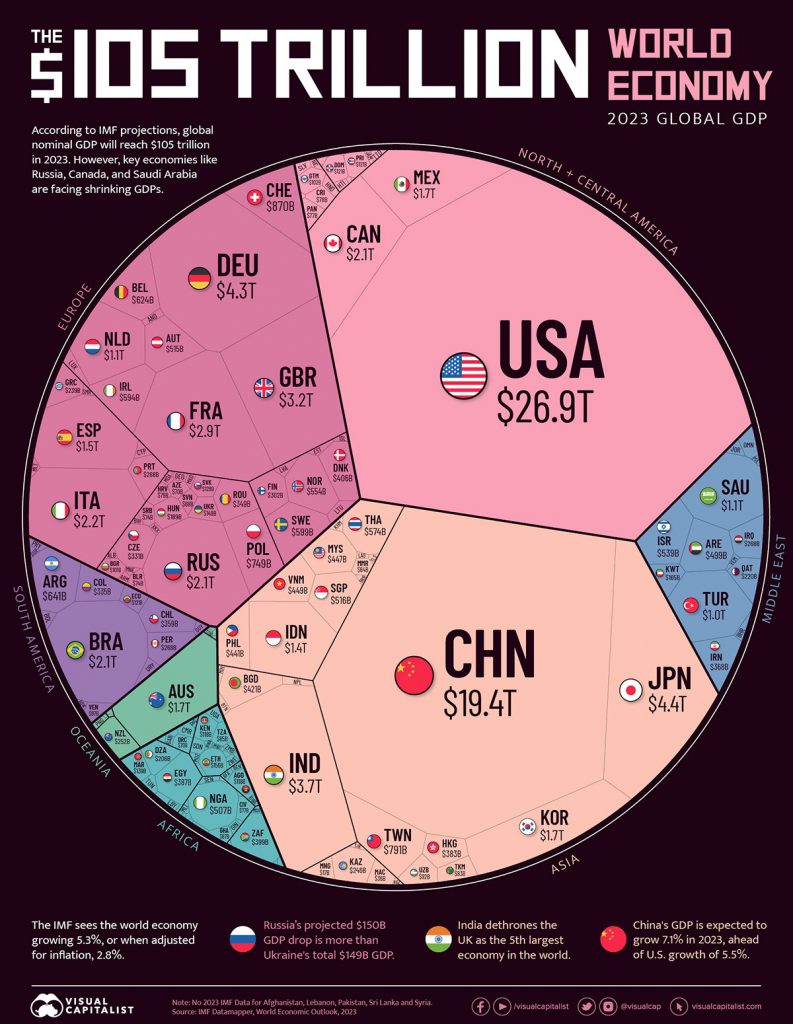

Separately, according to World Factbook, China is ahead of the US in Agriculture and Industry sector. Agriculture Output of United States is only 17.58% of China and 77.58% for the Industry sector. On the other hand, the services sector of the US is more than double of China. Finally, US is at the top in nominal GDP, whereas China is at the top in PPP GDP since 2017 after overtaking the US. As of 2021, both countries together share 41.89% and 34.75% of the entire world’s GDP in nominal and PPP terms, respectively (Figure 3). Hence, we believe it is irrational to exclude either China or US from the investment equation.

Figure 3: Visualizing the $105 Trillion World Economy in One Chart

Source: Visual Capitalist

Theme 3: A resurgence in the global tech cycle is anticipated after a sluggish period in both 2022 and 2023.

