The outcome of the recent U.S. presidential election is expected to have a significant impact on environmental, social, and governance (ESG) issues, with a notable retreat in federal regulations and a shift toward state and international regulations. Under President-elect Trump, policies supporting fossil fuel production are likely to be reinstated, including a potential U.S. withdrawal from the Paris Climate Accords, which would diminish the country’s role in global climate negotiations. This aligns with Trump’s “energy dominance” strategy, which favors oil, gas, and coal over renewable energy.

Trump’s administration is expected to rely heavily on executive orders to advance its agenda, including easing restrictions on fossil fuel extraction, relaxing emission standards, and rolling back environmental regulations. For example, policies on methane emissions from natural gas production and restrictions on coal-fired power plants may be reversed. Additionally, Trump’s nominee to lead the EPA, Lee Zeldin, has emphasized economic prosperity through fossil fuel development, with little focus on environmental protection.

At the state level, regulations like California’s Climate Corporate Data Accountability Act (SB253) will continue to move forward, requiring companies to report on their greenhouse gas emissions. Other states, such as New York and Illinois, could adopt similar measures. Furthermore, U.S. companies will still face international regulations, especially from the European Union, regarding climate disclosures.

In the realm of ESG investing, the new administration is expected to undo SEC climate disclosure rules, limiting ESG reporting requirements. However, many U.S. companies, particularly those with global operations, will likely continue their ESG initiatives. Investor demand, market forces, and long-term business strategies focused on sustainability will drive this continued commitment to ESG goals. Despite potential federal setbacks, global momentum toward sustainability will persist, with private sector innovation and international regulations shaping the future of ESG efforts.

Implications for Malaysia

The U.S. post-election shift under Trump 2.0 could impact Malaysia in several ways. A retreat from global climate leadership might reduce U.S.-driven ESG investments, although Malaysia’s green initiatives, like the Green Sukuk, could still attract investors. The focus on fossil fuels in the U.S. may benefit Malaysia’s energy sector in the short term through rising production. However, an oversupply of oil could drive prices down, potentially reducing Malaysia’s oil-related revenue. Malaysia may need to adapt by accelerating its renewable energy transition and capitalizing on green investments to ensure long-term sustainability.

Separately, Malaysia might need to realign its strategies for international trade and diplomacy. As the U.S. steps back from global climate leadership, Malaysia could increasingly collaborate with ASEAN countries and other global players to pursue sustainable growth, ensuring it remains competitive in green technologies and investments. Overall, while Malaysia could face some challenges from a reduced U.S. climate agenda, it also has opportunities to lead in green finance, renewable energy, and climate action to stay competitive in a changing global landscape.

Identify investment opportunities – Phillip Managed Account for Retirement (PMART) and Phillip Managed Account (PMA) ESG

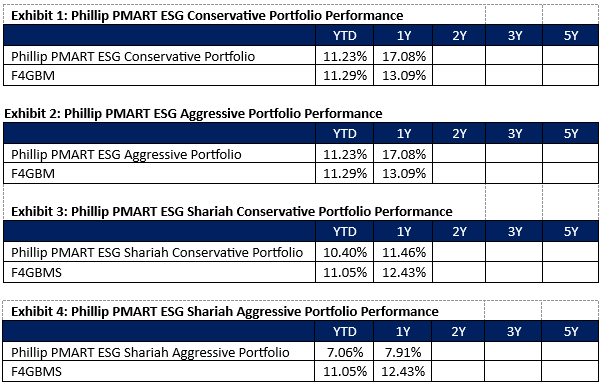

PMART and PMA ESG is a discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies. Exhibits 1-4 show the performance for PMART ESG Conventional and Shariah.

Source: PCM, 31 Oct 2024, link

Exhibits 5 & 6 provide a list of the stocks in our portfolio. The percentage composition of each stock may vary depending on whether the mandate is Conservative or Aggressive.

