Global markets sustained robust momentum in December, buoyed by the moderation of US inflation data. This development fuelled market expectations for a pause in the rate hike cycle in 2024 and potentially a fresh rate cut as early as March 2024.

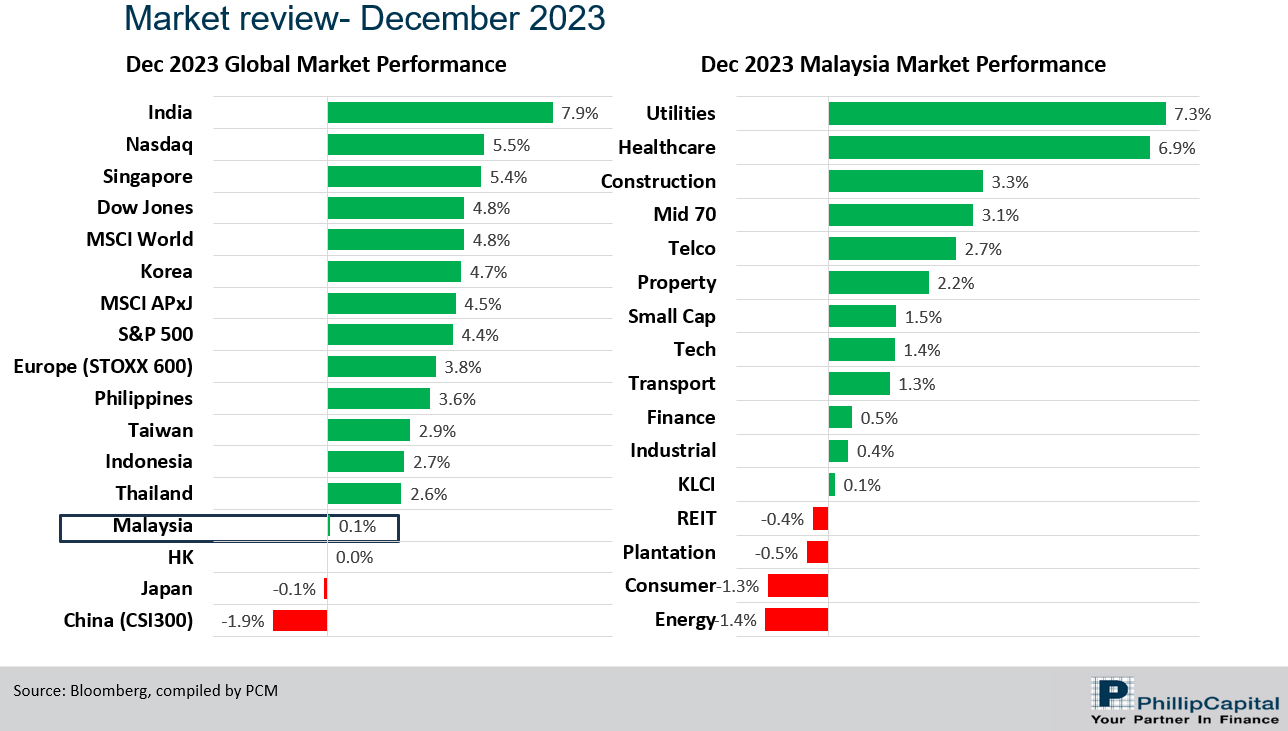

The MSCI Asia Pacific Ex-Japan Index (+4.5%) had a strong showing and only slightly underperformed the MSCI World Index (+4.8%) as year-end rallies in India, Singapore and South Korea helped lift the former. India (+7.9%) was the biggest star in December owing to bullish sentiment from economists and analysts as it overtakes HK as the 7th largest stock market in the world. Singapore (+5.4%) also fared very well as its economy grew faster than expected, boosted by rallies in manufacturing and construction. South Korea (+4.7%) on the other hand grew exports by 14.5%, attributed to rising demand from US for its semiconductor products. China (-1.9%) was the weakest link in Asia, albeit not too sharp of a decline as Beijing moved to protect the Yuan by orchestrating buying by state banks. Japan (-0.1%) and HK (0.0%) were fairly unchanged as markets weigh in on the latest macroeconomic data (see Exhibit 1).

