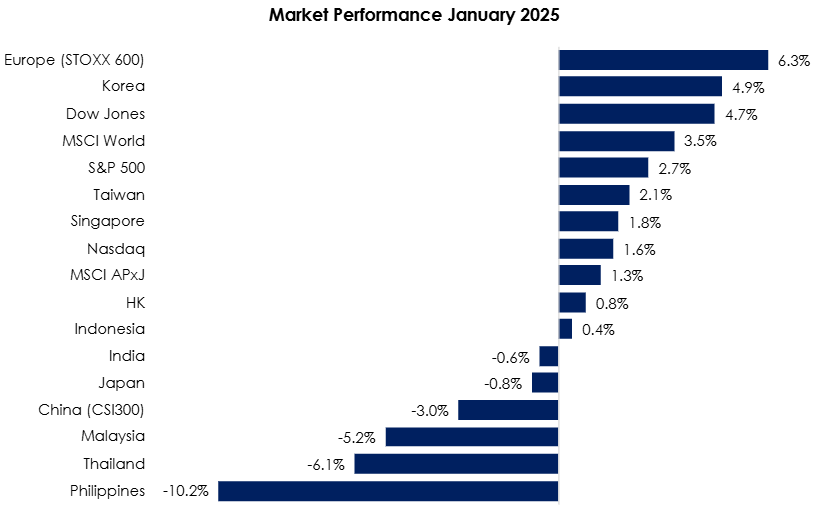

The MSCI Asia Pacific Ex-Japan Index (1.3%) trailed the MSCI World Index (3.5%) mom following the new year as developed markets such as Europe and US, retraced December pullback due to possible milder Fed Rate cut. South Korea (+4.9%) was the region top gainer, breaking its 6-month back-to-back stock market decline on the back of robust overseas demand for the nation’s manufactured goods. Taiwan (+2.1%) managed to net a handsome gain thanks to TSMC’s record quarterly top and bottom-line before closing early for Chinese New Year holidays. Meanwhile, Singapore (+1.8%) stocks jumped after the formalisation of the development of the Johor-Singapore Special Economic Zone early in the month. In contrast, Philippines (-10.2%) was Asia Pacific’s biggest loser as the tropical archipelago failed to meet government GDP growth estimates considerably, at 5.6% yoy vs estimates of 6 – 6.5%. Thailand (-6.1%) also suffered heavy losses as automobile production, a huge driver for Thailand economy, saw output decline 21% yoy due to stiff competition from China marques. On the home front, Malaysia (-5.2%) saw Data Centre-related stocks stumble after the announcement of new US AI export restrictions as well as the unveiling of innovative programming techniques from OpenAI-competitor, Deepseek, threatening the outlook for huge AI capital expenditures (see Exhibit 1).

Exhibit 1: Market Performance January 2025

Source: Bloomberg, PCM, 31 January 2025

On the monetary policy front, January saw a divergence in central bank actions. The Fed kept interest rates unchanged at 4.25-4.50%, while the European Central Bank (ECB) reduced its rate from 3.00% to 2.75%. Meanwhile, in Asia, the Bank of Japan (BOJ) increased its interest rates from 0.25% to 0.50%. Finally, the People’s Bank of China held the medium-term lending facility rate at 2.0% and left the 1-year and 5-year loan prime rates unchanged at 3.1% and 3.6%, respectively.

Back home, the year started off with the FBMKLCI declining by 5.2%, closing at 1,556.92. Similarly, the Small Cap Index fell by over 5.1%, while the Mid 70 Index saw a decrease of 6.7%. Sector-wise in January, the worst-performing sectors were Construction, Technology and Utilities, which saw losses of 13.5%, 10.5%, and 9.9%, respectively. On the other hand, REITs and Energy were the only sectors to post small gains, up 0.4% and 0.1%, respectively. Foreign investors continued to be net sellers for the fourth consecutive month in January, recording net sell flows of RM3.1bn, with outflows totaling RM10.9bn over the past four months. Separately, in January, there were three listings on the ACE Market (Swift Energy Technology Bhd, CBH Engineering Holding Bhd, and Oriental Kopi Holdings Bhd).

Equity Market Outlook & Investment Strategy

Malaysia

The Malaysian market saw weak performance in January, primarily due to profit-taking and foreign selling, particularly in AI/DC-related stocks, after news of Deepseek’s Large Language Model (LLM) performance dampened sentiment on capex investment. However, we believe that Moody’s reaffirmation of Malaysia’s sovereign credit rating at ‘A3’ – an upper-medium grade with low credit risk – highlights the country’s continued appeal as an investment destination. On a separate note, Malaysia market has never been this attractive in quite a while, with foreign shareholding hitting a record low of 19.4% in January. The KLCI now trades at 13.6x P/E, 1 standard deviation below its 10-year mean.