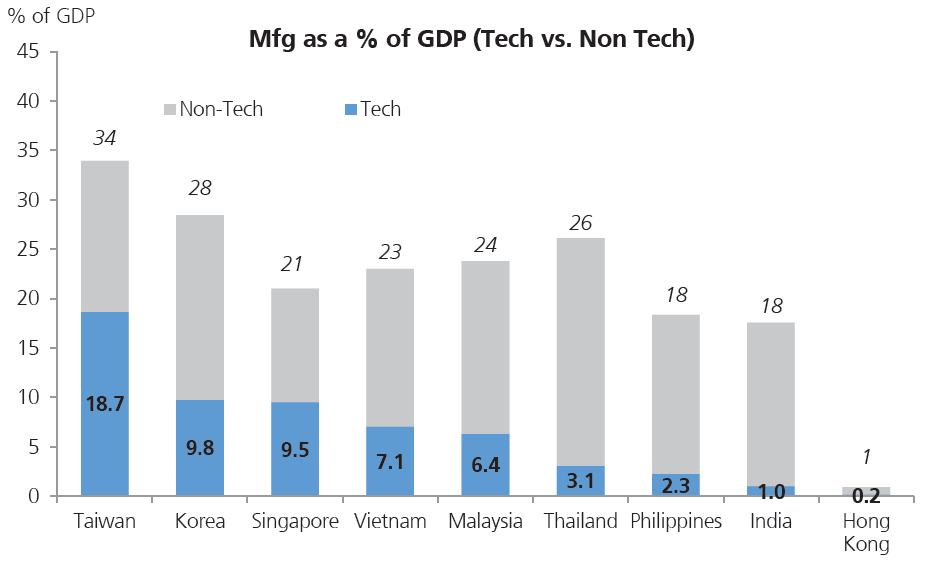

Following a decline in 2022 & 2023, we are seeing the beginning of an upturn in the global tech cycle, which should boost global trade. Specifically, the WSTS is projecting a rebound in semiconductor sales at an annual growth of 11.8% in 2024 versus a decline of 10.3% for 2023, to be driven by a broader recovery in the mainstream applications within mobile, automotive and industrials. WSTS expects a recovery in inventory replenishment, a rebound in smartphone shipments, as well as improving consumer sentiment across the board. That could benefit selected Asia Pacific markets including Korea, Taiwan or even Malaysia given the tech sector accounts for the largest share of GDP in Taiwan (19%), followed by Korea (10%), Singapore (9%), Vietnam (7%), Malaysia (6%) and Thailand (3%). Destocking pressures that weighed on growth throughout most of 2023 are likely to ease in 2024 (Figure 4).

Figure 4: Recovery in tech cycle boosts exports along the regional supply chain

Source: UBS Global Economics & Markets Outlook 2024-2025

Source: UBS Global Economics & Markets Outlook 2024-2025

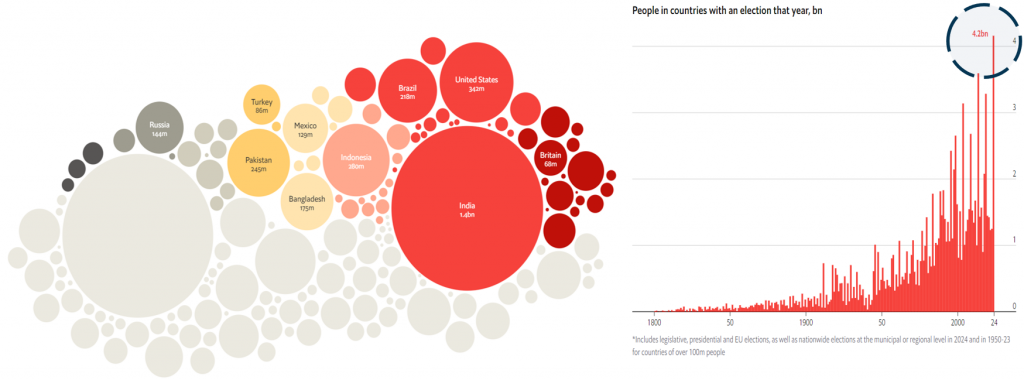

Theme 4: Pulse of Power: 40 Nations on the Edge in 2024

2024 will see some highly consequential contests where countries with more than half the world’s population (>4bn people) – will send their citizens to the poll. The electoral timeline begins in January with Taiwan, continues in February with Indonesia, and concludes with the U.S. presidential election in November. According to consensus, market-friendly outcomes are likely in India and Indonesia, and maybe less so in the UK. The status quo will persist in Russia and Iran as both countries continue their isolation from the West. Some elections will generate significant headline risks, like Taiwan and US (Figure 5).

