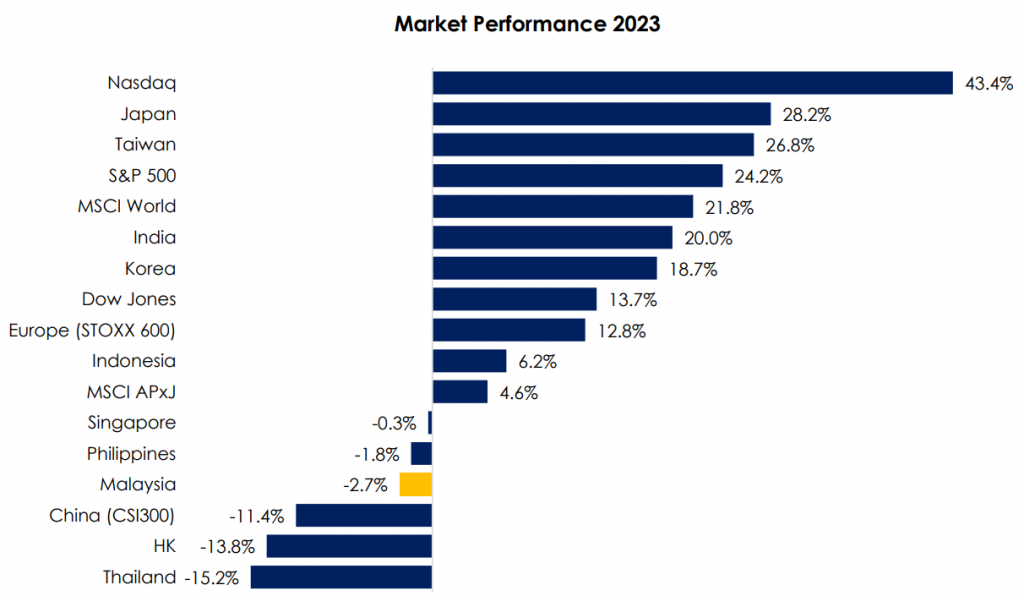

Despite the strong global market rally in 2023, the FBMKLCI or KLCI underperformed most of the regional markets, down -2.7% in 2023 (Figure 1). This is mainly due to foreign fund selling, inconsistent policy follow-through, along with external forces such as the US sticking to higher rates for a longer period and a sluggish recovery in China.

Figure 1: Global Market Performance 2023

Source: Bloomberg, PCM

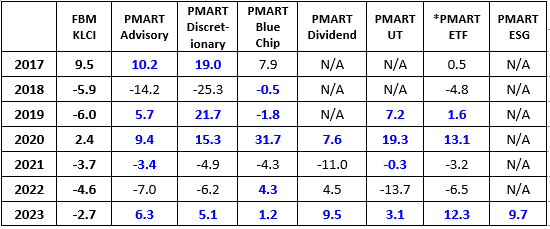

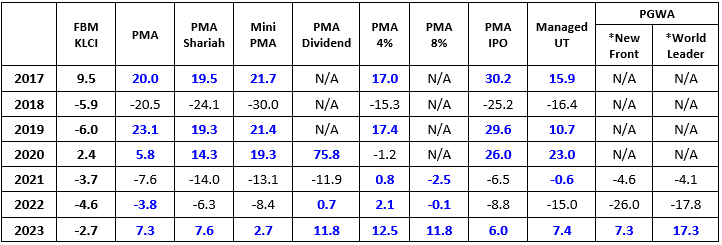

However, in the face of a challenging 2023, most of our Private Managed Accounts were able to register positive returns, outperforming KLCI which declined 2.7%. Our humble performance is credited to effective bottom-up stock selection and prudent management practices which allow us to navigate the market effectively. Please see Figure 2 for a summary of our performance across different mandates.

Figure 2: PCM Private Managed Accounts Performance

A: Phillip Managed Account for Retirement (PMART)

B: Phillip Managed Account (PMA) & Phillip Global Wrap Account (PGWA)

Note: Composite returns on all accounts, including new injections, as provided by IT Dept

Bold – Out-performed KLCI * Typical Account, Moderate Risk

Source: PCM

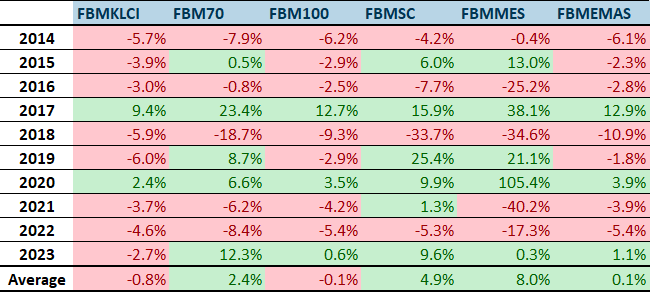

Investors who invest into KLCI constituents may encounter difficulties in generating profits as KLCI has only recorded 2 positive returns over the past 10 years (Figure 3). What’s more, the KLCI which is primarily dominated by traditional sectors such as Financials, Plantations, Telecommunications, and Utilities continue to maintain a limited appeal for investors. On a separate note, the FBM Small Cap (FBMSC) achieved a positive return of +9.6% in 2023, recording a positive performance over 6 out of the last 10 years. Similarly, the FBM70, comprising mid-cap stocks, demonstrated strength in 2023 with a positive return of +12.3%, sustaining positive performance in five out of the past 10 years. Both indices outperformed the KLCI. This notable outperformance can be attributed to robust corporate earnings growth within the small and mid-cap space.

