Welcome to the year of Wood Dragon!

Chinese Astrology follows a 12-year recurring cycle, where each year is symbolised by an animal, forming the 12 zodiac signs. Interestingly, each zodiac sign is associated to one of the five main elements each year (known as ‘Wu Xing Concept’): Gold (Metal), Wood, Water, Fire, and Earth. This configuration results in a 60-year cycle referred to as the ’60 Jia Zi.’ Following a Water Rabbit year (2023), the Wood Dragon, along with other elemental Dragons, comes once every 60 years. What significance does a Wood Dragon year hold?

In Chinese astrology, Dragon, the only mythical creature among the 12 zodiac signs, is known for its strength, vitality, and ability to overcome challenges. Meanwhile, the Wood element signifies growth, expansion and flexibility. As the Wood Dragon year unfolds (reigning from 10 February 2024 to 28 January 2025), it is believed to be auspicious, offering countless opportunities for growth.

Dominance of Fire & Earth elements in a Wood Dragon Year – who are the beneficiaries?

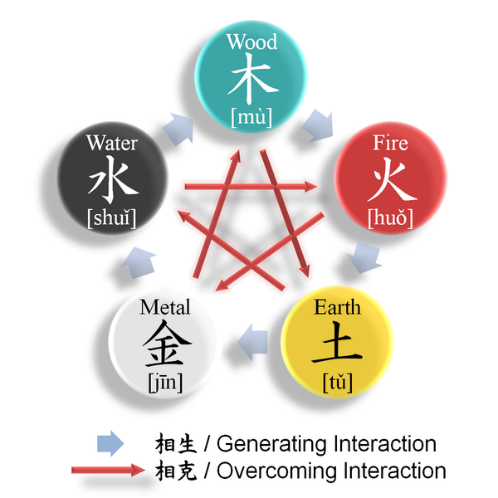

The ‘Wu Xing Concept’ serves as a fundamental framework to comprehend the relationships and interactions among the five elements (see Figure 1). Wood, according to the ‘Wu Xing Concept’, is believed to have a generating interaction with Fire, signifying that Wood feeds and nurtures Fire. Fire is a symbol of economic activity, confidence and optimism. The businesses that will benefit from this include Financials (investments, stocks, insurance), Energy, Entertainment, Travel, Healthcare (medicine, pharmaceuticals, life sciences) and Technology.

Despite the fact that the Earth element exhibits an overcoming interaction with Wood (Wood splits Earth), it does not necessarily imply a downturn for the Earth Element Industry. On the contrary, Dragon’s native character is the Earth element, which symbolises stability and reliability. This suggests that the Earth Element industry, despite the overcoming interaction, still stands to prosper in the upcoming Dragon year. This positive outlook extends to businesses within the Earth element, notably Construction and Property/Real Estate.

Figure 1: The ‘Wu Xing Concept’ and the interconnection among the five elements

Source: Asian Geographic

This is also aligned with our house view that we are positive in selected Property, Construction, Utilities, Renewables and Technology companies.

The Wood Element Supports Prospects for Green Investments

Given that Wood symbolises growth and environmental harmony, the Wood Dragon Year has the potential to foster investments in eco-friendly and sustainable ventures. Sectors focusing on renewable energy, green infrastructure, and environmentally responsible practices might continue to attract significant interest from investors. Back home, the announcement of National Energy Transition Roadmap (NETR) in July and a ESG-focused Budget 2024 establishes a solid foundation for ESG. We maintain a positive outlook on investments aligned with the ESG theme and we believe ESG should be regarded as a significant consideration within conscientious investors’ portfolios.

The Wood Element’s Adaptability Aligns with Dragon’s Resilient Characteristics

The Wood element has inherent qualities of flexibility and adaptability, and this aligns with the resilience embodied by the Dragon. In the dynamic landscape of Malaysia’s investment market, where no sector or investment can perpetually experience uninterrupted growth, it becomes imperative for investors to navigate potential turbulence. Analogous to the Wood element’s flexibility and adaptability, investors in the Malaysian market stand to gain by cultivating a diversified portfolio, adjusting strategies in response to market shifts, and capitalising on emerging opportunities throughout the year.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors.

Click here to learn more

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.