Malaysia market has been under-appreciated with the KLCI only recording 2 positive returns (in 2017 and 2020) over the past 10 years. This is mainly due to foreign fund selling, inconsistent policy follow-through, along with external forces such as the US sticking to higher rates for a longer period and a sluggish recovery in China. What’s more, the KLCI which is primarily dominated by traditional sectors such as Financials, Plantations, Telecommunications, and Utilities continue to maintain a limited appeal for investors.

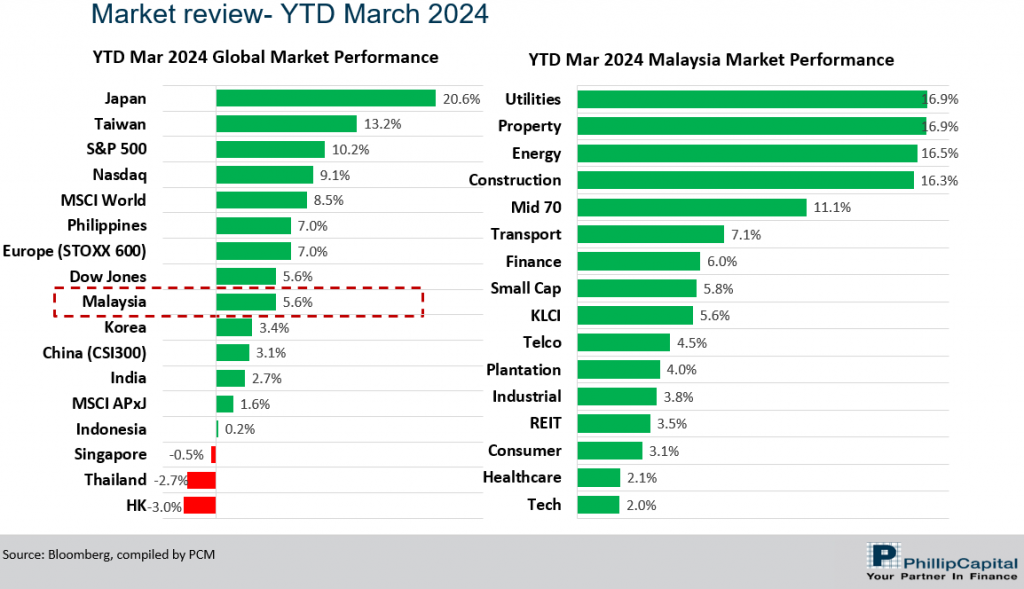

However, things have improved since the 2H of last year and this strong momentum persists into 2024, with KLCI registering +5.6% gains YTD as of March 2024, indicating signs of renewed optimism towards the Malaysia market. All sectors experienced positive gains YTD as of March 2024, with the Utilities, Energy, and Construction sectors emerging as the top performers, continuing their upward trend from 2023. Conversely, the Technology, Healthcare (particularly Gloves), and Consumer sectors lagged behind (see Exhibit 1).

Exhibit 1: Q1 2024 Market Performance

Source: Bloomberg, PCM, 31 March 2024

We saw profit-taking by foreign investors in March, yet the market remained well-supported by local institutions. Despite the recent stellar performance, we hold a positive view on Malaysia market over the medium to long term and we have identified various investment themes that we believe will continue shape the future outlook of Malaysia market.

Theme One: Peaking interest rates bode well with equities; Opportunities for Emerging Markets and Malaysia Market

The primary theme that we believe will lay the groundwork for 2024 is the anticipation of approaching interest rate cuts by the Fed. While the magnitude or the frequencies of rate cut remain uncertain, (and the Fed officials often cite that any monetary policy decision is data dependent), but the prevailing consensus leans towards anticipating a rate cut. This is mainly due to falling inflation in the US, and some emerging signs of a weakening in the labour market.

We believe the fall of interest rates expected in 2024 bode well for growth-oriented sectors (which would see valuation rerating) and import-dependent industries (which would see a reduction in cost of imported goods hence leading to better margins). Furthermore, historical data indicates that a rate cut leads to a weaker Dollar and outperformance in emerging markets, which could also potentially benefit the Malaysia Market.

According to UBS Research, FBM KLCI slightly negatively correlates with ringgit movement; with every 1% depreciation in the ringgit, FBM KLCI declines 0.33% on average. As we expect the ringgit to strengthen to by end-2024 amid potential Fed relief, we expect the Malaysia market especially large-caps and the laggards may benefit from improving sentiment when the ringgit appreciates.

