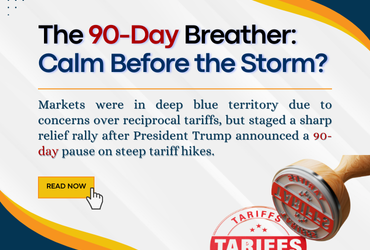

The political landscape has shifted dramatically as Joe Biden’s withdrawal has led to a surge in support for Vice President Kamala Harris. A recent poll showed Donald Trump leading Harris only by two percentage points. This serves as a reminder that the 3-month remaining until the Presidential Election is a long time in politics. It is obvious that Trump would have preferred to run against Biden than anyone else, though that certainly does not mean his campaign is a lost cause. Hence, all eyes will be on the Democratic National Convention on August 19th, where, similar to the Republican convention a month earlier, the Democrats will formally nominate their presidential candidate in Chicago. Key upcoming dates include the second presidential debate on September 10th and Election Day on November 5th.

Figure 1: Donald Trump v Kamala Harris: what the polls say

Source: The Economist, 29 July 2024, link

The AI boom drove over 70% of US S&P gains last year, and while it remains a key theme in 2024, the focus is now shifting. Investors are moving away from Big Tech in anticipation of the Federal Reserve lowering interest rates soon, which is benefiting smaller companies, banks, and real estate shares. In fact, according to data from EPFR Global, $10 billion flowed into small-cap funds for the week through July 17th, the largest weekly inflow since 2007. Meanwhile, semiconductor stocks have experienced a major sell-off since mid-July, driven by sector rotation, concerns over China’s restrictions, worries about AI demand coupled with disappointing earnings from Tesla and Alphabet. This has caused the tech-heavy Nasdaq to lose about 7% from its peak, while the S&P 500 has dropped around 3% from its peak. In contrast, the Russell 2000 saw a gain of about 9-10% within the month of July. As other sectors began to show benefits from innovation, policy reforms, and appealing valuations, we see this trend indicating a broadening of equity opportunities for the rest of 2024.

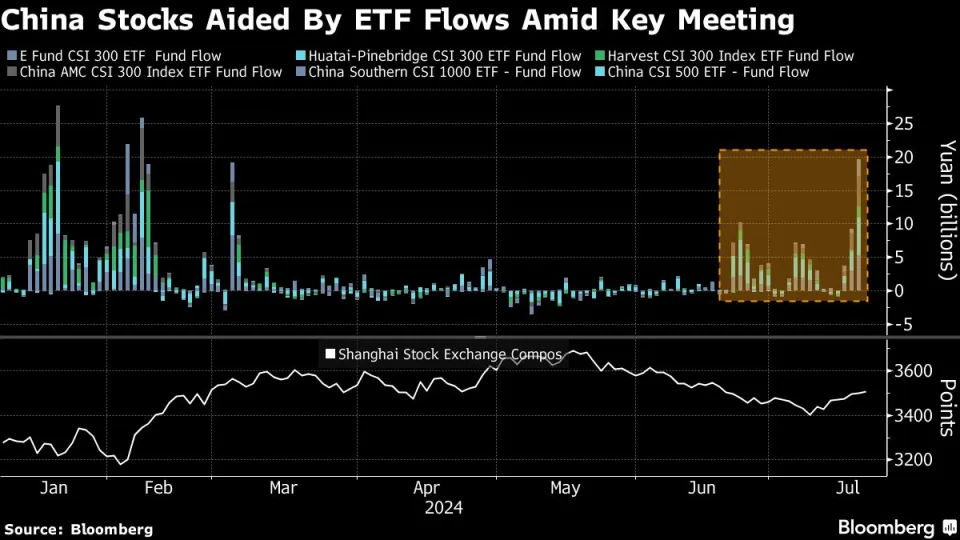

Back in China, favorable policy news remains the main positive driver. However, despite the anticipation, China’s Third Plenum has come and gone without delivering the significant measures some had hoped for. The good news is that the China National Team is still supporting the market via purchases of ETFs. Separately, People’s Bank of China (PBOC) cut its 1-year and 5-year Loan Prime Rates (LPRs) by -10bps to record lows of 3.35% and 3.85%, respectively. We foresee the Chinese government may consider more stimulus measures to counter any sign of slowdown in the domestic economy. Finally, China’s consumption, the key growth driver in the post-pandemic period, should recover by 2025 as home prices stabilize and supportive policies take effect, despite sluggish sales and excess supply delaying property price recovery.

Figure 2: Increased Buying Activity in China ETFs by the National Team

Source: Bloomberg, 18 July 2024, link

The recent Indian budget appears positive as it emphasizes fiscal consolidation and employment, bolstering India’s long-term growth prospects. The growth of capex is maintained at 17% and such investment will account for 23% of total government spending and 3.4% of GDP. The projected fiscal deficit for the fiscal year is set at 4.9% of GDP, lower than earlier market expectations of 5.3%. Despite a surprise increase in the capital gains tax to a uniform 12.5% rate across asset classes, it is viewed as manageable and unlikely to significantly dampen domestic investor interest in Indian equities. Credit rating agencies are expected to respond positively to the 2024 budget. Finally, there is widespread consensus in Prime Minister Narendra Modi’s ability to maintain his coalition government for its full term, as opposition parties offer little incentive to the smaller parties in the current NDA government.

Back home, the JS-SEZ agreement is expected to be signed in September 2024, with investment and tax incentives announced in October’s 2025 Budget. While there has been no official announcement on the proposed JS-SEZ location, it is expected to include Iskandar Malaysia and Pengerang areas. Property firms stand to gain from heightened developer activity in the region, alongside increasing demand for data centers and green industrial parks. Plantation companies holding significant land holdings in these areas are also poised to benefit from the resulting boost in real estate values. Other than that, we believe Malaysia’s outlook is still promising led by the anticipated Fed’s rate-cut pivot, stable corporate earnings and economic growth, planned investment inflows, and government reforms.

In terms of positioning, we think upcoming political election in the US will be the key event that may introduce greater policy uncertainties, which could have implications for sector positioning and security selection. Our analysis indicates that the investment case for US remains robust, bolstered by the corporates’ resilient earnings quality. Additionally, there is potential for a mean reversion trade given the deeply discounted valuations observed in the Chinese market. India has been one of the best-performing markets globally in local currency terms and has kept pace with US markets in dollar terms in recent decades. This trend is expected to continue, driven by favorable demographics and significant investment in infrastructure. Tech-heavy markets like Taiwan and Korea will also benefit from the ongoing tech recovery. Let’s not forget Malaysia, which has been one of the best-performing markets year-to-date. While there are numerous opportunities, investors are also closely monitoring geopolitical developments, including the Hamas-Israeli conflict, Iran-Israel tensions, and the Russia-Ukraine situation. They are equally attentive to global inflation trends, U.S. 10-year bond yields, global economic growth forecasts, and international interest rate movements.

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.