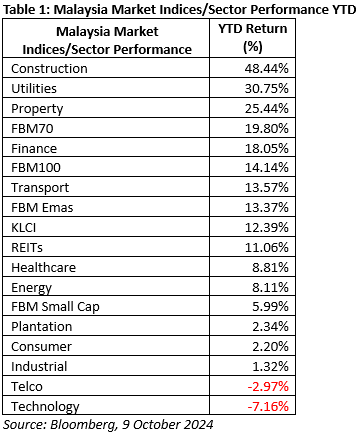

The Malaysian market has performed well year-to-date (YTD), with most indices we monitor showing positive returns. The Construction, Utilities, and Property sectors have led this growth, thanks to the implementation of masterplans and strategic initiatives like the National Energy Transition Roadmap (NETR), as well as a renewed interest in data centers that have boosted sentiment. In contrast, the Telco and Technology sectors have struggled. The Telco sector has lagged due to intense competition among mobile operators, and the merger of Celcom and Digi has yet to yield benefits. Separately, the Technology sector has been significantly impacted by the strengthening of the Ringgit, as most local technology companies generate their revenue in USD.

Another observation is that market volatility has prompted investors to shift their focus toward larger caps. This year, the KLCI (+12.39%) has outperformed small-cap stocks (+5.99%) due to a risk-off sentiment among investors, who are gravitating towards large-cap counters amid increasing foreign fund inflows. Meanwhile, the FBM 70 (+19.80%) has shown strong performance, largely driven by upswings in the construction and property sectors, supported by foreign direct investments and various growth trends. Overall, the YTD strong market performance can be attributed to a positive market sentiment fueled by ample liquidity (especially domestic amid strong GLC buying), enhanced by these foreign fund inflows following USD weakening.

Markets are eager for indications of fiscal reforms in the upcoming Budget 2025. With recent declines in oil prices and a relatively stable political climate, the unity government has a chance to push further reforms on subsidies and tax initiatives to narrow the fiscal deficit particularly through RON95 subsidy rationalization and possible reintroduction of GST (not popular, but we argue it is one of the most efficient tax systems) alongside e-invoicing implementation, in line with the Fiscal Responsibility Act’s medium-term goals to manage the economy’s deficit and debt levels sustainably. We may not be surprised that many investors will lock in realized gains for 2024, aiming to preserve returns while positioning for 2025 given the already-strong YTD performance. That said, we think Malaysia will continue to shine driven by several positive catalysts as follows:

- Strong Economic Growth. Malaysia’s full-year 2024 GDP is expected to exceed expectations, with Bloomberg Consensus projecting a growth rate of 4.9%, up from the previous estimate of 4.6%. This follows a stronger-than-anticipated 2Q 2024 GDP growth of 5.9% year-on-year, an increase from 4.2% in 1Q 2024, resulting in a growth rate of 5.1% for the first half of 2024.

- Stable Political Environment since PMX Anwar took over, with various masterplans being gradually implemented.

- Strong MYR has been the main reason in attracting foreign funds, given the US rate cut.

- Improved Domestic Liquidity, supported by increased buying from local institutions.

- Rising FDI & DDI Momentum, amid US/China-led trade tension leading supply chain shift in the semiconductor sector, as well as new structural growth drivers such as data centers (DC), Artificial Intelligence (AI) and renewable energy (RE).

- Additional Catalysts: JB-SG Special Economic Zone, the Rapid Transit System (RTS), and the possible revival of the High-Speed Rail (HSR) project with Chinese funding.

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.