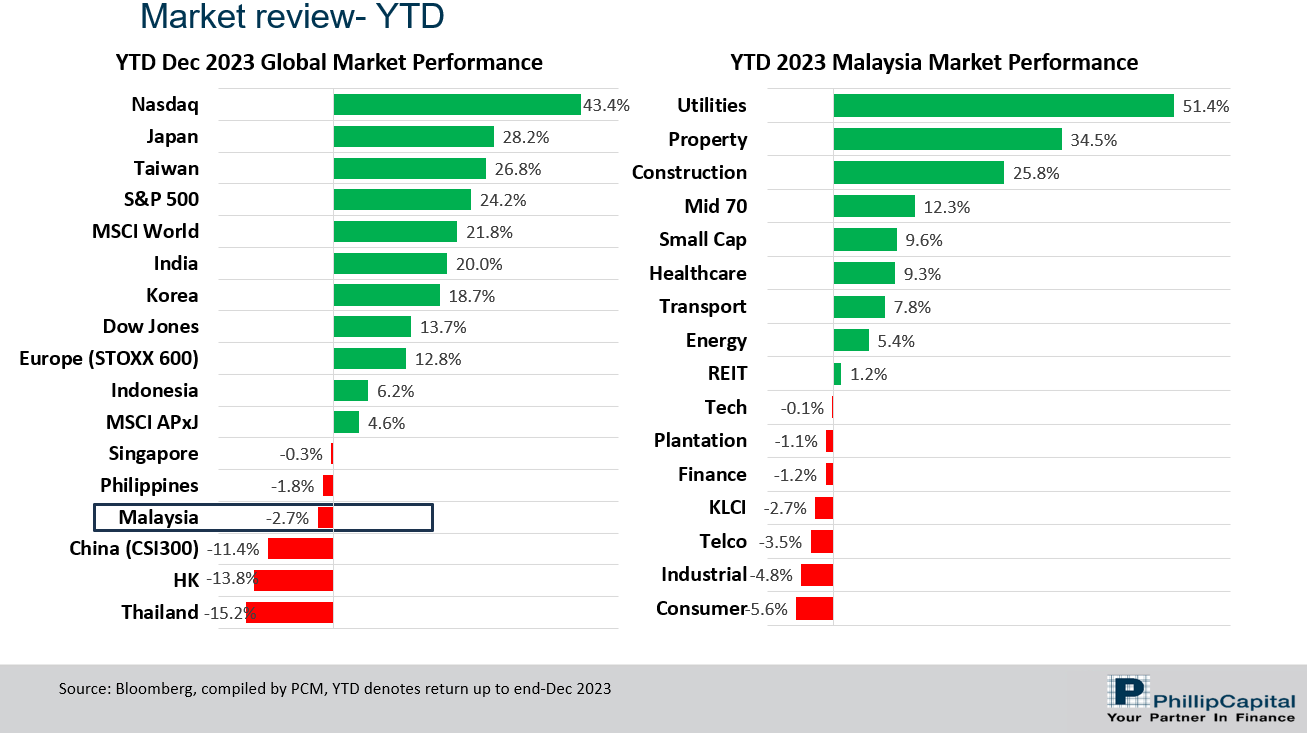

On a YTD basis, the MSCI World index demonstrated significantly stronger performance compared to the MSCI Asia Pacific Ex-Japan, with returns of 21.8% and 4.6% respectively. The US Nasdaq remained the top performer with a substantial gain of +43.4% helped significantly by the emergence of the AI theme, leading ahead of Japan (+28.2%), Taiwan (+26.8%), and India (+20.0%). On the flip side, Thailand (-15.2%), Hong Kong (-13.8%), and China (-11.4%) experienced the most significant losses in 2023 (see Exhibit 1).

After an elongated period of rapid policy tightening, we view the Fed interest rate policy will begin normalizing in 2024, signifying an inflection point by shifting from a ‘higher for longer’ view to a moderate pace before settling for a rate cutting cycle. The fall of interest rates expected in 2024 bode well for growth-oriented sectors and those that rely heavily on imports for production inputs. Separately, a weaker dollar eases the burden on deficit-laden governments and could potentially attract foreign inflows returning to emerging markets. On China, we expect more policy interventions and stimulus measures from the government and regulators to avert default in the property sector, including larger deficit spending by the government and potentially further interest rate cuts in 2024. The new growth areas such as Artificial Intelligence (AI), Electric Vehicles (EV), Renewables, Data Mining, Machine Learning, Cloud Computing and etc have the potential to expand further in China, transforming the economic structure over the longer term.

Back home, the domestic market closed marginally higher, posting a +0.1% gain and closing at 1,454.66. This helped reduce the YTD losses for 2023 to -2.7%. During the month, the Small Cap Index fared better with a positive return of 1.5%, while the Mid 70 Index gained 3.1%, resulting in YTD gains of +12.3% and +9.6% respectively (see Exhibit 1).

Sector-wise, the top performers were Utilities, Healthcare, and Construction, with gains of +7.3%, +6.9%, and +3.3% MoM, respectively. Laggards were Energy, Consumer, and Plantation, declining by -1.4%, -1.3%, and -0.5% MoM, respectively. For the full year of 2023, Utilities, Property, and Construction were the top performing sectors, with gains of +51.4%, +34.5%, and +25.8%, respectively. Laggards were Consumer, Industrial, and Telco, declining by -5.6%, -4.8%, and -3.5% respectively (see Exhibit 1).

