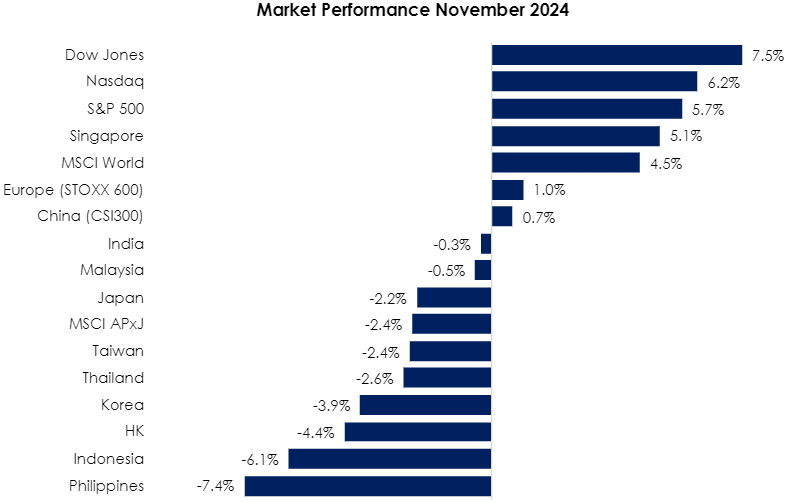

The MSCI Asia Pacific Ex-Japan Index (-2.4%) fell behind the MSCI World Index (+4.5%) mom in November as US markets raced past all regions after President-elect Donald Trump’s decisive win in the 2024 presidential elections. Singapore (+5.1%) was the top performing region in Asia Pacific thanks to GDP growing much faster than expected in 3Q24 at 5.4% yoy vs. the Ministry of Trade and Industry’s projection of 4.1%. The only other winner in Asia Pacific is China but with a paltry gain of +0.7%, a slight recovery after last month’s pullback on stimulus concerns. Philippines (-7.4%) plummeted as devastating typhoons caused severe agricultural damage and threatens economic stagnation for 4Q and onwards. Indonesia (-6.1%) also stumbled as the market pulled back from its August rally, likely due to investors’ geographic rotation to developed market equities. HK (-4.4%) also caught the flu in the market as internet, auto and energy stocks suffered high single digit declines, signalling weakening consumer sentiment (see Exhibit 1).

Exhibit 1: Market Performance November 2024

Source: Bloomberg, PCM, 30 November 2024

On the monetary policy front, the Bank of England cut interest rates from 5.00% to 4.75%, marking the second reduction of 2024. The Fed also lowered its benchmark rate by 0.25% to a range of 4.50% to 4.75%, the lowest level since March 2023. The People’s Bank of China maintained the medium-term lending facility rate at 2.0% and kept the 1-year and 5-year loan prime rates unchanged at 3.1% and 3.6%, respectively.

Back home, the FBMKLCI fell by 0.5% mom in November, closing at 1,594.29. Conversely, the Small Cap Index gained 2.0%, and the Mid 70 Index increased by 1.5%. Sector-wise, the top performers were Healthcare, Plantation, and Utilities, with gained of 5.3%, 3.8% and 3.6% mom, respectively. Laggards were Telco, Energy and Industrials, which declined by 3.1%, 2.8% and 2.2%, respectively. In terms of fund flow, foreign investors continued to be net sellers in November, recording net sell flows of RM3.1bn. This turned cumulative foreign flows to a net outflow position of RM1.3bn for the first eleven months of 2024. Separately, there were three listings on the Main Market (Mega Fortis Bhd, Azam Jaya Bhd, and Life Water Bhd) and three listings on the ACE Market (3Ren Bhd, Metro Healthcare Bhd, and Supreme Consolidated Resources Bhd) in November.

Locally, we remain focused on the technology and industrial sectors, as Malaysia stands to benefit from the US’s planned tariff increases on Chinese imports such as semiconductors, batteries, solar cells and critical minerals. This is expected to attract multinational companies seeking alternative investment destinations, while the strong USD should further boost sector earnings.

Strategy for the month

Trump’s 2024 trade policies are expected to mirror his “America First” approach, aiming to reduce the US trade deficit, protect American jobs, and challenge perceived unfair trade practices, particularly with China. Proposed measures include blanket import duties and a 60% tariff on Chinese goods, likely provoking retaliatory tariffs and raising import costs. This could lead to higher prices for US consumers and reduced demand, slowing global trade. In contrast, Malaysia has benefitted from the US-China trade war, with re-exports growing and foreign direct investment (FDI) surging, especially in sectors like electronics, semiconductors, and green technology. Our outlook on global equities remains cautiously optimistic. We favour US equities due to strong corporate earnings and positive economic data. Trump’s proposed corporate tax cut to 15% could further enhance earnings potential for US companies, providing additional support to the market. As we approach the tail end of 2024, we anticipate continued market volatility. In this environment, we are maintaining a cautious approach to sector and theme selection, particularly in areas where valuations appear stretched relative to fundamentals.

In terms of market positioning, our preference in order is: US (strong earnings, positive economic data, proposed tax cuts) > Malaysia (policy). Following the election, we have become more optimistic about the US market, as corporate earnings remain strong and economic data continues to show positive trends. Furthermore, Trump’s proposal to lower the corporate tax rate to 15% could improve earnings potential for US companies.

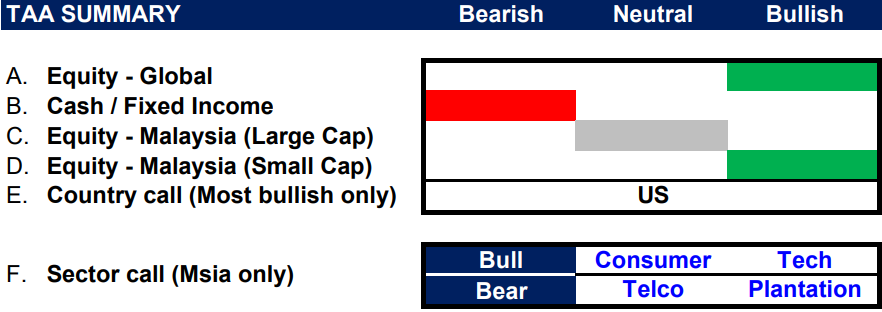

In Malaysia, we have turned neutral on large-cap stocks but continue to favour selected small-cap stocks. Sector-wise, we are optimistic about the Consumer sector, driven by pension hikes and EPF Account 3 withdrawals, which are expected to stimulate domestic consumption, and the Technology sector as semiconductor stabilization and AI opportunities emerge. Conversely, we continue to hold our underweight stance in Telco and Plantation sector (see Exhibit 2).

We became less optimistic about Asia Pacific ex-Japan after Trump’s win due to concerns that his trade policies, particularly the “America First” stance, would disrupt trade flows and economic relations in the region. Separately, the potential tariff hikes under the new Trump administration could negatively impact China‘s economy in 2025, though valuations have priced in many risks, and investor positioning in Chinese equities remains light. The net impact ultimately depends on China’s policy response.

Exhibit 2: PCM’s monthly strategy snapshot

Source: PCM, 30 November 2024

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

TAA_Presentation_Deck_Dec-13.12.2024

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.