Source: Bloomberg (Left), UBS (Right)

Theme Two: Stable domestic political environment; Economic restructuring is set to bolster growth prospects

The Malaysia market has been derated since 2018 amid political uncertainty but we have seen modest improvement in the political environment especially since the conclusion of state election last year. 2024 should be a “take off” year for Malaysia’s medium-to-long-term economic “transition“ & “reforms” outlined in the blueprints, masterplans, roadmaps and legislations announced last year, including MADANI, NETR, NIMP, 12MP-MTR, Fiscal Responsibility Act (FRA) & Budget 2024. These policies aim to rectify the structural imbalances in the country. Malaysia should see higher productivity and stronger fiscal balance moving forward.

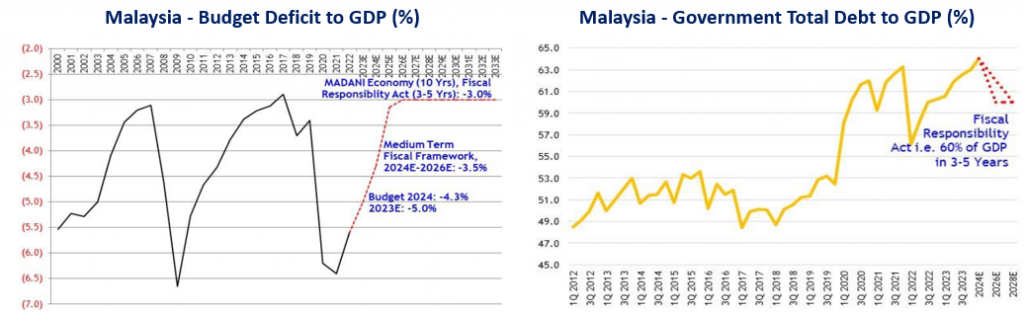

Fiscal reforms and economic restructuring are the top priorities of the government’s agenda, with the key element being the implementation of targeted rationalisation of fuel subsidy in 2024 to lower budget deficit, as per Budget 2024 (4.3% of GDP vs the estimated 5.0% of GDP in 2023), and ultimately capping deficit spending to no more than 3% of GDP under FRA and MADANI Economy. This is on top of FRA’s target to lower Government’s total debt to 60% of GDP in 3-5 years’ time. These policies introduced by the Government would continue to be the pillars of various investment themes/ideas going into 2024.

Source: Maybank Research

Theme Three: Reversal in foreign outflows; Robust buying interests from foreigners provides support for Malaysia market

Foreign investors’ underweight position on Malaysia, is bottoming out with March’s foreign shareholdings in Malaysian equity market stands at 19.6% respectively (vs all-time low of 19.5% in Dec 23).

After experiencing an outflow of funds by foreign investors since 2018, totaling close to RM50 billion, we have observed a reversal of this trend, especially since the conclusion of the state elections in the second half of 2023. In terms of sectors, foreign investors favour Construction, Utilities and Property which explained the outperformance last year and this year.

Finally, there has been a lot concerns about Ringgit but on a positive note, its undervaluation serves as another reason for foreign investors to consider Malaysia as their investment destination.

Theme Four: Recovery in global tech cycle; Malaysia’s Tech and E&E sectors would benefit

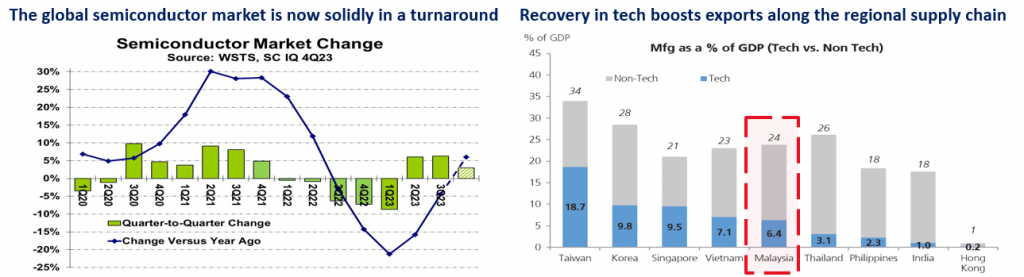

Following a decline in 2023, we are seeing the beginning of an upturn in the global tech cycle, which should boost global trade. Specifically, The World Semiconductor Trade Statistics, WSTS is projecting a rebound in semiconductor sales at an annual growth of 11.8% in 2024 versus a decline of 10.3% for 2023 to be driven by a broader recovery in the mainstream applications within mobile, automotive and industrials.

WSTS expects a recovery in inventory replenishment, a rebound in smartphone shipments, as well as improving consumer sentiment across the board. Apart from Tech-heavy markets including Korea & Taiwan, Malaysia would also benefit from the recovery in tech given the tech sector accounts for 6% for our country’s GDP.

What’s more, the gradual recovery in the tech cycle is supportive of Malaysia’s tech export basket (i.e. the E&E exports, which is largely related to semiconductor assembly and testing), which comprise 40% of exported goods.