Figure 5: 2024: A wave of elections

Source: The Economist

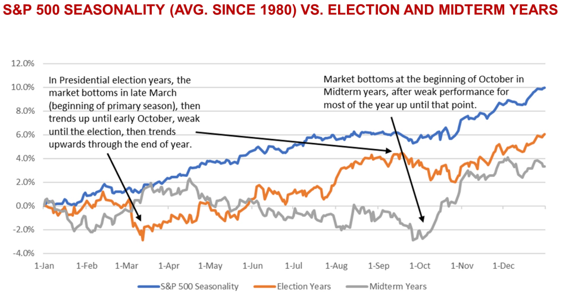

The key question is how does it affect the market. One interesting research done by Raymond James Research revealed that historical trend advises shorting in Feb, going long in April, shorting in Aug, then going long pre-election for S&P 500 gains (Figure 6). Certainly, it is important to note that past performance does not guarantee future results. We will keep a vigilant watch for any development in this space.

Figure 6: Assessing US Election Impact

Source: Raymond James Research

Theme 5: Net zero drives Renewables, EV opportunities

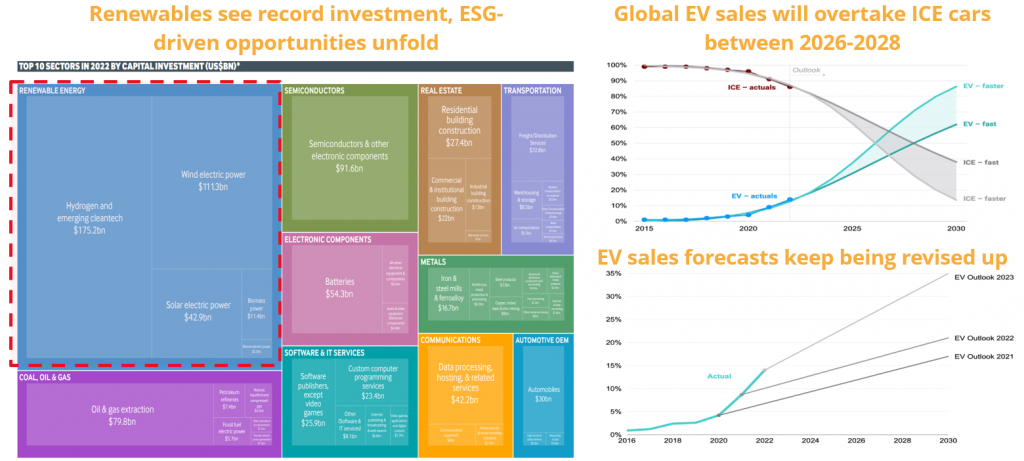

In 2022, the renewable energy sector attracted a record-high FDI of $343.6 billion across 527 projects, constituting 30% of the total. The projects cover areas in green hydrogen and wind energy, solar and biomass. In fact, according to IEA, to reach net zero emissions by 2050, annual clean energy investment worldwide will need around USD4 trillion by 2030, which translates to pockets of opportunities for investment across various sectors and industries (Figure 7 – left).

Separately, EV Sales are growing exponentially up S-curves. According to RMI, EV sales could overtake ICE sales as early as 2026. Each year forecasters revise their EV market share projections upwards, driven by declining battery costs, consumer preferences shift to EVs, and improving infrastructure. Presently, consensus centers around a 40% EV market share by 2030. And China leads a race to dominate future EV technologies (Figure 7 – right).

Figure 7: Look for the strongest industries

Source: The fDi Report 2023 (Left); RMI (Right), compiled by PCM

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

Phillip Capital Malaysia offers a comprehensive suite of financial services including managed accounts and unit trusts, that may suit your investment preferences and financial goals. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors.

Click here to learn more

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies.

To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link. We like these companies because they have received high ESG ratings, which we believe can contribute to their long-term sustainability, responsibility, and profitability.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Separately, for investors who would like to have regional exposure, PMART UT, is a portfolio of EPF approved unit trust funds managed by award-winning fund managers. It allows investors to invest in multiple unit trust funds through a single investment and is reviewed and adjusted regularly or as needed in response to major events. Separately, PMA UT is ideal for cash investors seeking a tailored investment solution via investment in multiple unit trust funds through a single investment. We offer both conventional and Shariah-compliant options to accommodate the preferences of all investors. We also offer both Moderate and Aggressive mandates that cater to different investors’ level of risk appetite. Separately, we also like US market where we are of the view that quality of earnings is much better, as such we have also introduced PMART Quant US for those who can take foreign currency/market volatility and single market exposure.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.