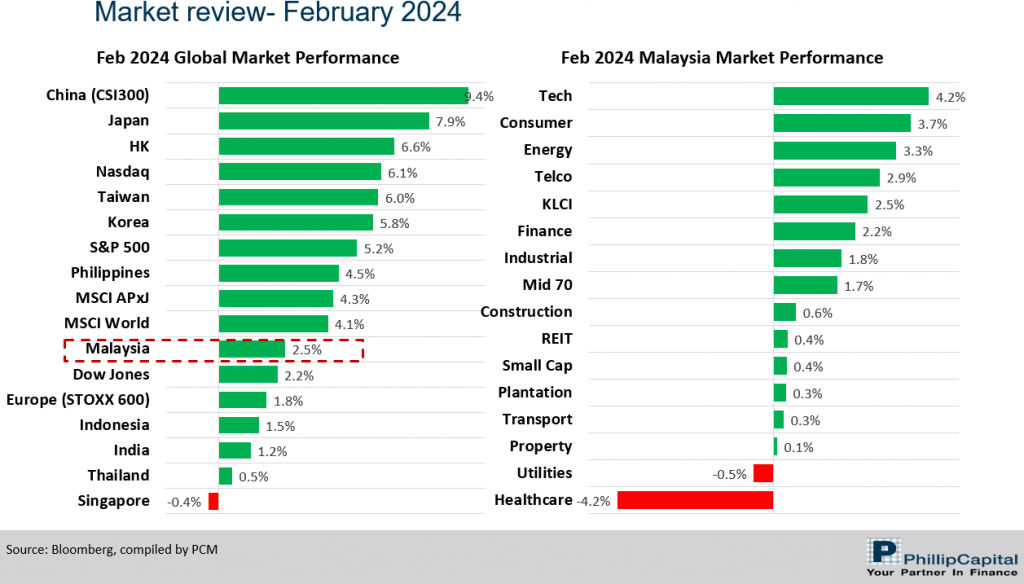

The MSCI Asia Pacific Ex-Japan Index (+4.3%) slightly grazed past the MSCI World Index (+4.1%) on account of strong market performance from China & Hong Kong. China (+9.4%) & Hong Kong (+6.6%) both enjoyed an exceptionally strong month on the back of increased tangible and forceful efforts from China’s government to support the region’s ailing stock market. Japan (+7.9%) continues its dominance despite going into a technical recession, with famed investor Warren Buffett endorsing the region in his latest letter to investors. In the US, the Nasdaq (+6.1%) and S&P 500 (+5.2%) hit new highs after Nvidia’s record-breaking results. Singapore (-0.4%) was the only market to be slightly in the red for February on news of tepid GDP growth of 1.1% for the whole of 2023 (see Exhibit 1).

During the month of February, China cut its five-year loan prime rate (LPR) by 25 basis points to 3.95%, the first reduction since June 2023, aiming to bolster the economy. It was also reported that China’s state-backed funds injected USD57 bn (CNY410 bn) into Chinese stocks this year to support the market. Separately, the 2024-2025 budget for HK removed all cooling curbs (buyer’s stamp duty (BSD), new residential stamp duty (NRSD) and special stamp duty (SSD)) on property transactions in an effort to boost the market.

The domestic market sustained its upward momentum throughout February, posting a +2.5% gain MoM and closing at 1,551.44. During the month, the Small Cap Index trailed behind but still posted a positive return of +0.4%, while the Mid 70 Index gained +1.7%. Sector-wise, the top performers were Technology, Consumer, and Energy, with gains of +4.2%, +3.7%, and +3.3% MoM, respectively. Laggards were Healthcare and Utilities, declining by -4.2% and -0.5% MoM, respectively. In terms of fund flow, foreign investors remained net buyers in February with buying value of RM1,321.9m. Foreign investors, in net, bought Financials, Utilities, Telco, and Healthcare sectors in February 2024, whereas Plantation, REITs, Industrial, and Construction sectors witnessed some outflows. (see Exhibit 1).

