Korea has been one of the worst-performing markets this year, with the KOSPI Index down 7.51% year-to-date as of November 30, 2024. The recent political drama surrounding South Korean President Yoon Suk Yeol’s declaration and revocation of martial law within six hours has further compounded the market’s struggles. As of December 6, the KOSPI has declined an additional 0.60% month-to-date, deepening negative sentiment in an already challenging market environment.

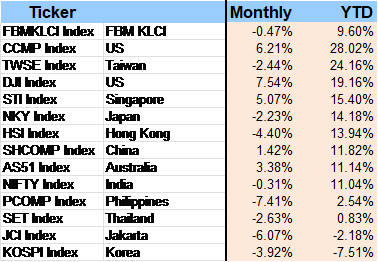

Table 1: Performance of Selected Markets Year-to-Date as of November 30, 2024

Source: Bloomberg, PCM, 30 November 2024

The primary factor contributing to Korea’s underperformance is the significant decline of Samsung Electronics, which is down 32% as of December 6. Samsung Electronics has been trailing behind SK Hynix in the development of high-bandwidth memory (HBM) chips, which are crucial for AI chipsets. Samsung Electronics was also hurt by President-elect Donald Trump’s threat to levy tariffs on imports that would hit demand for electronics products. That being said, in the latest press release, management emphasized their commitment to leading efforts to overcome the current crisis, with the goal of turning the challenging situation into an opportunity for a robust recovery.

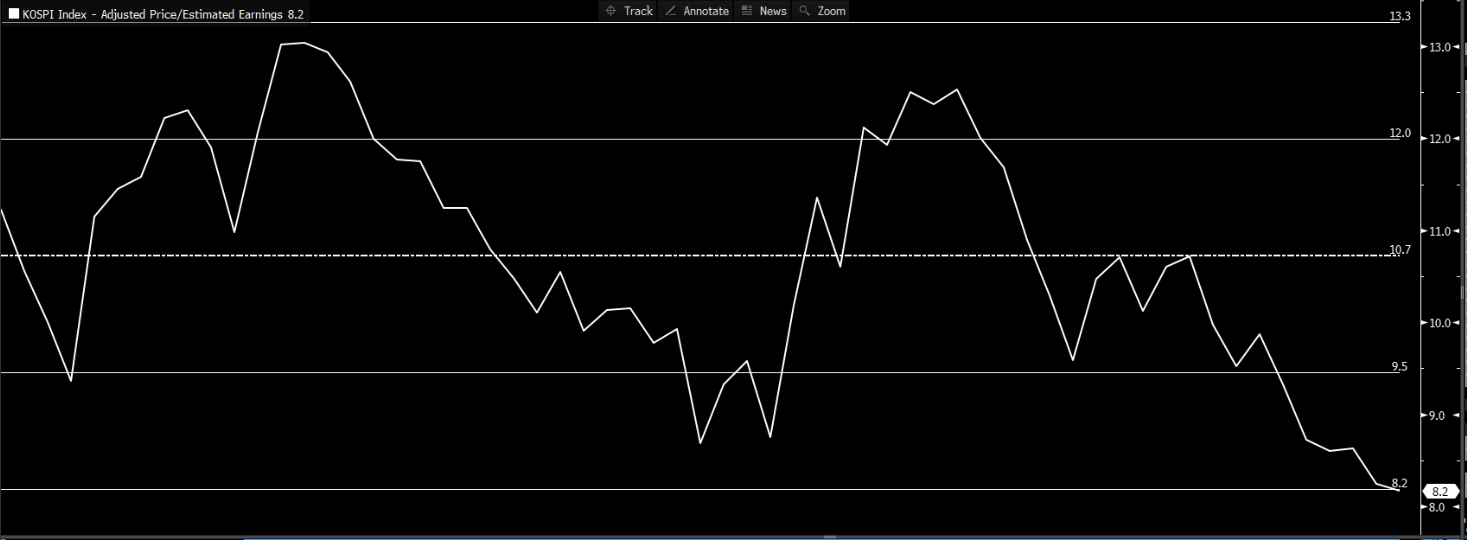

At this stage, we believe the stock is trading at a reasonable valuation, at a P/E of 9.2x, which is approximately one standard deviation below its 5-year average (Figure 1), though additional information on the turnaround plan is needed. Samsung Electronics recently announced a $7.2 billion share buyback program after its share price experienced a significant drop, accompanied by changes in its management. Likewise, the KOSPI Index is trading at a P/E of 8.2x, which is approximately two standard deviations below its 5-year average (Figure 2). Any positive catalysts could potentially drive a re-rating of the valuation.

Figure 1: Samsung Electronics Valuation Chart

Source: Bloomberg, 30 November 2024

Figure 2: KOSPI Valuation Chart

Source: Bloomberg, 30 November 2024

Investors seeking Korea exposure can consider our Managed UT Portfolio, which includes PMART UT, PMA UT, and PMART UT Flexi for targeted investment opportunities. Our portfolio is available in both Conventional and Shariah options. Additionally, as mentioned in our previous article, investors looking to increase their exposure to Korea in their portfolios may want to consider the Islamic Asia Fund rather than a conventional Asia Fund. This is because the benchmark for the Islamic Asia Fund, MSCI Asia Pacific ex Japan Islamic Index, has a higher weight in Korea at 24.01%, compared to just 9.65% in the conventional index. Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.