Green bonds are debt instruments issued by governments, municipalities, or corporations to fund projects that have a positive environmental impact. These projects typically focus on sustainability and climate change mitigation, such as renewable energy, clean transportation, energy efficiency, and climate-resilient infrastructure. The essential feature of green bonds is that their proceeds must be used exclusively for these environmentally-focused initiatives.

The appeal of green bonds lies in their ability to attract investors seeking to align their financial goals with sustainability objectives. Green bonds offer market-competitive returns while supporting projects that address urgent environmental challenges. As demand for sustainable investments continues to rise, green bonds have become a popular way to finance climate-related projects without sacrificing financial returns. For issuers, green bonds provide access to capital dedicated to green initiatives, which can improve their reputation as sustainability leaders, potentially lower borrowing costs, and lead to favorable market positioning—especially when governments offer tax breaks or favorable interest rates.

However, challenges remain. Ensuring that the funds raised through green bonds are used as intended requires strict transparency and verification processes to avoid “greenwashing” — misleading claims about the environmental benefits of projects. Additionally, measuring the actual environmental impact of these projects can be complex, requiring standardized metrics and robust data.

Malaysia has positioned itself as a leader in green financing, achieving significant milestones in sustainable investment. In 2017, Malaysia made history by issuing the world’s first green SRI sukuk to fund large-scale solar photovoltaic power plants in Kudat, Sabah, setting a global precedent for green sukuk. Building on this success, the Securities Commission (SC) introduced the SRI-linked Sukuk Framework in June 2022, allowing companies to raise funds for projects addressing sustainability goals, including climate change and social issues. This framework supports the transition to a low-carbon economy and expands the range of sustainable investment products.

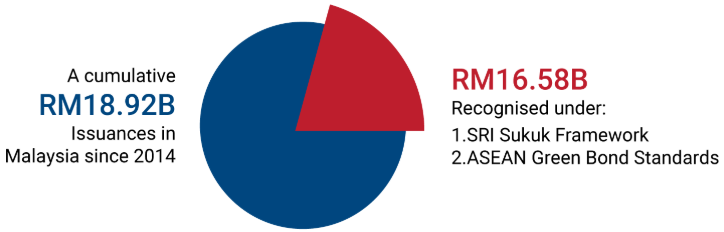

In 2023, Malaysia issued RM27.61 billion in SRI sukuk, bringing the cumulative total to RM18.92 billion since the framework’s introduction in 2014. Notably, Malaysian issuances accounted for approximately 24% of the total ASEAN SRI sukuk. To promote transparency, data on sukuk issued under the SRI framework and ASEAN standards are publicly available on the BIX platform, enhancing accountability in green financing.

Figure 1: Malaysia’s Progress in SRI Sukuk

Source: Capital Markets Malaysia, link

Investing in SRI sukuk offers several advantages, particularly in financing projects aligned with the United Nations Sustainable Development Goals (SDGs). This instrument broadens the investor base by attracting those prioritizing sustainability and drives investment in green, social, and sustainable assets, including waqf. SRI sukuk issuances in Malaysia are also eligible for tax incentives, such as tax deductions on issuance expenses for bonds and sukuk that meet green, social, and sustainable standards, as approved by the SC, until the Year of Assessment (YA) 2023. Additionally, recipients of the SRI Sukuk and Bond Grant Scheme, introduced in Budget 2021, can benefit from income tax exemptions for up to five years (YA 2021 to YA 2025).

Launched in 2018, the SRI Sukuk and Bond Grant Scheme covers up to 90% of the costs for independent expert reviews of sustainable sukuk issuances. By June 2022, 15 issuers had benefited from this scheme, with projects focused on renewable energy, green building, and sustainability. The scheme was expanded in August 2022 to include SRI-linked sukuk, further supporting Malaysia’s transition to a low-carbon economy and encouraging carbon-intensive industries to adopt sustainable practices.

As of June 2024, 317 bonds and sukuk in Malaysia have been categorized under the ASEAN Green Bond Standards, ASEAN Social Bond Standards, or ASEAN Sustainability Bond Standards on the BIX Malaysia platform. Additionally, 331 bonds and sukuk are classified as Sustainable and Responsible Investment (SRI), demonstrating Malaysia’s commitment to green and sustainable financing. The BIX platform enhances transparency by publicly providing data on SRI and ASEAN-compliant bonds and sukuk. This reinforces Malaysia’s role as a frontrunner in green financing while ensuring accountability and promoting further growth in the sustainable investment market.

Identify investment opportunities – Phillip Managed Account for Retirement (PMART) and Phillip Managed Account (PMA) ESG

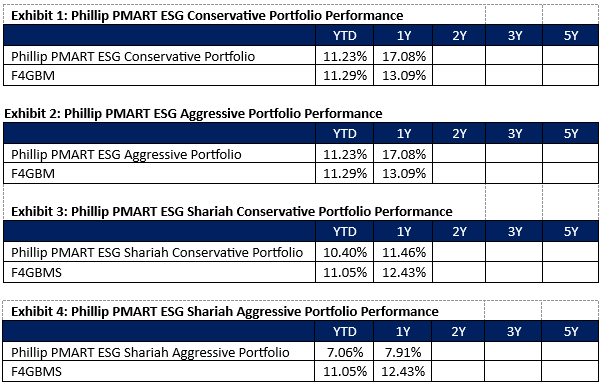

While PhillipCapital Malaysia does not currently offer green bonds, we are pleased to offer a range of investment solutions, including stock mandates, tailored to meet your financial goals and sustainability preferences. PMART and PMA ESG is a discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies. Exhibits 1-4 show the performance for PMART ESG Conventional and Shariah.