The recent 4Q23 reporting season was another good one with strong growth coming through mainly from domestic sectors such as Banks, Auto, Conglomerates, Real Estate and Telecoms, while Petrochemical, Plantations and Gloves continued to experience challenges. Investors are currently weighing the potential impact of various tax initiatives and subsidy rationalisation strategies outlined in Budget 2024 on corporate earnings. The recent introduction of revised water tariffs starting February 1, 2024, and the enforcement of capital gains tax from March 1, 2024, are also being closely monitored. We also expect corporates to divulge changing operation dynamics due to the heightened freight rates globally due to Red Sea conflicts.

With that being said, we believe the local market is supported by continuous execution of the macro blueprints launched in 2023, robust domestic demand, the potential reversal in the strong US dollar trend, and attractive valuation. After years of foreign selling, we see foreign investors’ underweight position on Malaysia bottoming out with February’s foreign shareholdings in the Malaysian equity market standing at 19.9% (vs all-time low of 19.5% in Dec 23). Finally, there have been plenty of concerns about the weakening Ringgit but on a positive note, its undervaluation serves as another reason for foreign investors to consider Malaysia as their investment destination, both in terms of FDI and portfolio flows.

Exhibit 1: 2024 Feb Market Performance

Strategy for the month

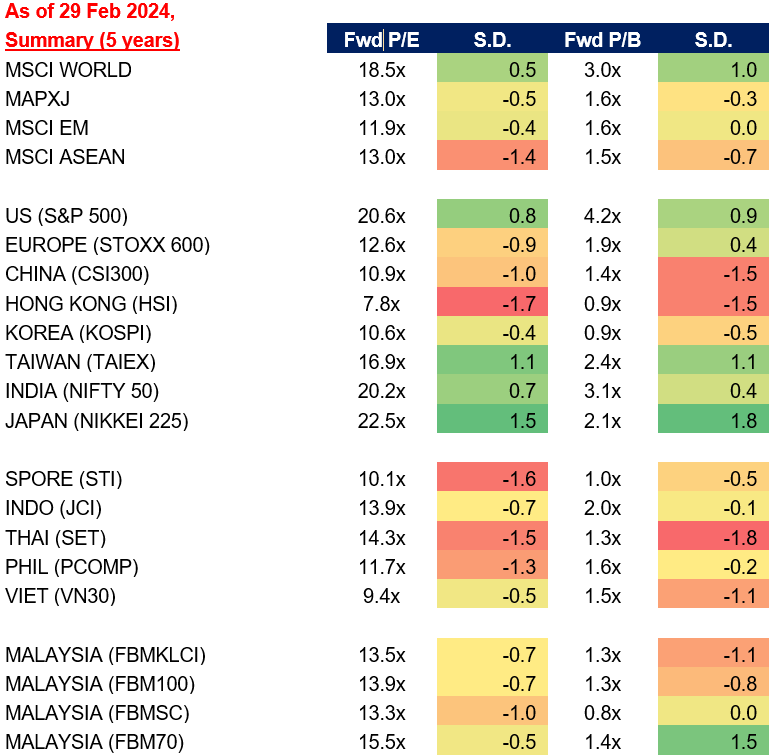

Several indications suggest the Fed may postpone an interest rate cut following recent hawkish remarks and sticky inflation figures, compounded by the complexities of the Red Sea Shipping Crisis which could reignite inflation. While the labour market remains robust (low unemployment rate), consensus suggests potential weaknesses by year-end, reinforcing the argument for a rate cut. Nevertheless, our outlook on global equities remains cautiously optimistic, with a preference for the Hong Kong/China market due to appealing valuations and policy stimulus. Additionally, the US market is favoured for its strong earnings quality, presenting opportunities for investment during any potential pullback.

In Malaysia, we hold a positive view on large-cap stocks and selected small-cap stocks. Sector-wise, similar to the previous month, we favour the Construction sector, a beneficiary of Budget 2024, infrastructure project rollouts, and the National Energy Transition Roadmap. We continue to like Technology as we see signs of down-cycle bottoming out. We also like Energy (particularly the upstream names) given the sustained momentum in earnings. Conversely, we continue to hold our underweight stance in Telco and Plantation sectors.

Exhibit 2: Selected Market Indices Valuations

Source: Bloomberg, PCM, 29 Feb 2024

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors.

Click here to learn more

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.