In terms of fund flow, foreign investors remained as the net buyer in December with buying value of RM256m. On a YTD basis, foreigners were net equity sellers of RM2.3bn. Foreign investors favoured Utilities, Property, and Construction sectors in 2023, whereas Financial, Consumer, and Industrial sectors witnessed some outflows.

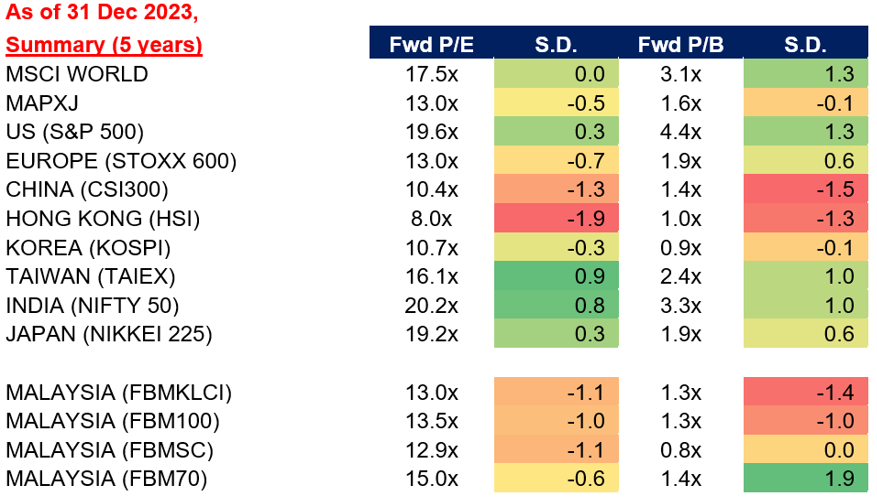

Looking ahead, we believe the local market is supported by continuous execution of the macro blueprints launched in 2023, robust domestic demand (amid normalising tourism and cash aids for B40 & M40) and a potential reversal in the strong US dollar trend. A US soft landing (or ideally a no-landing scenario) and gradual recovery in China could also offer some support to the local market. Furthermore, KLCI is supported by an undemanding valuation (13.0x forward P/E vs 10Y average 16.6x) accompanied by an all-time low foreign shareholding of 19.5% (as at Dec 2023). Other positive catalysts include a boost in Malaysian tourism due to China reopening, rising FDI momentum, and signs of the tech cycle bottoming out.

Exhibit 1: Dec 2023 & YTD 2023 Market Performance

Strategy for the month

The geopolitical landscape is growing more complex, marked by ongoing US-China trade tensions, heightened North/South Korea tensions, Israel-Hamas conflicts, and Middle East unrest. Our outlook on global equities remains cautiously optimistic, with a preference for the Hong Kong/China market due to appealing valuations and policy stimulus (CSI300 – 10.4x forward P/E, -1.3 standard deviation below its 5-year mean; HSI – 8.0x forward P/E, -1.9 standard deviation below its 5-year mean) and supportive policy stimulus (see Exhibit 2).

In Malaysia, we hold a positive view on large-cap stocks and have become more optimistic about selective small-cap stocks. Our preference lies with companies demonstrating robust earnings growth under quality management. Sector-wise, similar to the previous month, we favor the Construction sector, a beneficiary of Budget 2024, infrastructure project rollouts, and the National Energy Transition Roadmap. Additionally, we have become more positive on the Energy sector, particularly the upstream segments expected to benefit from Petronas contract awards. Conversely, challenges are anticipated in the Telco sector due to intense competition, while the Plantation sector may experience sluggish earnings in 2024.

Exhibit 2: Selected Market Indices Valuations

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

Phillip Capital Malaysia offers a comprehensive suite of financial services including managed accounts and unit trusts, that may suit your investment preferences and financial goals. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors.

Click here to learn more

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. PMART and PMA ESG is suitable for investors who want to optimise the risk-adjusted return by constructing a diverse sustainable portfolio of ESG companies.

To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link. We like these companies because they have received high ESG ratings, which we believe can contribute to their long-term sustainability, responsibility, and profitability.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Separately, for investors who would like to have regional exposure, PMART UT, is a portfolio of EPF approved unit trust funds managed by award-winning fund managers. It allows investors to invest in multiple unit trust funds through a single investment and is reviewed and adjusted regularly or as needed in response to major events. Separately, PMA UT is ideal for cash investors seeking a tailored investment solution via investment in multiple unit trust funds through a single investment. We offer both conventional and Shariah-compliant options to accommodate the preferences of all investors. We also offer both Moderate and Aggressive mandates that cater to different investors’ level of risk appetite. Separately, we also like US market where we are of the view that quality of earnings is much better, as such we have also introduced PMART Quant US for those who can take foreign currency/market volatility and single market exposure.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.