Exhibit 5: Stock List – ESG Conventional

| Company Name | ESG Rating |

| CTOS DIGITAL BERHAD | **** |

| DELEUM BHD | **** |

| DIALOG GROUP BHD | *** |

| GAMUDA BHD | *** |

| HARTALEGA HOLDINGS BHD | **** |

| HIBISCUS PETROLUEM BHD | *** |

| INARI AMERTRON BHD | **** |

| KELINGTON GRP BHD | **** |

| KOSSAN RUBBER INDUSTRIES BHD | *** |

| LAGENDA PROPERTIES BERHAD | *** |

| MATRIX CONCEPTS HLDGS BHD | *** |

| RCE CAPITAL BERHAD | **** |

| SHANGRILA HOTELS (M) BHD | *** |

| TELEKOM MALAYSIA BHD | *** |

Source: PCM, 30 Nov 2024, listed in alphabetical order

Exhibit 6: Stock List – ESG Shariah

| Company Name | ESG Rating |

| BANK ISLAM MALAYSIA BERHAD | *** |

| CTOS DIGITAL BERHAD | **** |

| D & O GREEN TECHNOLOGIES BHD | *** |

| DELEUM BHD | **** |

| DIALOG GROUP BHD | *** |

| GAMUDA BHD | *** |

| HARTALEGA HOLDINGS BHD | **** |

| HIBISCUS PETROLUEM BHD | *** |

| INARI AMERTRON BHD | **** |

| KELINGTON GRP BHD | **** |

| KOSSAN RUBBER INDUSTRIES BHD | *** |

| LAGENDA PROPERTIES BERHAD | *** |

| MATRIX CONCEPTS HLDGS BHD | *** |

| RCE CAPITAL BERHAD | **** |

| SHANGRILA HOTELS (M) BHD | *** |

| TELEKOM MALAYSIA BHD | *** |

Source: PCM, 30 Nov 2024, listed in alphabetical order

Recognising the increasing significance of ESG factors in investment decisions, we have introduced the Dividend Enhanced ESG Mandate in April 2024, which integrates quantitative investment methods inspired by our Dividend Enhanced strategy. This methodology involves Universe selection, Filtering, Construction, and Rebalancing. Building upon our investment strategy, we have integrated an ESG filter mandating that selected stocks meet a minimum ESG Rating of 3 Stars from the FTSE4Good Bursa Malaysia (F4GBM) Index. Exhibits 7 & 8 show the list of stocks in our Dividend Enhanced ESG mandates.

Exhibit 7: Stock List – Dividend Enhanced ESG Conventional

| Company Name | 12M Forward Dividend Yield | ESG Rating |

| GENTING MALAYSIA BHD | 7.46 | *** |

| SIME DARBY BERHAD | 6.45 | *** |

| MALAYAN BANKING BHD | 6.37 | **** |

| RHB BANK BHD | 6.21 | **** |

| BANK ISLAM MALAYSIA BHD | 6.08 | *** |

| HEINEKEN MALAYSIA BHD | 6.02 | *** |

| AXIS REAL ESTATE INVESTMENT | 5.73 | *** |

| MISC BHD | 5.04 | **** |

| PETRONAS DAGANGAN BHD | 4.62 | *** |

| AXIATA GROUP BERHAD | 4.47 | *** |

| PETRONAS GAS BHD | 4.34 | **** |

| WESTPORTS HOLDINGS BHD | 4.30 | **** |

| CELCOMDIGI BHD | 4.22 | **** |

| TELEKOM MALAYSIA BHD | 3.75 | *** |

| TENAGA NASIONAL BHD | 3.74 | *** |

| AVERAGE YIELD | 5.25 |

Source: PCM, 30 Nov 2024, sorted by 12M Forward Dividend Yield

Exhibit 8: Stock List – Dividend Enhanced ESG Shariah

| Company Name | 12M Forward Dividend Yield | ESG Rating |

| BERMAZ AUTO BHD | 10.02 | **** |

| SIME DARBY BERHAD | 6.45 | *** |

| BANK ISLAM MALAYSIA BHD | 6.08 | *** |

| AXIS REAL ESTATE INVESTMENT | 5.73 | *** |

| MISC BHD | 5.04 | **** |

| PETRONAS DAGANGAN BHD | 4.62 | *** |

| SYARIKAT TAKAFUL MALAYSIA KE | 4.50 | *** |

| RCE CAPITAL BHD | 4.48 | **** |

| AXIATA GROUP BERHAD | 4.47 | *** |

| MATRIX CONCEPTS HOLDINGS BHD | 4.34 | *** |

| PETRONAS GAS BHD | 4.34 | **** |

| WESTPORTS HOLDINGS BHD | 4.30 | **** |

| CELCOMDIGI BHD | 4.22 | **** |

| TELEKOM MALAYSIA BHD | 3.75 | *** |

| TENAGA NASIONAL BHD | 3.74 | *** |

| AVERAGE YIELD | 5.07 |

Source: PCM, 30 Nov 2024, sorted by 12M Forward Dividend Yield

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.