With Country Garden missing recent debt payments, investors have raised concerns about the recovery in the housing market and the broader economy. Not only that, July saw a widespread weakening of data in various sectors, which can be attributed to the slow revival of domestic consumption, the property downturn, and persistent challenges from the global economic environment. The growth rate of retail sales and industrial production decelerated in July, even as traditional offline services were gradually resuming normal operations. Despite recent efforts to relax policies, the property market downturn persisted, leading to reduced demand for loans. However, a different trend was observed in the manufacturing and infrastructure investment sectors, which remained relatively stable supported by structural trends. In view of that, the People’s Bank of China (PBoC) lowered the rate on its one-year loans – or medium-term lending facility (MLF) – by 15 basis points to 2.5%. We believe more policy easing is likely and the PBoC is likely to stay accommodative for longer.

Referring to Country Garden, the current default and ongoing restructuring process are negatively impacting market sentiment. The company faces a significant challenge as it has an onshore bond of Rmb3.9 billion maturing on September 2, and any failure to make payment would result in a default. This escalating debt crisis has the potential to create widespread repercussions within China’s fixed-income market and affect the sentiment surrounding the housing sector. Furthermore, it could potentially initiate a subsequent round of defaults among other private developers. Given this situation, it becomes imperative for regulatory authorities throughout the Chinese government to accelerate efforts aimed at revitalising demand within the real estate sector, which constitutes approximately one-fifth of China’s total gross domestic product. Furthermore, the government pledged further easing of property measures following its Politburo meeting in late July.

Back home, the conclusion of 6 state elections brought about the expected outcome, with PH-BN coalition retained the three states: Penang, Selangor and Negeri Sembilan but with slimmer majority overall. Separately, PN retained Terengganu, Kelantan and Kedah with a significant majority, and notably a clean sweep in all of Terengganu’s 32 state seats. It also made inroads in Penang, and denied the unity government’s two-thirds majority in Selangor. Despite this, we believe the unity government can now rule with certainty until the next general election. The immediate priority for the unity government revolves around expediting the implementation of its policy agenda, encompassing reforms and subsidy rationalisation.

China has been Malaysia’s largest trading partner since 2009. The value of trade between Malaysia and China in 2022 was about 17.1% of Malaysia’s total global trade worth RM2.8 trillion. As a result, there is a strong interconnection between China’s recovery and that of Malaysia. Similarly, the Chinese yuan and the Malaysian ringgit exhibit a strong correlation. While weak China sentiment may drag ringgit and the market down, conversely, Malaysia stands to gain from any potential recovery in the Chinese economy. We reaffirm our belief that there are still opportunities in China and Malaysia due to their attractive valuations, and we maintain a discerning approach in choosing high-quality stocks for our portfolio.

The market currently presents several opportunities for investors. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

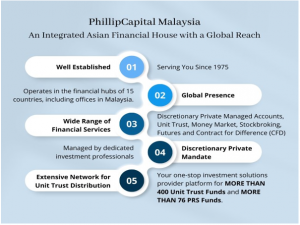

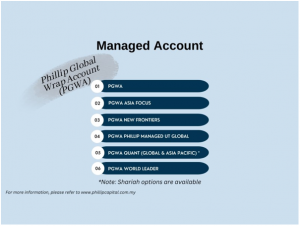

Phillip Capital Malaysia offers a comprehensive suite of financial services including managed accounts and unit trusts, that may suit your investment preferences and financial goals. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.