Figure 3: Malaysia’s Market Performance Over Past Decade

Source: Bloomberg, PCM

Hence, in PCM, we focus on seeking alpha ideas within the small to mid-cap space which, in our view, presents a more favourable risk-reward scenario. We avoid trying to time the market, focusing instead on investing in companies with strong fundamentals, sustainable business models, clear earnings visibility, and a high-quality management team. Having said that, we maintain a selective approach towards certain large-cap names which are generally more stable and less volatile.

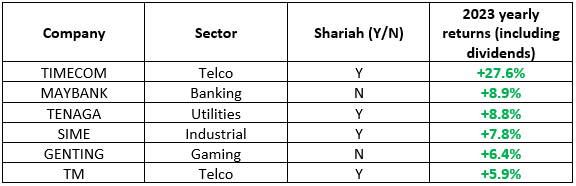

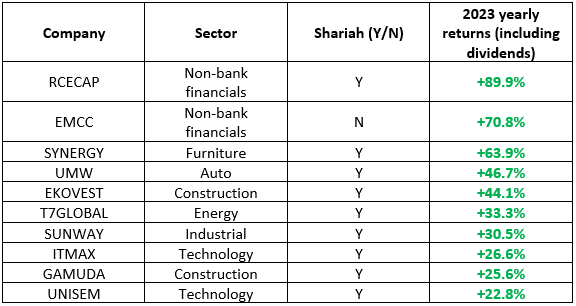

While our diverse mandates address distinct risk appetites, investment profiles, investment universe (unit trust funds or stocks) and compliance with Shariah and non-Shariah principles, there are some shared similarities among the mandates. In many of our Malaysia-focused stocks mandates, we invest in the following top-performing stocks; however, it is worth noting that not all stocks may be included in all our mandates (for instance, Shariah mandates would not buy non-Shariah stocks; Blue Chip mandates would not buy concept stocks; and etc). See Figure 4.

Figure 4: PCM Private Managed Accounts Holdings (Note: the list is not exhaustive)

Selected Large Cap Holdings

Selected Mid/Small Cap/Ace Market Holdings

Source: PCM

On the flipside, in 2023, our fund performances were detracted by some exposure in AEONCR (-7.5%), SAM (-17.1%), BJFOOD (-39.4%) but the overall performance was positive due to the strength of our well-diversified portfolio.

When selecting companies for our portfolio, we conduct thorough financial and fundamental analyses, assess industry trends, evaluate management effectiveness, identify and manage risks and utilise various valuation metrics. We also closely engage with the management team through physical meetings and/or conference calls to understand their strategic vision, operational plans, and responsiveness to market dynamics. This holistic approach guides our decision-making for a well-balanced and informed investment strategy.

We also wish to spotlight the list of recommended stocks as featured in our previously published write-up titled “2023 Stock Review 2401.” The stocks recommended by PCM in 2021, 2022 and 2023 showed average returns of -1.1%, -3.5% and +8.3%, respectively, as compared with the FBMKLCI’s loss of -3.7%, -4.6%, and -2.7% in 2021, 2022, and 2023. Among the 39 stocks recommended over the past three years, 19 stocks had outperformed the local bourse and the stock picks that garnered prominent performance were Synergy, KGB and Gtronics as each of these stocks had achieved a return of more than 40%.

2024’s Malaysia Outlook

As mentioned in our previous publication titled “From The Desk of CIO – Bursa to Recover from US Rate Cut”, we anticipate a strong recovery in the Malaysian market in 2024, primarily driven by the expected weakening of the USD resulting from declining interest rates, leading to a reversal in the flow of funds from the US to both emerging markets and, in particular, the Malaysian market. We also pointed out that current valuations present an attractive opportunity as many stocks are trading way below net asset value and have single-digit price-earnings ratios.

In addition to that, in our publication titled “A Year Between Fear and Greed: Pivot Point or Bull Trap?“, we emphasised the abundant opportunities in Malaysia, driven by increasing Foreign Direct Investment (FDI), robust domestic demand, a more favourable policy outlook, subsidy rationalisation, and the anticipated recovery in the Malaysian technology sector. The outlook for Malaysia market is further supported by macro blueprints like NETR, NIMP2023, and promising thematic developments specifically in Johor, Penang and Sarawak, which would benefit selected Property, Construction, Utilities, Renewables and Technology companies. Finally, KLCI is supported by an undemanding valuation (13.0x forward P/E vs 10Y average 16.6x) accompanied by an all-time low foreign shareholding of 19.5%.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.