Source: WSTS (Left), UBS (Right)

Theme Five: Strong economic fundamentals – Stronger GDP, moderating inflation, low unemployment and an improved MYR.

For the full year of 2023, Malaysia’s GDP expanded by 3.7% (2022: 8.7%), which was lower than official target (which is around 4.0%). This slower-than-expected GDP growth outturn will provide a favourable base effect for this year’s economic outlook, in addition to several positive growth catalysts including global tech upcycle, tourism recovery, initiatives outlined in the national master plans and realization of robust investment approvals since 2021. Although the 1H24 growth path could still be bumpy, the 2H24 is expected to see a meaningful pick-up as global monetary conditions start to ease. According to Bloomberg consensus, Malaysia is expected to record 4.4% GDP growth this year, while inflation is expected to stay low at 2.5% and unemployment rate at 3.3%.

On the monetary policy front, BNM’s last rate hike in May 2023 brought the OPR to 3.0%. We do not expect further tightening to take place, given the slowing growth and cooling core inflationary trends. We do not expect BNM to cut policy rates in 2024 as Malaysia’s inflation risks are tilted to the upside due to partial subsidy rationalisation. Furthermore, BNM has not tightened policy as

aggressively as other central banks in the region. Its policy rate is still about 25bps below the peak of 3.25% over the past decade.

Finally, according to Bloomberg consensus, the Ringgit is projected to appreciate against the USD to 4.50 by the end of 2024.

Source: Bloomberg

Phillip Capital Malaysia and our offerings

We reaffirm our belief that there are still opportunities in the market, and we maintain a discerning approach in choosing high-quality stocks for our portfolio. However, it is crucial to exercise caution and carefully select investment options to ensure the best risk-adjusted returns. By taking a vigilant and discerning approach, investors can potentially reap the benefits of the current market opportunities while minimising risks.

A noteworthy avenue for investors seeking diversification in their portfolio is through PhillipCapital Malaysia. PhillipCapital Malaysia offers multiple private mandate services managed by professional fund managers. By leveraging PhillipCapital Malaysia’s private mandate services, investors can enhance their resiliency, optimise portfolio performance, and navigate the complexities of the market with confidence.

We also offer both conventional and Shariah-compliant options to cater to the needs of all investors. For Malaysia’s mandates, we like:

- PMART/PMA Dividend Enhanced

Our PMART Dividend Enhanced and PMA Dividend Enhanced is an income-driven portfolio focused on high dividend-yielding equities. We apply the Dog of the Dow approach, screen and select top market cap stocks to minimise risk and ensure consistent performance. The portfolio is an equal weighting portfolio which reduces concentration risk and provides similar exposure to all clients, both initially and after rebalancing. We offer both conventional and Shariah investment options to cater to the diverse needs of our investors.

Click here to learn more

- PMART/PMA ESG

Phillip Capital Malaysia offers discretionary portfolio that invests in stocks with high ESG ratings from the F4GBM and F4GBMS Indices, namely PMART and PMA ESG. There are both conventional and Shariah options available. To explore the companies in which both Conventional and Shariah ESG mandates invest, you can refer to the provided link.

- PMART/PMA Blue Chip and Opportunity

Our Blue-Chip portfolios primarily allocate our investments towards companies with large market capitalisations, while the Opportunity portfolios predominantly invest in companies with smaller market capitalisations. We also offer both conventional and Shariah-compliant options to cater to the needs of all investors.

Please click on the link to learn more or email us at cse.my@phillipcapital.com.my if you require any further information.

Disclaimer:

The information contained herein does not constitute an offer, invitation or solicitation to invest in Phillip Capital Management Sdn Bhd (“PCM”). This article has been reviewed and endorsed by the Executive Director (ED) of PCM. This article has not been reviewed by The Securities Commission Malaysia (SC). No part of this document may be circulated or reproduced without prior permission of PCM. This is not a collective investment scheme / unit trust fund. Any investment product or service offered by PCM is not obligations of, deposits in or guaranteed by PCM. Past performance is not necessarily indicative of future returns. Investments are subject to investment risks, including the possible loss of the principal amount invested. Investors should note that the value of the investment may rise as well as decline. If investors are in any doubt about any feature or nature of the investment, they should consult PCM to obtain further information including on the fees and charges involved before investing or seek other professional advice for their specific investment needs or financial situations. Whilst we have taken all reasonable care to ensure that the information contained in this publication is accurate, it does not guarantee the accuracy or completeness of this publication. Any information, opinion and views contained herein are subject to change without notice. We have not given any consideration to and have not made any investigation on your investment objectives, financial situation or your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any persons acting on such information and advice.