On 25th November, United States President Donald Trump has announced plans for imposing tariffs on the United States’ top 3 trading partners—Canada, Mexico, and China. Trump announced a 25% tariff on all imports from Canada and Mexico, and an additional 10% tariff on Chinese imports. Tariffs are taxes imposed on imported goods, while they may seem like an abstract economic policy, their effects are felt deeply in local industries, consumer markets, and international relations. Whether aimed at protecting local jobs, generating revenue, or influencing foreign practices, tariffs shape the global trade landscape. Here’s a closer look at how tariffs work, why governments impose them, and who stands to gain or lose in their wake.

How Tariffs work?

A tariff increases the cost of foreign goods, making domestically produced alternatives more competitive. For example, a 10% tariff on a $50,000 Japanese car raises its price to $55,000, potentially swaying buyers toward a similar American-made vehicle. While this benefits local manufacturers, the higher costs are often passed on to consumers.

Why Governments Use Tariffs

- Protecting Domestic Jobs and Industries

Tariffs act as a shield for local businesses against cheaper foreign competition, as it may raise the price of the imported goods, and hence increased the competitiveness of the local good. For instance, the U.S. Smoot-Hawley Tariff Act of 1930 introduced sweeping tariff hikes to protect farmers during the Great Depression. However, protectionist tariffs can also trigger retaliatory measures, complicating their overall effectiveness.

- Revenue Generation

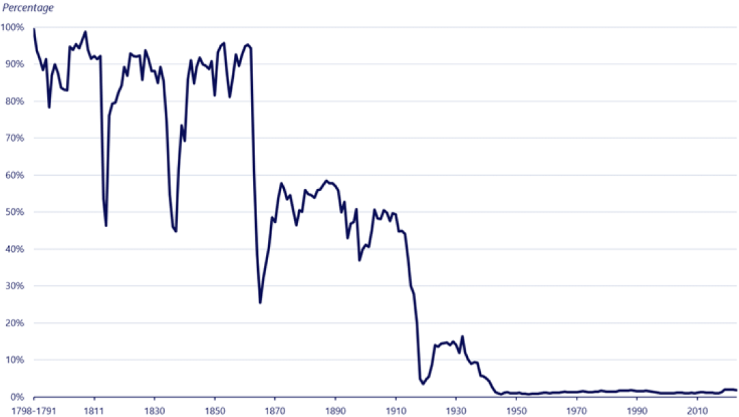

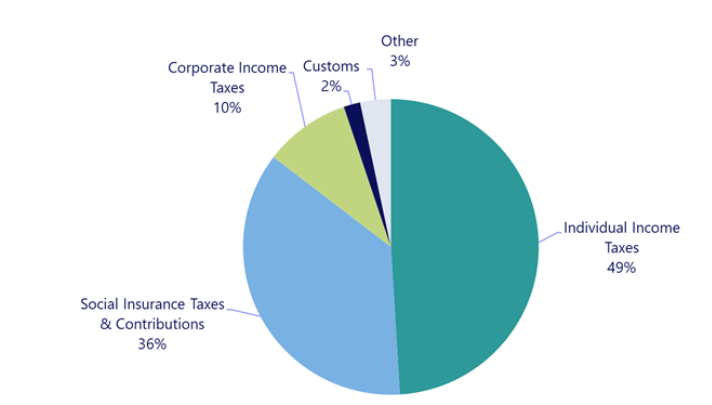

Historically, tariffs were a primary income source for governments. Although they now account for less than 2% of U.S. federal revenue (as shown in Exhibit 1 & 2), tariffs remain significant in developing countries.

Exhibit 1. Tariffs revenue as a share of Federal Receipt

Source: Council of Economic Advisers, White House, as of June 2024

Exhibit 2. FY2023 Net Federal Receipt by Source

Source: Council of Economic Advisers, White House, as of June 2024

- Addressing Unfair Practices

Tariffs discourage practices like “dumping,” where foreign companies sell goods below market value to dominate a market. For instance, the Biden administration increased tariffs on Chinese electric vehicles, accusing China of flooding the market with underpriced EVs to undermine competitors.

- Retaliation in Trade Wars

Tariffs can escalate into full-blown trade wars. When the U.S. imposed tariffs on Chinese goods during the Trump administration, China retaliated with levies on U.S. agricultural products, disrupting exports like soybeans and other commodities.

The Impact of Tariffs

On Exporting Countries: Tariffs can severely impact exporters, reducing the competitiveness of their goods. For example, during the U.S.-China trade war, Chinese exporters saw declines in revenue as their products became less affordable in American markets.

On Importing Countries: While tariffs may benefit local producers by reducing foreign competition, they often lead to higher consumer prices. For instance, a 15% tariff on imported shoes could raise the price of a $50 canvas sneaker to over $60. Similarly, businesses reliant on imported materials, such as U.S. manufacturers using foreign steel, face higher production costs, potentially reducing employment in those sectors.

On Consumers: Ultimately, consumers shoulder the burden. The added cost of tariffs trickles down through the supply chain, leading to inflated prices for everyday goods, from laptops to footwear.

Who are the winners from the trade war?

- Neutral Countries

Nations uninvolved in the conflict often benefit as they step in to fill gaps in global trade. For instance, Southeast Asian countries such as Malaysia & Vietnam gained export opportunities during the U.S.-China trade war. Singapore, deemed as a regional financial centre and politically-neutral safe haven, would also benefit as well. - Domestic Producers

The domestic producers may benefit from the trade war as the imposed tariff may increase their competitive advantage. Industries protected by tariffs, like steel in the U.S., may experience short-term gains. However, the costs of such protection often outweigh the benefits.

The Bigger Picture: Are Tariffs Worth It?

While tariffs can protect specific industries and serve as a tool for geopolitical strategy, their ripple effects are complex. Retaliatory measures, higher consumer prices, and supply chain disruptions often negate their intended benefits. As global economies become more interconnected, the long-term efficacy of tariffs remains a subject of debate among economists and policymakers alike.

In the end, tariffs are more than a financial tool; they are a reflection of national priorities and global relationships.

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced and/or PMART/PMA Dividend Enhanced ESG

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors. Click here to learn more. We recently also introduced PMART/PMA Dividend Enhanced ESG Mandate as we remain dedicated to investing in ESG stocks given their stronger valuation and profitability.

2. PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

3. PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.