Source: PCM, 31 Oct 2024, link

Exhibits 5 & 6 provide a list of the stocks in our portfolio. The percentage composition of each stock may vary depending on whether the mandate is Conservative or Aggressive.

Exhibit 5: Stock List – ESG Conventional

| Company Name | ESG Rating |

| CTOS DIGITAL BERHAD | **** |

| DELEUM BHD | **** |

| DIALOG GROUP BHD | *** |

| GAMUDA BHD | *** |

| HARTALEGA HOLDINGS BHD | **** |

| HIBISCUS PETROLUEM BHD | *** |

| INARI AMERTRON BHD | **** |

| KELINGTON GRP BHD | **** |

| KOSSAN RUBBER INDUSTRIES BHD | *** |

| LAGENDA PROPERTIES BERHAD | *** |

| MATRIX CONCEPTS HLDGS BHD | *** |

| RCE CAPITAL BERHAD | **** |

| SHANGRILA HOTELS (M) BHD | *** |

| TELEKOM MALAYSIA BHD | *** |

Source: PCM, 30 Nov 2024, listed in alphabetical order

Exhibit 6: Stock List – ESG Shariah

| Company Name | ESG Rating |

| BANK ISLAM MALAYSIA BERHAD | *** |

| CTOS DIGITAL BERHAD | **** |

| D & O GREEN TECHNOLOGIES BHD | *** |

| DELEUM BHD | **** |

| DIALOG GROUP BHD | *** |

| GAMUDA BHD | *** |

| HARTALEGA HOLDINGS BHD | **** |

| HIBISCUS PETROLUEM BHD | *** |

| INARI AMERTRON BHD | **** |

| KELINGTON GRP BHD | **** |

| KOSSAN RUBBER INDUSTRIES BHD | *** |

| LAGENDA PROPERTIES BERHAD | *** |

| MATRIX CONCEPTS HLDGS BHD | *** |

| RCE CAPITAL BERHAD | **** |

| SHANGRILA HOTELS (M) BHD | *** |

| TELEKOM MALAYSIA BHD | *** |

Source: PCM, 30 Nov 2024, listed in alphabetical order

Recognising the increasing significance of ESG factors in investment decisions, we have introduced the Dividend Enhanced ESG Mandate in April 2024, which integrates quantitative investment methods inspired by our Dividend Enhanced strategy. This methodology involves Universe selection, Filtering, Construction, and Rebalancing. Building upon our investment strategy, we have integrated an ESG filter mandating that selected stocks meet a minimum ESG Rating of 3 Stars from the FTSE4Good Bursa Malaysia (F4GBM) Index. Exhibits 7 & 8 show the list of stocks in our Dividend Enhanced ESG mandates.

Exhibit 7: Stock List – Dividend Enhanced ESG Conventional

| Company Name | 12M Forward Dividend Yield | ESG Rating |

| GENTING MALAYSIA BHD | 7.46 | *** |

| SIME DARBY BERHAD | 6.45 | *** |

| MALAYAN BANKING BHD | 6.37 | **** |

| RHB BANK BHD | 6.21 | **** |

| BANK ISLAM MALAYSIA BHD | 6.08 | *** |

| HEINEKEN MALAYSIA BHD | 6.02 | *** |

| AXIS REAL ESTATE INVESTMENT | 5.73 | *** |

| MISC BHD | 5.04 | **** |

| PETRONAS DAGANGAN BHD | 4.62 | *** |

| AXIATA GROUP BERHAD | 4.47 | *** |

| PETRONAS GAS BHD | 4.34 | **** |

| WESTPORTS HOLDINGS BHD | 4.30 | **** |

| CELCOMDIGI BHD | 4.22 | **** |

| TELEKOM MALAYSIA BHD | 3.75 | *** |

| TENAGA NASIONAL BHD | 3.74 | *** |

| AVERAGE YIELD | 5.25 |

Source: PCM, 30 Nov 2024, sorted by 12M Forward Dividend Yield

Exhibit 8: Stock List – Dividend Enhanced ESG Shariah

| Company Name | 12M Forward Dividend Yield | ESG Rating |

| BERMAZ AUTO BHD | 10.02 | **** |

| SIME DARBY BERHAD | 6.45 | *** |

| BANK ISLAM MALAYSIA BHD | 6.08 | *** |

| AXIS REAL ESTATE INVESTMENT | 5.73 | *** |

| MISC BHD | 5.04 | **** |

| PETRONAS DAGANGAN BHD | 4.62 | *** |

| SYARIKAT TAKAFUL MALAYSIA KE | 4.50 | *** |

| RCE CAPITAL BHD | 4.48 | **** |

| AXIATA GROUP BERHAD | 4.47 | *** |

| MATRIX CONCEPTS HOLDINGS BHD | 4.34 | *** |

| PETRONAS GAS BHD | 4.34 | **** |

| WESTPORTS HOLDINGS BHD | 4.30 | **** |

| CELCOMDIGI BHD | 4.22 | **** |

| TELEKOM MALAYSIA BHD | 3.75 | *** |

| TENAGA NASIONAL BHD | 3.74 | *** |

| AVERAGE YIELD | 5.07 |

Source: PCM, 30 Nov 2024, sorted by 12M Forward Dividend Yield

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.