Regional

DeepSeek has become a key market concern in January, with its cost-efficient use of lower-tier chips challenging US tech dominance. Our analysis suggests that if this trend persists, it could reshape the global semiconductor industry. We believe it is crucial to monitor responses from major tech firms, which have committed billions to AI infrastructure, as demand for high-end AI chips may decline. Separately, after announcing a 25% tariff on imports from Canada and Mexico, President Donald Trump agreed to delay them for one month. However, the 10% tariff on China remains set to take effect from 4 February onwards. The tariffs are aimed at addressing the fentanyl crisis, protecting US industries, and negotiating better deals. We believe US Treasury yields are likely to stay elevated and the dollar is likely to strengthen amid tariffs. We favour the US over Asia-Pacific for now, as US equities are likely to benefit from tariffs and a stronger dollar. As global markets grapple with heightened uncertainty, we emphasize the importance of diversification and a focus on quality amid volatility.

Fixed Income Outlook & Strategy

Malaysia

In January, the Monetary Policy Committee (MPC) of Bank Negara Malaysia decided to maintain the Overnight Policy Rate (OPR) at 3%. The Malaysian economy, the overall growth for 2024 was within expectations. Moving forward, the strength in economic activity is expected to be sustained in 2025, driven by resilient domestic expenditure. At the current OPR level, the monetary policy stance remains supportive of the economy and is consistent with the current assessment of inflation and growth prospects. The MPC remains vigilant to ongoing developments to inform the assessment on the domestic inflation and growth outlook. The MPC will ensure that the monetary policy stance remains conducive to sustainable economic growth amid price stability.

Regional

As widely expected, the FOMC decided at its first policy meeting of 2025 to keep rates unchanged. The decision to maintain the target range for the federal funds rate at 4.25%-4.50% was universally supported by all 12 voting members of the FOMC. The decision came after three consecutive rate cuts since September 2024, totalling 100bps. It was also the first Federal Reserve meeting since Donald Trump took office, during which he swiftly expressed his desire for the central bank to lower rates.

On 24 January 2024, the Bank of Japan (BoJ) raised its key short-term interest rate by 25 basis points to 0.5%, the highest level in 17 years, in line with market consensus. The move reflected wage hike momentum and steady progress in inflation. It also marked the third rate hike since the central bank ended negative interest rates in March 2024. The central bank also indicated plans for further rate increases and reduced monetary support if economic and price data align with its forecasts. Friday’s decision passed with an 8-1 vote, as board member Nakamura dissented. Meantime, in its quarterly outlook, the BoJ lifted its forecasts for core inflation to 2.7% for FY 2024 from October’s estimates of 2.5%, citing a growing labour shortage. It projects core inflation to further moderate to 2.4% in FY 2025 and 2.0% in FY 2026. Meanwhile, the central bank slightly lowered its 2024 GDP growth forecast to 0.5% from earlier figures of 0.6%. Growth outlook remains at 1.1% for FY 2025 and 1.0% for FY 2026.

The Governing Council decided to lower the three key ECB interest rates by 25 basis points on 30 January 2025. Accordingly, the interest rates on the deposit facility, the main refinancing operations and the marginal lending facility will be decreased to 2.75%, 2.90% and 3.15% respectively, with effect from 5 February 2025.

China GDP grew by 5.0% in 2024 aligning with the government’s official target. 4Q2024 growth accelerated to 5.4% up from 4.6% in the 3Q2024 contributing to the overall annual growth of 5.0%. This marks a more moderate pace compared to the 5.2% growth seen in 2023. Stimulus measures introduced since September, including cuts to the market based benchmark lending rates, a reduction in the reserve requirement ratio for banks, and a substantial fiscal package of 10 trillion yuan to address local government debt risks have played a crucial role in supporting the economy. In response to potential new tariffs under the Trump administration, Chinese officials are reportedly planning to introduce larger fiscal stimulus packages in 2025 rolling them out in stages and carefully adjusting to the evolving US policy landscape.

Strategy for the month

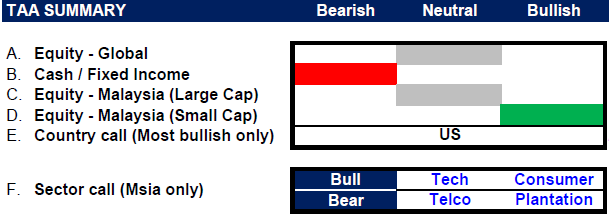

We are neutral on global equities as geopolitical risks and rising inflation concerns continue to influence market sentiment. However, with the recent ceasefire between Israel and Hamas, the outlook is somewhat more positive, offering a glimmer of stability. In terms of market positioning, we favor the U.S. over Asia-Pacific for now, as U.S. equities are likely to benefit from tariffs and a stronger dollar. As global markets grapple with heightened uncertainty, we emphasize the importance of diversification and a focus on quality amid volatility. Separately, the potential tariff hikes under the new Trump administration could negatively impact China’s economy in 2025, though valuations have priced in many risks, and investor positioning in Chinese equities remains light. The net impact ultimately depends on China’s policy response.

In Malaysia, we maintain a neutral stance on large-cap stocks while continuing to favour selected small-cap stocks. Sector-wise, we are positive on the Technology sector, with semiconductor stabilization and emerging AI opportunities. We are also optimistic about the Consumer sector, supported by civil servant salary hikes and EPF Account 3 withdrawals, which are expected to boost domestic consumption. However, we remain underweight on the Telco and Plantation sectors.

Exhibit 2: PCM’s monthly strategy snapshot

Source: PCM, 31 January 2025

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.